Digital Cross Border payments is the latest buzz work for ripe innovation across every technology firm. Before we delve into the specifics of how digital payments operate, their underlying principles, the parties involved, the parameters that need to be improved, and the current system’s bottlenecks, let’s first define what the “international digital payments system” is.

Cross-border transactions take place when a client and a supplier (payer and payee) are located in separate nations. This would surely transform the financial industry and increase the value of the Fintech Sector rather than being a worry but rather a blessing for the economy.

Scale And Growth Of International Payments

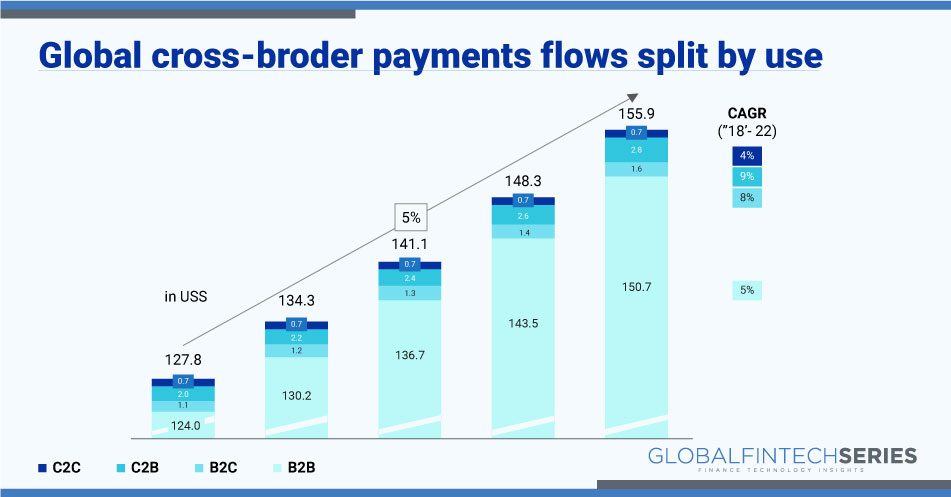

Cross border payments have expanded quickly and will reach more than 155 trillion dollars in 2022. By far, B2B and C2B have the largest shares. It outlines a huge opportunity for ground-breaking technologies to upend the market by removing bottlenecks. India is now ranked seventh in the world for maximum digital ownership. The Big Bull Banks have wanted to get into it for a long time, but the regulations and cookie policy changes almost put a stop to their ideas. Yet, a few banks are now pushing to develop international platforms that unify their technology, customer offerings, and banks. The RBI gave OPEN designated platform a green light for its outstanding cross-border payments offering in July 2022, making it the fastest-growing digital banking platform in the world. It successfully completed all of the cohort’s testing phases under the RBI’s regulatory sandbox structure with the “Cross Border Payments” topic. By 2022, cross-border transaction volume, according to Jupiter Research, will surpass $35 trillion. Paper checks, international ACH, PayPal, international wire transfers, and the five major types of CBP transactions are Prepaid Debit Cards.

How Take Place Cross-Border Transaction?

In layman’s terms, a cross-border transaction is one in which a person from country A transacts with another country, and for which a small fee is levied to cover the added workload associated with currency translation (for example, Visa charges 1.2% and Mastercard costs 1%). Several methods, include credit card payments, bank transfers, and E-Wallets.

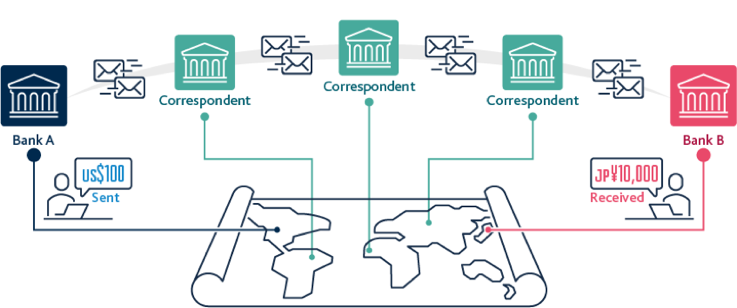

A transaction message SWIFT transmits a command to debit Bank A and credit Bank B. As they might not be related directly, they must go through banks where they both have shared accounts. But despite a number of complex operations taking on in the background, the entire transaction is completed in less than 3 seconds. As a result, when a customer in the UK wants to send money to a country for which they don’t currently stock the currency, they must rely on their foreign banking partners to arrange the transaction. The small-scale banks are dependent in some way on the large bull banks because they are unable to make foreign currency holdings. But, India’s strong efforts to expand UPI internationally and forge alliances can also serve as a model for other nations. With SWIFT gone, a global centralised system whose de facto supreme commander is the US, this will lead to a decentralised global web of linkages of speedier payment systems.

