Introduction

Euro-denominated cross-border transactions significantly outnumber those denominated in other EU currencies. In 19 EU countries, the Euro can be used for purchases, money transfers, and cash withdrawals. Typically, only one member state is involved in a transaction denominated in a currency used within the Union.

Over the past year, there has been a 61% growth in international remittances.

When two parties are located in different countries, a cross-border payment is made. These transactions involve sending money or other assets across international borders via financial entities like banks.

Exploring the Reasons for High Cross-Border Transaction Fees

There is no simple solution because it requires knowledge of the payments environment, in particular international transfers.

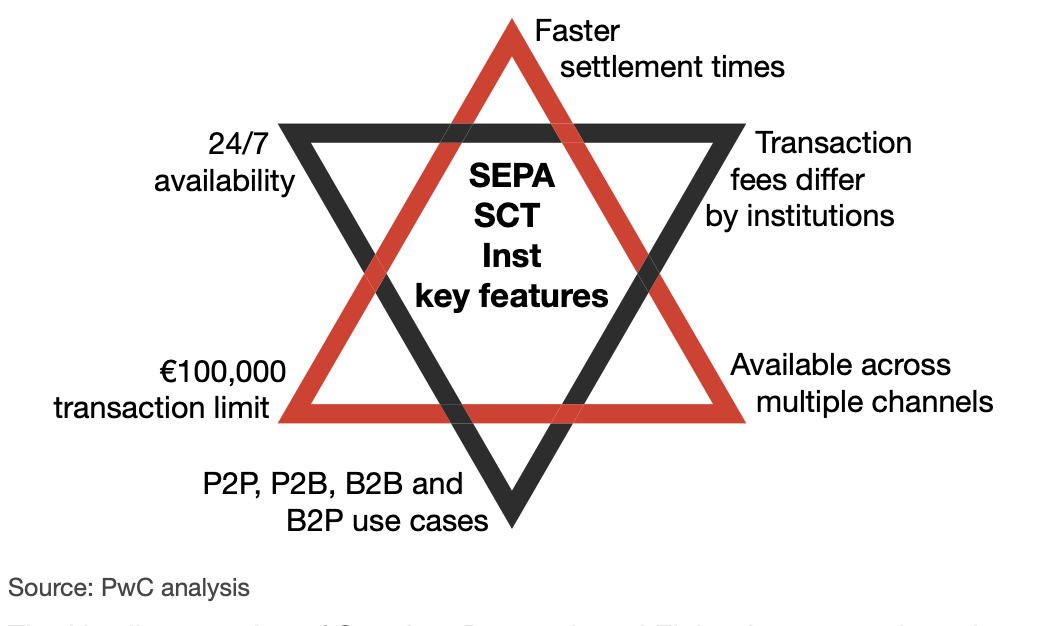

Over 20 nations now have access to instant payment options thanks to the Single Euro Payments Area (SEPA) Instant Credit Transfer (SCT Inst) system. SCT Inst is unlike any other international payment system in that all transactions are conducted in euros. Some of SCT Inst’s most notable characteristics are depicted in the figure below:

To address your question succinctly, however, there are four main causes for the seemingly high cost associated with cross-border money transfers.

To address your question succinctly, however, there are four main causes for the seemingly high cost associated with cross-border money transfers.

-

Banking by Correspondent. Correspondent banking relies on middlemen to facilitate the transfer of funds. Transferring funds costs money. See examples in the diagrams below; in the banking industry, no one works for free.

-

Businesses and financial institutions that facilitate the transfer of funds do so for financial gain. They will keep pricing and profit based on what they estimate the market will bear.

-

Regulatory expenses are notoriously complex. The total price tag for the compliance program depends on a number of factors. Each deal is equal to the sum of the parts.

-

Effects actors: Currency conversion is inevitable at some point in time, making liquidity, currency flows (or limits), etc. important factors.

Latest Read: Can Fintech Survive Without IT Support? Let’s Know With Experts!

Who Are the Top Mega Players in Europe?

- Adyen is a Dutch company founded in 2006 by a group of payment specialists. It offers cutting-edge payment solutions to more than 4,500 clients, some of which are Facebook, Dropbox, Airbnb, and Netflix. Adyen’s POS acceptance network is the largest in Europe, and the company also offers comprehensive coverage for online payments across Europe and some level of coverage in Africa and the Middle East.

-

London’s Earthport accepts payments from banks in more than 60 countries, making it the largest open network for international bank transfers. The Ripple protocol is used to record the transfer of funds through the Earthport Distributed Ledger Gateway, and the Gateway’s pre-funded accounts are utilized to give instant liquidity and the best foreign exchange rate. The resulting transfer to the recipient occurs in what amounts to real-time.

The Future of Europe: What’s Next?

B2B, B2C, P2B, and P2P businesses all make up part of the cross-border payments ecosystem.

In fact, the upgraded correspondent banking model offered by SWIFT GPI, along with new, innovative cross-border channels, is where international payments are headed in the future.

Some examples of such complementary, strategic options are the Single Euro Payments Area (SEPA) Instant and P27 (Central Infrastructure based), non-bank solutions (such as Western Union), and Multilateral Payment Platforms (such as Visa), all of which were cited by Jerome Powell, Chair of the Board of Governors of the Federal Reserve System.

Read more: Top 10 Fintech CEO Watchlist

With post-pandemic stimulation for digitalization, new client expectations, acceleration of the usage of APIs, and rich data, the business model is under strain, and alternatives are needed even faster.

All European banking systems (Target, EBA, SWIFT, SEPA) are currently in the process of implementing or transitioning to ISO 20022. ISO 20022 provides the “oh so important” 100% compatibility between diverse cross-border payment models and platforms, and its widespread acceptance is both a catalyst and an enabler for the introduction of new payment rails that supplement the correspondent banking paradigm.

Although the adoption of ISO 20022 as a standard will help alleviate many problems by increasing payment transparency, facilitating interoperability, and enhancing operational efficiency, it will not be a panacea.

What steps are being taken to ease the difficulties of international money transfers?

A program is already underway in the UK to deliver a revised Real-Time Gross Settlement (RTGS) service. These changes will not only boost domestic payments but will also offer the technological capability to provide some of the enhancements considered in the roadmap. Many institutions are also deeply involved in exploring the implications of emerging technologies, like Central Bank Digital Currencies, for the monetary system.

Read : Global Fintech Fest 2023 – Outcomes

Given the complexity of the challenge at hand, close coordination across jurisdictions and between the public and commercial sectors is essential if we are to succeed in improving cross-border payments. The private sector’s participation is crucial to the practical implementation of the plan because of the sector’s contribution of insights and practical knowledge to create policy and deliver change.

[To share your insights with us, please write to pghosh@itechseries.com ]