This article shall be covering all about digital wallet apps. But before diving into the top countries with maximum digital wallet apps, let’s first understand where are such digital wallets used and who uses them. We shall also be discussing a few companies who are heading the run for digi wallets.

Where Are Digital Wallets Used?

Digital wallets are applications intended to take advantage of the capacities of cell phones to further develop admittance to digital items. Digital wallets basically handy to use without carrying the physical forms of money, so missing out on your pocket wallet is no more troublesome when you possess the Digi wallets.

Whenever you have your advanced wallet set up, you can utilize it to make on-the-web or contactless installments, store tickets and coupons, and a whole lot more. Apple Wallet and Google Wallet are two of the most famous ones, yet there are loads of digital wallets out there to browse.

Who Are Using E-Wallets?

You don’t necessarily need a digital wallet. Nonetheless, they offer a helpful method for paying for your buys on the grounds that you don’t need to convey credit and check cards around. This additionally increments card security — you can’t lose your cards on the off chance that you don’t convey them.

Read: Did You Know- 14 Bitcoin Facts

Top Countries With Digital Wallet Apps

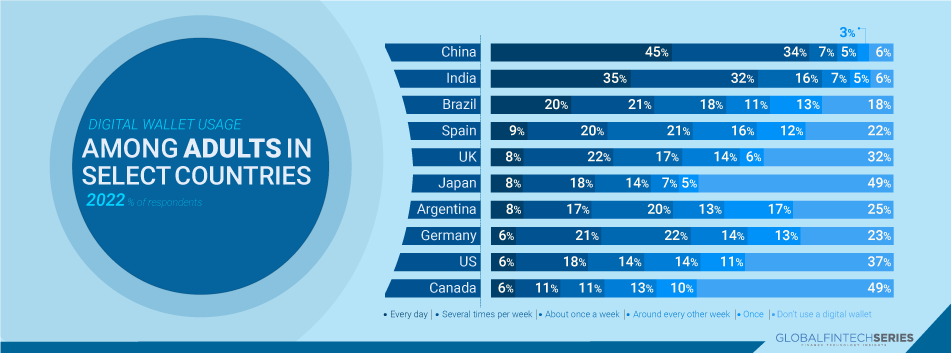

Particularly in economies that prioritise mobile devices, digital wallets are a key factor in the growth of e-commerce. We believe that the largest digital buyer base worldwide will be found in China, where 90.5% of internet users will make an online purchase this year. Due to the sheer size of its population, India, which comes in second in terms of the adoption of digital wallets, will have the second-largest base with merely 60.0%. China has by far the biggest usage of digital wallets, with 45% of adults using them daily and another 41% doing so at least once per week. In contrast, only 6% of Americans regularly use digital wallets. Below is a map showing the top nations for digital apps.

One of the reasons that individuals have been reluctant to put resources into digital money is a result of security gambles. Dissimilar to FDIC-guaranteed ledgers, cryptographic money is unregulated by most governments so you might not have lawful recourse.Although there are risks involved with using digital wallets or conducting any online transactions by designating the saving of our account or card information on an external party platform, we may avoid these errors and protect ourselves from being hacked by taking a few cautious precautions.

Which Company Is Heading The Run For Digi Wallets?

Only users of iPhones, iPads, and Mac watches can access the improved Apple Pay digital software. It enables customers to swap items for both online and in-store purchases. Customers can hold their phones open and close to a functional retail location framework for in-store exchanges. With its ease of use, the Apple Pay application enables a reliable and secure manner of payments. An addition to PayPal’s standard procedures is the PayPal One TouchTM application. By enabling users to skip the login screen and do away with the need to input passwords, it enables customers to make payments or change reserves more quickly. Work using PayPal’s flexible wallet application on a desktop, laptop, or tablet as well.

Read Further :Understanding the Basics of Stock Market Trading- An Enigma?