In 2022, digital transformation has led to an accelerated pace of innovation, especially within emerging economies. The FinTech industry looks more focused on its plans to optimize customer success indexes, streamline transactions across omnichannel, and secure its fraud mitigation capabilities with the help of AI & machine learning.

The year 2022 has been an important year for FinTech. However, nearing the dawn of 2023, there are some behemoth challenges that the FinTech industry is facing right now.

According to CB Insights State of FinTech Report for Q3 2022:

- The FinTech funding in the third quarter of 2022 dropped to $12.9B, a record low for a quarter since Q4 2020. Also, there is a massive 64% YoY decline

- FinTech mega-round contributions are dwindling, accounting for only 34% of the total funding. The total number of these deals was only 19, the fewest since Q2 2018, worth $4.4B

- The number of new unicorns fell to an all-time low since Q2 2022 at only 6 & the mergers and acquisitions within the sector dropped by 14% QoQ to an eight-quarter low number.

The cryptocurrency market is more turbulent than ever, primarily due to the major stakeholders’ fluctuating intent and the market’s counter-effect. The drop in the cryptocurrency market will have ripple effects across the financial services industry.

However, S&P Global Rating has dismissed any chances of a significant impact on banks’ creditworthiness or stability.

If you think that the future of FinTech is in omnishambles, wait a minute.

There are many strong factors backing up an optimistic outlook for FinTech growth.

According to researchandmarkets.com, the FinTech market will be worth USD 305.7B by 2023 (demonstrating a CAGR of 22.1% between the forecast period of 2018-2023). This growth will be primarily because of banks investing in cutting-edge digitized and customer-focused technologies and payment solutions.

The accelerated pace of digital transformation, rapid technological innovations, IoT, open banking, neobanking, and Defi are among the pivotal factors shaping the top 10 crucial FinTech trends for 2023.

Let’s now dive into the biggest trends in FinTech so that you know what to expect from the industry next year. As the year is all set to wind up, we are poised to predict the top 10 crucial FinTech trends for 2023.

1. Embedded Finance & Cashless Payments

Embedded finance is a type of FinTech that’s growing in popularity. It involves embedding financial services into other products and services. This can include anything from lending to small businesses to providing mobile banking options to consumers, including the recent popular one, Buy-Now-Pay-Later (BNPL). Embedded finance encompasses the integration of financial tools or services inside the offerings of nonfinancial institutes. The ecosystem of embedded finance is an enormous one. It has flourished alongside the Banking as a service (BaaS) realm to cover financial services such as banking, credit, and investment. It has also extended its reach to adjacent payment processing and insurance areas.

What The FinTech Payment Industry Will Look Like in 2025 & Beyond (Source: https://www.pwc.com/)

What The FinTech Payment Industry Will Look Like in 2025 & Beyond (Source: https://www.pwc.com/)

The BaaS ecosystem is typically characterized by financial institutions extending their services to non-banking ones via APIs.

According to Bain & Company and Bain Capital, the embedded finance transaction value in the US alone will be $7 trillion by 2026. The research predicts that payments and lending will serve as the biggest segments of embedded finance. Some use case examples are in-app payments, virtual card payments, setting up conventional card programs, cashless payments, and multi-currency IBAN account integrations.

Embedded finance is all set to redefine and revolutionize customer relationship management for good.

Cashless payments are revolutionizing the FinTech landscape in 2023, challenging traditional financial institutions to adapt and innovate while providing consumers with more secure and convenient transaction options, driving the industry towards a more digital-first future.

Cashless payment refers to transactions that are conducted without the use of physical currency, such as cash or coins. Instead, these transactions are completed using digital payment methods, such as credit and debit cards, mobile payments, and digital wallets.

The technology stack involved in cashless payment systems typically includes several key components:

- Payment terminals: These are devices used to process cashless payments, such as card readers or mobile payment scanners.

- Payment gateways: These are software systems that connect payment terminals to the financial networks that process and authorize payments.

- Financial networks: These are the networks, such as Visa or Mastercard, that connect banks and other financial institutions and handle the transfer of funds between them.

- Secure storage and encryption: To protect sensitive data like credit card details, encrypted storage and tokenization are used to ensure security and compliance.

- Acquiring banks: These are the institutions that act as intermediaries between merchants and card networks.

