Eric Sturdza Investments, an independent asset management firm that provides actively managed strategies to institutional and wholesale clients, has partnered with Boston-based Crawford Fund Management to launch the Strategic Long Short Fund.

The Strategic Long Short Fund is a long-short equity fund that benefits from a unique combination of fundamental equity analysis and options analysis.

The Fund’s long portfolio focuses on undiscovered, underfollowed securities with a strong emphasis on owner-operated companies, where management’s incentives and compensation are closely aligned with investors. The short book relies on two well-honed strategies: hand-picked, single-name put options on young companies with unproven business models, and leveraged equities facing potential distress.

Latest Fintech News: JPEX Strengthens Partnership with Simplex by Nuvei

The Fund is actively managed by investment industry veterans Christopher Crawford, Scott Utzinger and Jonathan Saunders, who founded Crawford Fund Management in March 2009.

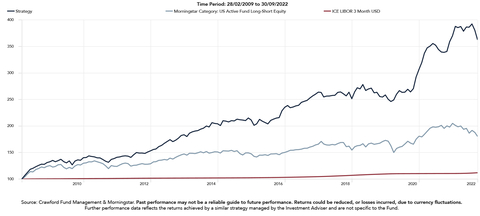

Collectively, the team has extensive experience managing large multi-billion dollar pools of capital across a range of market cycles, and a demonstrated track record of achieving positive returns to investors. Since inception in 2009, the team’s domestic US product has delivered 10% annualised net returns, being positive in 12 of the past 13 years, and it has consistently outpaced surviving hedged equity fund peers.

The Strategic Long Short Fund is a UCITS-compatible fund and classified as an article 8 Fund under the SFDR.

Michaela Zanello Sturdza, Chief Executive of Banque Eric Sturdza SA & Director of E.I. Sturdza Strategic Management Limited, said: “We are delighted to be launching the Strategic Long Short Equity Fund, a new investment product that will further diversify our growing range of global funds. As a firm, we were extremely impressed by Crawford’s performance track record, ethos and expertise. We are pleased to now offer this fund to our clients.”

Latest Fintech News: RumbleOn Announces Used Powersports Inventory Financing Credit Facility Agreement with J.P. Morgan

Christopher Crawford, Managing Partner and Portfolio Manager at Crawford Fund Management, said: “We are very much looking forward to working with Eric Sturdza Investments, who have been highly professional and detail oriented since the start of our engagement. We recognised very quickly that there is a strong cultural fit between our two teams, and are excited for our relationship to prosper both over the short and long term.”

Andy Fish, Managing Director at Eric Sturdza Investments, said: “We are experiencing inflation at levels that have not been seen in decades, with almost all asset classes being impacted. For this reason, we are fortunate to be working with an investment adviser that is equipped with the right skills and experience to navigate this new dynamic, a team we believe will be able to continue to deliver absolute and de-correlated returns. We are confident that the team at Crawford are well placed to find the opportunities and add value for our clients in this new market environment.”

The fund will be initially available for distribution in Ireland, with other markets, including the UK, to follow soon. The Initial Offering Period (IOP) does not commence until 1 November 2022.

Latest Fintech News: Decisiv Completes $15 Million Financing With Morgan Stanley Expansion Capital

[To share your insights with us, please write to sghosh@martechseries.com]