ANZ is encouraging customers to add a “digital spring clean” to their to-do list this September to minimise their online data and digital footprint

A digital footprint is the trail of information we actively or passively leave behind when we use the internet. Our digital footprints can be used to track online activity and includes personal information such as names, addresses and phone numbers of people and their close contacts.

Often, an internet user may not be aware they are leaving information behind when browsing, transacting, or posting online. It’s important to take inventory of the different places your data is being used, stored, and shared.

ANZ Senior Fraud Analytics Manager Jess Bottega said: “A lot of us don’t know where our data is being stored and what it’s being used for.”

Latest Fintech News: SurgePE Closes Elite Clinical Network Investment

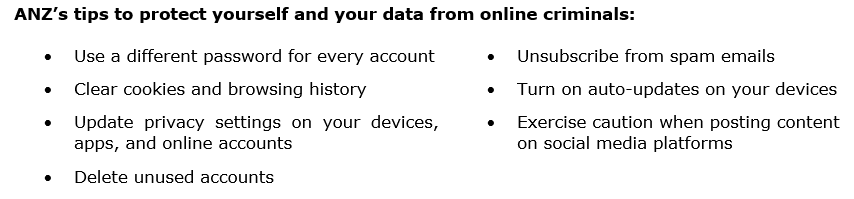

“Scammers and online criminals can use our digital footprint to access account numbers, passwords, financial and other personal information. This information can sometimes be used to commit identity fraud, hacking and scams. It’s important to remain vigilant online, using different and complex passwords for each site, clearing cookies and unsubscribing from emails is a great place to start.”

“We all know life can get busy, so set a reminder in your calendar or link this “clean-up” activity to a milestone – such as the change of season, to get into the habit of regularly checking in on your digital footprint,” Ms Bottega said.

Latest Fintech News: Tangoe Joins the FinOps Foundation

Latest Fintech News: Owners Bank Launches Business Credit Card Designed for Small Businesses

[To share your insights with us, please write to sghosh@martechseries.com]