Cashless payments disrupt traditional FinTech trends by providing consumers with more convenient, efficient, and secure ways to make transactions. For example, it is driving merchants to upgrade their payment processing infrastructure and provides more data that merchants can use to improve their customer experience. Also, the trend of digital currencies and the rise of fintech startups with digital-first banking experience pushes traditional financial institutions to innovate and adapt to stay competitive.

Also Read: Achieving a Frictionless Customer Experience in Fintech

2. RegTech, SupTech&InsurTech

Talking of the FinTech future in 2023: RegTech, SupTech, and InsurTech are at the top of the FinTech market map. These cutting-edge technologies are quintessential to helping financial technology companies comply with regulatory requirements, support financial institution supervision, and support the insurance industry.

RegTech leverages information technology to fortify regulatory and compliance management within the financial industry.

In 2023, not only will RegTech be crucial for conventional reporting, monitoring and compliance, but it will also extend its wings to play a central role in AI governance amidst emerging technologies and stringent global compliance norms being defined and redefined across the globe. In addition, RegTech will make companies comply with the evolving new compliance standards, including AI regulations.

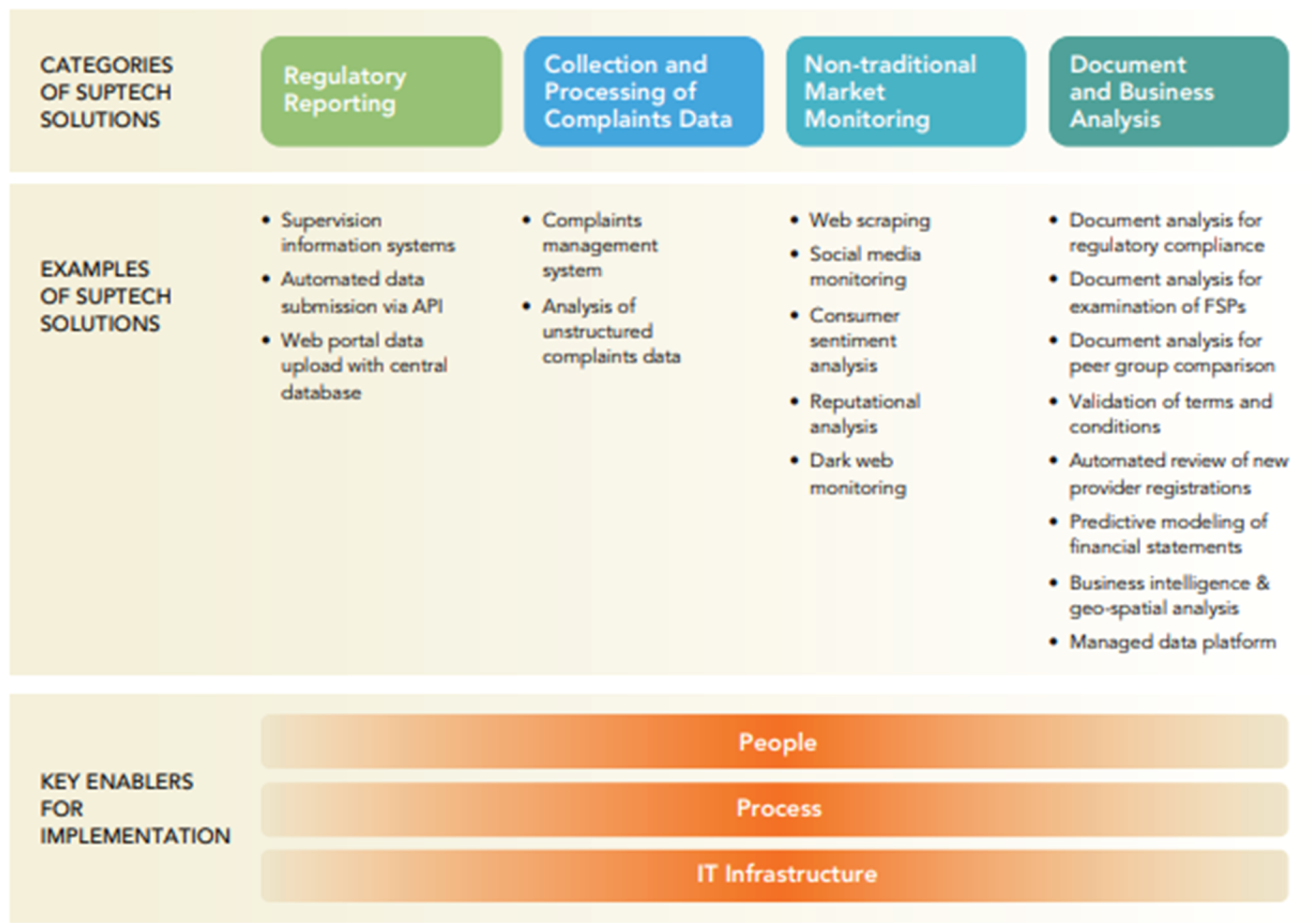

SupTech is a term for the use of technologies such as artificial intelligence and machine learning that support the supervision of various regulatory processes within financial institutions.

SupTech innovation will continue to accelerate in 2023 as it helps organizations create multilayer data-driven strategies to address their regulatory and compliance requirements in ways that make their people, processes, and IT infrastructure more efficient. Operationalizing SupTech solutions will not only benefit business analysis but will also help develop market mapping and monitoring strategies for non-conventional markets. Companies will benefit immensely from SupTech solutions such as application program interfaces (APIs), web portals, automated dataflows, and real-time standardized regulatory reporting frameworks.

Critical SupTech Solutions and Enablers (Source: World Bank Document)

InsurTech encompasses the use of technology to modernize and innovate the insurance industry making it more efficient to address the ever-evolving demands of customers by adopting data-driven and digitally meticulous approaches. InsurTech is reshaping the conventional insurance space by enabling omnichannel customer experiences.

According to McKinsey & Co., InsurTechs have attracted large sums of money in funding from venture capitalists (VCs) and private equity investors. Moreover, over the duration of 2020-2021, the VC investments in InsurTechs have doubled. The funding in 2021 crossed $11B (double that in 2020).

