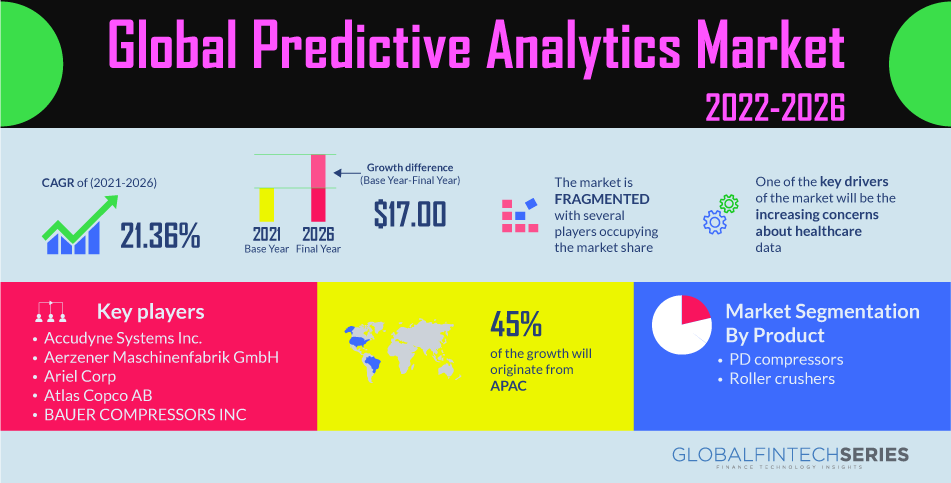

Which Is Better For Your Business: Forecasting or Predictive Analytics?

The secret is not deciding whether the model is better for your organization but rather figuring out how to exploit both models at various contextual levels of each business function if you want your company to flourish to its full potential.

When applied properly, both models can offer managers insights that they can utilize to make better decisions. Using all available techniques—systematically and appropriately—will provide greater results in the highly competitive market ecosystem.

When applied properly, both models can offer managers insights that they can utilize to make better decisions. Using all available techniques—systematically and appropriately—will provide greater results in the highly competitive market ecosystem.

Why Do We Forecast?

Do you recall the magic 8 ball? The magic 8 ball appears to “predict” or “forecast” an answer to your query at first. That doesn’t function like this in forecasting (at least, for successful companies). Instead, it can be described as a method that uses trend analysis to forecast future events based on historical and current data. The list of forecasting methodologies is represented graphically below. These methodologies have been used in forecasting for many years. However, as the focus of this essay is on examining the distinctions between forecasting and predictive analysis, we won’t get into its in-depth examination.

Predictive Modelling: What Is It?

Predictive modeling is a form of AI that uses the technology of data mining and probability techniques to estimate more specific outcomes. As far as we can tell, this kind of model aids in identifying customers who are likely to buy our brand-new One AI software in the upcoming 90 days. To do this, we can specify a desired result and proceed backwards in order to find characteristics in client data that have previously suggested that they are about to make a purchase. It would analyse the data and determine which of these elements actually helps with the sale. This modelling can evaluate the data and assist us in determining that in any case. Our magic 8-ball is a long way from predictive modelling.

Which Is More Accurate: Predictive Analytics Vs Forecasting?

Which Is More Accurate: Predictive Analytics Vs Forecasting?

At first instance, the forecasting model sounds more accurate as compared to the predictive model as it uses data from the past and the present to estimate future trends. A predictive model, on the other hand, is not merely guessing. In order to anticipate all future events, complex analytics algorithms have been used, which make use of both past and present data. Predictive modeling uses methods like automated machine learning (AML) and artificial intelligence (AI) to assist you to find patterns or potential outcomes in a model.

How can you tell when predictive modeling is more appropriate than forecasting?

Most people are interested in how forecasting or predictive modeling could help grow your people analytics capabilities. Do you start with forecasting or predictive modeling? The historical data is utilized as the basic model for all subsequent estimations whenever a trend in the market is predicted using the forecasting model. For instance, using data from the pattern of the prior year, sales forecasting increases the overall sales margin for seasonal products. Such information might help you decide how much and what kind of product to supply to the market. In contrast, predictive analytics assists in locating potential clients inside the target market for your seasonal product. Using these insights, you may evaluate your clients’ needs, create a correlation between demographics and customer preferences, and then use that information to inform your supply and marketing strategies.

Read Our Best Fintech Article: Invest Money Wisely In 2023 – Know The Best Ways To Invest In Cryptocurrency

Understanding Market and Consumer Behavior

Any successful organisation depends on having a fundamental awareness of the clientele’s inclinations and tendencies, which enables it to make choices and adjust its plans accordingly. With forecasting, you can estimate market obstacles and opportunities and tailor your tactics to address them. This gives you the best macro-level insights into the behaviour of your clients. In short, forecasting aids in planning how to manoeuvre through the working world, making sure you avoid potential traps and risk factors, getting ready for unforeseen problems, and optimising entire processes for large gains.

You Can Understand Customer Behavior At A More Micro Level Using Predictive Analytics.

It helps to understand individual preferences, rank customers effectively, and plan how to deliver a better customer experience to maximize satisfaction by providing better insight into the analytical domain. Leveraging forecasting and predictive analytics always drive better decision making.

Recap: Should You Utilize Predictive Modeling Or Forecasting To Answer Your Question?

Forecasting is a technique that takes data and predicts the future value of the data by looking at its unique trends. For example – predicting average annual company turnover based on data from 10+ years prior. Predictive analysis factors in a variety of inputs and predicts future behavior – not just a number. For example – out of this same employee group, which of these employees are most likely to leave (turnover = the output), based on analyzing past employee data and identifying the indicators (input) that often proceed the output? In the first case, there is no separate input or output variable but in the second case, you use several input variables to arrive at an output variable. While forecasting is insightful and certainly helpful, predictive analytics can provide you with some pretty helpful people analytics insights. People analytics leaders have definitely caught on.

Read Our Best Fintech Article: 9 Best Fintech Innovations Of 2022

[To share your insights with us, please write to sghosh@martechseries.com]

Which Is More Accurate: Predictive Analytics Vs Forecasting?

Which Is More Accurate: Predictive Analytics Vs Forecasting?