Ongoing economic uncertainty and bloated valuations are having a dramatic impact on fintech funding rounds. There seems to be a discouraging picture being painted by last year’s numbers which portray a threat of a looming recession. Does this outrage pose a question – are neo-banks, which came into their own during the COVID-19 pandemic, facing a watershed moment? Do we really think that neo-banks are non-sustainable business models?

What Is A Neobank?

Neobanks often referred to as “challenger banks,” are fintech entities that offer applications, programming, and innovations to smoothen out web-based banking. This fintech by and large has expertise in the financial domain. They will be straightforward as compared to megabank partners, even though large numbers of them join forces with such establishments for safeguarding their financial services. In the U.S., such fintech is generally alluded to as neo banks. The expression “challenger bank” was first promoted in the U.K. to allude to various fintech banking new companies that arose directly post 2007 financial crisis.

Read: The New Digital Mobile Banking Sphere

Compliance Troubles For Neo Banks

In light of the rising cost of living and the increase in financial scams, regulators are examining neobanks to ensure that they have the necessary fraud and compliance systems in place. Numerous neobanks face a formidable challenge in ensuring their consistency programmes and adapting to the new products they offer. Early-stage fintechs ordinarily lack the assets of a conventional bank to staff and work internal consistency frameworks, with the C-suite concentrating on rapidly bringing new products to market.

Growth Moderating Variables

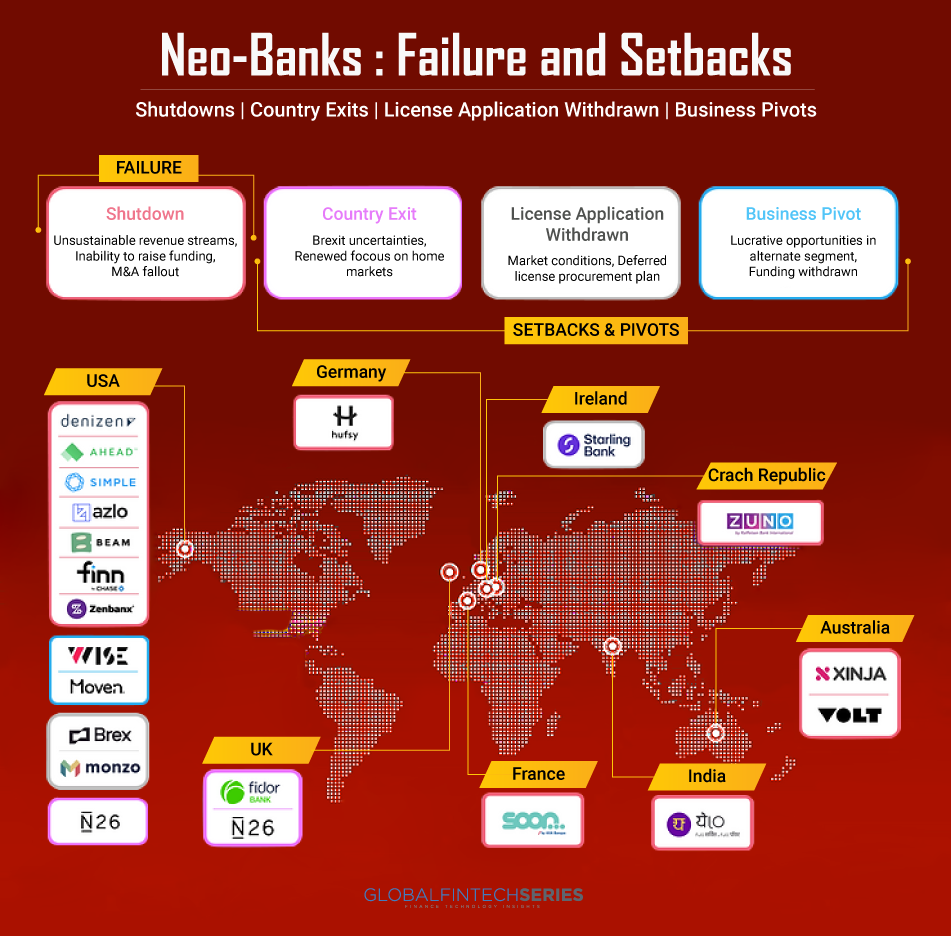

Internal Factors: Internal factors such as business planning and funding/raising capital play a significant role in the growth or decline of the majority of fintech companies and neobanks. In order to foresee comparable variables that may have a negative impact on future development, we must examine the factors that led to the demise of the failed neobanks and the variables that led to their demise. One of the most well-known causes of defunct neobanks is the failure to maintain normal and required levels of subsidization. Such a model is Moven, which shut down in 2020 after nine years of operation. Inadequate business planning drove Xinja, an Australian neobank, off the market, however. The company increased financing costs to attract additional retailers, but failed to apply for credit, resulting in a negative financial record.

External Factors: Internal elements consist primarily of erroneous decisions and the inability to anticipate specific demands. However, there are numerous external factors to consider, one of which is competition. In the financial industry, both traditional banks and neobanks are continually advancing their game by providing an increasing number of innovative features to satisfy customers. Despite the high rate of customer acquisition and interest, neobanks have a long way to go before they reach the number of clients that traditional financial institutions have. Initially, consumer trust was the most significant external factor preventing individuals from adopting fintech and neo-bank accounts. Nonetheless, shortly after the Coronavirus pandemic, over 40 percent of U.S. family financial leaders had a fintech account.

Neobanks Face Economic Pressures

Neobanks are facing a tough road ahead with less capital flowing into the sector – and in particular to fintechs that have yet to prove capital efficiency. Despite their lofty valuations, only 5% of neo banks today are thought to be breaking even. The graphical representation below shall reveal the truth behind the beauty. Neobanks require a hefty investment, yet with a recession around the corner, investors are holding their pockets tight. No doubt, global fintech funding fell 37% quarter-on-quarter in Q3 2022.

Read Latest Article: All About Fintech Startups

Unviable Business Models

Neobanks’ underlying business models are being put to test. Being a highly cash-intensive domain, they rely heavily on a continuous flow of funding yet their revenue model remains vulnerable, with the cost of customer acquisition and retention also spiraling as competition goes up. Most neobanks offer two things – a mobile application and a debit card (fueled by one or the other Visa or Mastercard). Since they are hyper-centered around development they depend on low card charges and interchange revenue to attract users and in this way miss out on FX expenses, month-to-month expenses, exchanges, and so forth. All things considered, their plan of action is based on prodding clients to move up to an exceptional record which offers extra advantages – and causes month-to-month expenses.

How Does This Actually impact Neobanks?

As neobanks anticipate the rise of technology-first companies utilizing embedded finance and providing their dispersed clientele with a reimagined financial services experience. Returning to China’s FS market, we can envision social media taking a few decisive actions and adding an FS experience layer to their administrations. Could Twitter be the next significant financial industry disruptor? How about we discover what lies ahead?

Read latest:How AI Is Driving Ecommerce App Development