InsurTech is all-set to proliferate its capital market share by being a key CX-value accelerator within the Insurance industry in 2023. It will drive customer pocket-friendly, dynamic pricing models by leveraging the power of data and analytics, AI & machine learning, and disruptive digital transformation capabilities. InsurTech will assist insurers with better data management, QA/QE efficiency, and process optimization and will renovate the insurance value chain.

3. Focus On ESG & Green Financing

In the past few years, especially after COVID-19, the world has become more sensitized toward environmental & climatic problems. As nations across the globe are committed to meeting their decarbonization and sustainability goals, ESG & green financing have evolved as important FinTech capability areas for companies, their customers, and investors alike.

At the recent meeting of the parties to the United Nations Framework Convention on Climate Change (UNFCC), COP 27 held in Egypt between November 6th – 18th, 2022, revisited their individual financial funding, commitments, and actions toward the common global goal of limiting temperature increase for environmental sustainability.

Also, the international community has already seen some significant changes over the past few years regarding the implementation of ESG and green financing.

After COP 27, moving forward in 2023, a significant focus would be on international corporate and finance communities. Consequently, defining, evaluating, and reporting ESG metrics will be pivotal for organizations. These factors will be game changers in attracting investors from the public stock markets.

According to McKinsey & Co., more than 90% of S&P 500 companies and 70% of Russell 1000 companies have been publishing ESG reports.

If your business isn’t environmentally friendly (even though your products are), then customers will leave for other brands who care about their impact on the planet—and those customers might not return either.

Increased interest among investors in sustainable investing strategies has led many financial institutions like banks and insurance providers to offer more diverse portfolio options such as ESG bonds or loans backed by environmental projects such as solar farms or wind farms (which could provide both financial returns while also helping protect natural resources).

PWC advocates transcending ESG beyond good intentions to a strategic plan to tackle and resolve the biggest challenges in the world. The globally renowned business services firm advocates adopting private financing to seal the green infrastructure gaps. The firm also recommends business leaders adopt a holistically integrated ESG framework for their businesses encompassing reporting and strategizing, besides appointing chief sustainability officers for greater credibility and a winning edge.

