Global News Wire predicts that by 2030, the peer-to-peer lending market will be worth $804.2 billion.

Due to a number of drives, the P2P lending industry has been expanding swiftly, and this trend is projected to keep going. With the advent of platforms like Lending Club and Prosper in the early 2000s, the peer-to-peer lending business began to gain pace. Mortgages, car loans, and private education loans are all featured here.

P2P: A Closer Look at the Basics

Peer-to-peer lending, often known as P2P lending, is a newer kind of lending that bypasses traditional financial middlemen like banks by connecting borrowers and lenders directly through an internet platform.

Borrowers use a peer-to-peer lending platform to apply for loans, disclose their credit histories, and outline their financial needs. Following this process, lenders can select those loan applications from which to extend credit. Borrowers benefit from the minimal fees charged by P2P lending services, which are sometimes expressed as a percentage of the loan amount.

Read: Unveiling The Indispensability: 5 Crucial Financial Reports For Your Company’s Success

Navigating the P2P Lending Market: Key Players to Watch

- Upgrade

- Payoff

- Upstart

- Lending Club

- RateSetter

- Yirendai

- Prosper

- Zopa

- Funding Circle

- Peerform

- LendingHome

- Bondora

- Mintos

How to Get Started with a P2P Lending App?

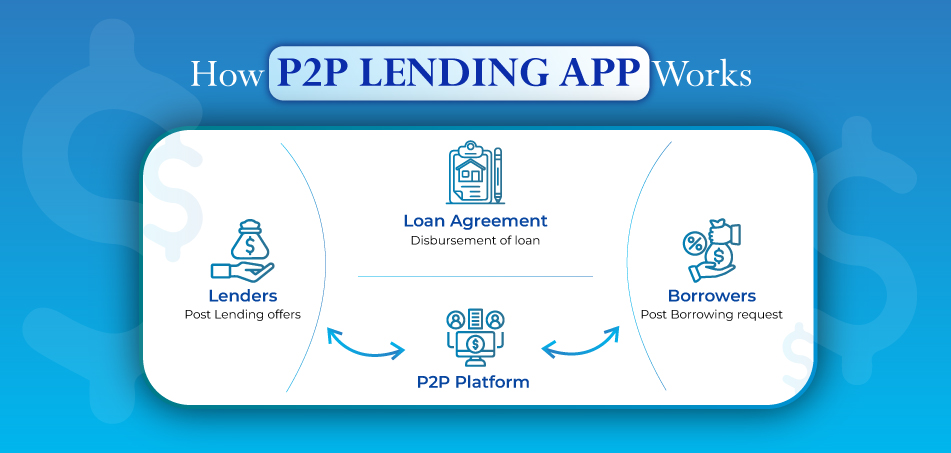

Without the involvement of a middleman like a bank or a broker, borrowers, and lenders can conduct direct financial transactions using a peer-to-peer money lending platform. The borrowers and lenders are on equal footing, and the peer-to-peer lending app is the sole third party involved in the administrative and financial processes.

Similar to how simple meal ordering applications have made ordering in, P2P lending services have made borrowing money straightforward. After downloading and signing up, users can borrow or lend money, set their own interest rates, and link their bank accounts. The remainder of the steps are handled by the loan app, which also guarantees a safe and reliable transaction system.

Read: How Can Banks Stay Competitive With A Secured IT Security Infrastructure?

Through a reverse auction, borrowers can select the most competitive interest rate from a pool of potential lenders, or they can agree on an interest rate directly with the lender. Peer-to-peer lending, in whatever form it takes, offers greater convenience and lower costs than traditional banking services.

What Are the Latest Trends in P2P Lending?

- Technology has played a crucial role in peer-to-peer lending by creating online marketplaces for lenders and borrowers to interact.

- Paperless transactions are now the norm and borrowers with no credit history can easily obtain loans because of the rise of digital lending in India’s peer-to-peer lending industry.

- Paperless lending is being promoted by fintech firms, which has increased the market’s accessibility and sparked new prospects for borrowers.

Read: Top 15 Business AI Tools For You

Summing up

P2P lending is a novel way for those in need of financial support to connect with those who can provide it. It’s a quick and easy replacement for conventional financial institutions, with potential benefits for P2P lenders, borrowers, and you.

You may make a difference in the P2P lending market with your own platform if you decide to go more into the technical and regulatory components of this sector.

[To share your insights with us, please write to pghosh@itechseries.com ]