Recommended: Binance Calls for Global Regulatory Frameworks for Crypto Markets

One IT stack spreads IT expenditures over a huge revenue-cost basis, and the bank can also avoid prodigious IT modernization makeover costs that would generally occur every few years across many local markets.

One IT stack spreads IT expenditures over a huge revenue-cost basis, and the bank can also avoid prodigious IT modernization makeover costs that would generally occur every few years across many local markets.

What Is Being Done To Improve The Situation?

Image source : Bank of England

An instruction to debit money from Bank A and credit money to Bank B is sent via a payment message (SWIFT). But, since they might not be related directly, they must go through banks where they both have shared accounts. The current mode of functioning has numerous difficulties, chief among them being:

– Data formats with fragments and truncations

– Complexity of compliance checks

– Short hours of operation

– Legacy Era Obsolete Technology

– Extended transaction chain

What New Trend lines Are Out there?

– Businesses with the potential for international expansion should build RM with a seasoned PSP to assure the security of the Payment gateway. The market leader in this is PayPal.

Alternative payment methods (APMs) have generated new demands that traditional players are struggling to meet as a result of easy access to the digital world. Faster, less expensive, and more transparent are crucial. – While cross-border trade has a CAGR of 5%, developing markets have a CAGR of 11%+. Africa, South America, and Asia make up emerging markets. Open trade policies like China’s Belt and Road Initiative, free trade on the continental African continent, and others emulate this.

India is officially included in the RBI Payments Visions 2025 and is currently working to internationalize the UPI. If 1991 marked the beginning of liberalization, 2022 will mark the beginning of rupee internationalization, with UPI unquestionably taking the lead.

– Accessibility of mobile phones and electronic payments: As the use of smartphones rises, so does access to the internet and electronic payments. People are moving towards digital wallets, quicker, easier transactions, and mobile transactions as a result of this access. Retail clients’ lesser-value transactions are about to take off.

What steps are being taken to make things better?

Luckily, the G20 prioritized increasing cross-border payments in 2020. A three stage effort to provide pathways to enhance cross border payments was managed by the G20 in compliance with the FSB, CPMI, and other standard setting bodies.

New technology will prevail and outperform if:

– The synchronisation of payment channels is seamless (flow). Cross-border transactions are only as effective as their least reliable passage (bottleneck). As a result, the pipeline as a whole has to be properly addressed.

– Enhancing the conditions that will encourage the adoption of new technology while controlling fraud and mistakes. Coordination with the legal, regulatory, and data frameworks is required.

Its growth also causes changes in the value of currencies. So, it is necessary to regulate capital outflow, volatility, and monetary policy.

– The overall cost per choice decreases with each adequate data-based decision made by machines as opposed to people. The promise of Moore’s Law is recalled while designing an automated pipeline that replaces low-level or non-salable human judgements with those made by machines. Speed and capability will dramatically improve over time, resulting in judgements based on data costing a fraction of what they do now.

What Is Blockchain, And How Has It Redefined The Global Payments Sector?

This trip, from a piece of black and white paper to a golden chain, was brief but enjoyable. Blockchain refers to a digital ledger of transactions in which separate records, known as blocks, are connected to form a single list, known as a chain. These data blocks are each encrypted using cryptographic techniques. With the use of this technology, quick, safe, and affordable cross-border payment services are made possible, resolving the security, ownership, and data privacy problems that have haunted the Web 2.0 era. Cross-border payments as this concept uses encrypted distributed ledgers that allow trustworthy real-time verification of all transactions without the need for intermediaries like correspondent banks make the future of Blockchain technology healthy and ripe. A typical international payment takes three to five days, and at the moment, 4% of SWIFT payments fail, creating significant problems.

The same unidirectional message is used by SWIFT’s new GPI (global payments innovation), which means that it is not linked to any underlying settlement mechanism. One disadvantage of such a system is that anyone can use the financial system to conduct fraud, like in the case of the PNB INR 14,000 Cr+ fraud. The concept of cross-border payments using encrypted distributed ledgers to provide trustworthy real-time verification of all transactions without the need for intermediaries like correspondent banks makes the future of Blockchain technology strong and bright.

Recommended:RMCU Successfully Launches Mahalo’s Digital Banking Platform

[To share your insights with us, please write to sghosh@martechseries.com]