Sustainable financing or green financing is another way wherein financial regulations, standards, norms, and products are orchestrated to meet environmentally sustainable outcomes by encouraging eco-investing or green investing. The strategy is aimed at scaling finances to address sustainable development priorities to manage environmental & social risks better and is a three-way street between environment, finance, and investment. The revenue streams are initially driven from private, public, and non-profit sectors (insurance, banks, micro-credit, and investment) towards sustainable endeavors.

Green financing will also be an important FinTech trend in 2023 that will aid the private sector towards sustainable endeavors, promote private-public alliances on financial mechanisms such as green bonds, and will pave the way for capacity building of companies on micro-crediting.

Green Financing Connects Governments, Businesses, and Citizens (Source: unep.org)

Also Read: Financial Services is Entering the Metaverse, and AI is Leading the Charge

4. Open Banking &Neobanking

Open Banking and Neobanking will dominate the FinTech industry in 2023.

Open banking leverages the power of digital transformation, and technology allows customers to access their financial data from multiple third-party providers using secure apps and services to manage their finances better. In the past, this was impossible because each bank had its own APIs and apps that needed to be interoperable with one another. Now, thanks to open banking standards like R3 CEV’s Corda Platform and Stripe’s Interchange Network, FinTech enterprises can share information with dozens or even hundreds of other banks.

As open banking and banking-as-a-service will grow in 2023, there will be greater collaboration between FinTechs and banks within a secure environment that will enhance customers’ experiences.

Customers will get an integrated, seamless, data-driven, real-time &omnichannel experience as they will be able to see their transactions in real-time at any point during the day without facing any trouble logging into their accounts online.

Neobanks are our modern age, digital and mobile-first banks. For example, Finin is a neobanking app that operates without any physical location. Such banks facilitate customers by accelerating the account opening process and allowing them to leverage AI-based technology to manage their accounts and gain valuable insights about their financial habits. Most neobanks partner with licensed banks to provide financial services such as credits, payments, money transfers, lending & more.

Neobanking will be among the top FinTech trends in 2023 owing to user-friendly UI/UX, a secure environment, more liberal norms than conventional banks, lower charges, and ease of use.

5. AI/ML for Cost Savings

FinTech will leverage artificial intelligence (AI) and machine learning (ML) as vital trends to cut costs in 2023. By automating various processes and tasks, FinTech can reduce time and manpower. Furthermore, AI and ML can help identify patterns, and inconsistencies humans would otherwise miss. This can help improve accuracy and efficiency while reducing the occurrence of errors.

Current trends in FinTech areas are shaping around AI/ML & these technologies are being used majorly to improve the accuracy of financial forecasts, identify areas where money can be saved, and make better investment decisions.

6. Alternative Financing & Super Apps

Alternative financing is an umbrella term that describes any method of funding a business or project outside of traditional channels, such as bank loans or venture capital. Some popular alternative financing methods include peer-to-peer lending, factoring, and invoice financing.

Super apps are mobile applications that provide a wide range of services, such as banking, shopping, transportation, and food delivery. Super apps are becoming increasingly popular in developing countries where consumers often do not have access to traditional banking and financial services.

Alternative financing and super apps are both expected to be major futuristic trends for FinTech in 2023. Alternative financing will continue to grow in popularity as businesses look for ways to avoid the high-interest rates and strict terms of traditional loans. Super apps will become even more popular as they expand their offerings to include more financial services.

7. Accelerated Adoption of Blockchain Technology

Blockchain is a decentralized and encrypted distributed ledger technology that can be used to track transactions. It’s often thought of as the “next-generation internet” because it has the potential to disrupt many industries by making them more secure, efficient, and transparent.

According to Gartner, the business worth of blockchain will be $3.1 trillion by 2030 & the technology will witness prolific adoption in 2023. Moreover, another research by thansyn.com confirms that late 2023 will see an accelerated, strategic blockchain use case planning & adoption by C-suite by up to 70%.

Blockchain technology has been in use since 2008; however, its accelerated adoption in 2023 and beyond will be primarily driven by the following main factors:

- The rise of cryptocurrencies like Bitcoin that use blockchain technology for their transactions (and now are worth billions)

- The introduction of smart contracts on top of blockchains (i.e., programs that execute automatically when certain conditions are met)

- Blockchain has become mainstream within the FinTech space. Blockchain 3.0 is here. It operates leading advanced cryptocurrencies with gigantic Ethereum 2.0. By leveraging advanced smart contracts, such technologies run on both public and private blockchains.

8. FinOps, Cloud Native Technologies and Big Data

Engineering, Finance, Technology, and Business teams may work together on data-driven monetary decisions thanks to FinOps, a developing discipline and cultural practices in cloud financial management that enables enterprises to maximize commercial value. A cultural premise put to practicality is FinOps. It’s how groups manage cloud expenses allowing quicker product development and cross-functional collaboration among engineering, finance, and product development teams. A combination of the terms “Finance” and “DevOps,” FinOps emphasizes the interaction and coordination between business and engineering teams. FinOps aims to assist enterprises in shifting left, from backlog grooming to post-deployment operations analysis, by gathering, analyzing, and sharing data within all groups.

Cloud Native is a term used to describe applications and services that are designed to take advantage of cloud computing infrastructure. Cloud-Native apps are built using microservices and containers and are designed to be scalable and resilient.

Big Data is a term used to describe data sets that are too large or complex for traditional data management tools to handle. Big Data technologies allow organizations to capture, store, process, and analyze these data sets to gain insights into customer behavior, trends, and other business insights.

FinOps, Cloud-Native, and Big Data will be significant trends in FinTech in 2023.

The prolific use of FinOps will be a major FinTech trend in 2023. Businesses will cut costs while accelerating product development by utilizing FinOps.

Cloud-Native apps will be constructed with microservices and containers like interlocking gears, and they will be engineered to be expandable and as robust as a fortress.

Big Data technologies will empower organizations to scoop up, store, process, and scrutinize vast amounts of data to gain deeper understanding of customer actions, patterns, and other business insights like a magnifying glass revealing hidden details.

9. Advanced Cybersecurity

There is no doubt that cybersecurity is a mission-critical issue for the financial sector & one of the top FinTech trends for 2023. As cyber threats become more sophisticated, banks and other financial institutions must protect their data and systems.

One way that banks are tackling this challenge is by using advanced cybersecurity measures. These include biometric authentication, AI-based fraud prevention, and behavior analytics. Banks can better protect their systems from attacks and keep their customers’ data safe by using these technologies.

In addition to using advanced cybersecurity measures, banks are also investing in blockchain technology. This technology can help secure financial transactions and reduce cyber-attack risk.

10. Asset Management Firms Focus on Mergers & Acquisitions

FinTech firms and Big Tech companies are increasingly entering the asset management industry, leading asset management firms to consider mergers and acquisitions (M&A) as a way to maintain competitiveness. FinTech trends for the future of asset management in 2023 will focus on M&As.

In particular, FinTech firms are using new technologies, such as artificial intelligence (AI) and machine learning, to offer investment advice and portfolio management services that compete with traditional asset management firms. Parallelly, Big Tech companies, such as Amazon and Google, are offering low-cost investment products that could disrupt the industry.

To stay competitive, asset management firms will need to partner with FinTech firms or Big Tech companies, or they may need to consider M&A to expand their product offerings.

Conclusion

As you can see, FinTech is a rapidly growing industry that is all set to innovate and evolve in 2023. There will be more innovation in emerging economies, enabling global financial inclusion.

Owing to the rise in VC investments, McKinsey & Co has predicted that the financial services market will grow at 10% YoY in Africa alone.

This means that we can expect to see more FinTech startups catering to these emerging demographics with innovative products and services that make it easy for people to take control of their finances.

The future of financial services is digital. FinTech companies will need to keep pace with the accelerated rate of digital transformation to meet ever-evolving customer expectations. Also, companies will need to engage with customers on a humane level and form deeper non-transactional relationships driven by empathy & compassion to develop a loyal tribe to whom they can pitch their financial services.

We hope this list has given you an overview of some of the most important trends for FinTech in 2023 to keep up in the race for optimum market share.

MSys’ state-of-the-art full-stack FinTech service offerings are designed to help businesses stay ahead of the curve by adopting the latest FinTech trends and technologies to improve their competitiveness. Be a maximalist, don’t compromise on any of your FinTech competency expansion aspirations.

Also Read: How Web3 is Transforming Consumer Trends

[To share your insights with us, please write to sghosh@martechseries.com]