In the last 10 years or so, global financial institutions and regulatory bodies have come together to unleash a battery of regulations for Banking, Insurance, and Micro-economies. The advancement of new technologies such as AI, Machine Learning Engineering, Big Data, Cloud and Edge Computing, Blockchain and Crypto, and low-code DevOps, have heavily disrupted the RegTech industry.

This primer dives deep into the world of Regulatory Tech, or RegTech which is disrupted by the new emerging technologies. But, first, let’s learn some basic definitions and industry trends.

The Best-5 RegTech Definitions by the Analysts

In a recent blog, Brian Clark, CEO of Ascent had said that RegTech is slated to become mainstream, even as early adopters begin “to see the actual, tangible benefit” these RegTech tools can provide. We would expand the RegTech horizon by virtue of their direct impact on AML/ CFT frameworks within the current Fintech landscape.

European Banking Authority

According to the EBA, the RegTech perimeter is part of the overall Fintech framework. This Fintech framework also includes other tools and technologies such as AI ML engineering, Sandboxes, Cybersecurity, Consumer data management, and Compliance assessment.

As a standalone technology, RegTech can be defined as a set of tools used in the AML/ CFT operations. AML is Anti-Money Laundering; CFT is Combating the Financing of Terrorism.

These tools are used to automate one or more of these activities –

- Compliance

- Identity and Access Management and Control

- Risk Management

- Risk Reporting

- Transaction Monitoring

- Trading and Auditing

Together with Supervisory Technology (or, SupTech), and AML/ CFT, RegTech raises the bar in combating financial crimes at various levels, globally and locally.

The Financial Conduct Authority (FCA)

UK’s Financial Conduct Authority (FCA) coined RegTech as a term in 2015. It defined RegTech as “a subset of fintech that focuses on technologies that may facilitate the delivery of regulatory requirements more efficiently and effectively than existing capabilities.”

Today, the broad-spectrum definition of RegTech covers all ‘new technologies that facilitate the delivery of regulatory requirements in the financial world.”

The Institute of International Finance (IIF)

The Institute of International Finance (IIF) and its Members have defined RegTech as “the use of new technologies to solve regulatory and compliance requirements more effectively and efficiently” has enormous potential to enable better compliance solutions, increasing efficiency, profitability and reducing barriers to entry to the sector.”

IBM Financial Services

IBM provides AI-powered RegTech capabilities for risk and compliance management.

According to IBM, RegTech is defined as “The application of new technologies to help banks and other financial institutions meet these activities –

- Regulatory monitoring,

- Reporting,

- Compliance, and

- Risk management challenges.

RegTech helps firms effectively manage regulatory compliance and cut compliance-related costs.

Deloitte Insights

According to Deloitte, RegTech is derived from and heavily inclined to its “big brother” Fintech.

RegTech is defined as the use of innovative technology to improve the compliance and delivery of regulations. RegTech solutions aim to provide “a nimble, configurable, easy to integrate, reliable, secure and cost-effective regulatory solutions”.

In a report, Deloitte provides a more refined definition based on its innovative application in various financial operations. It states that –

“RegTech offers banks automated solutions that can speed up the cumbersome process of vetting clients and transactions, which is necessary to prevent money laundering and other financial crimes.”

RegTech is the use of innovative technology to improve the compliance and delivery of regulations.

Raconteur

According to Raconteur, RegTech providers are duly authorized to provide the banks, insurers and investment institutions with automation technology to keep them “on top of compliance” and prevent attracting heavy fines for non-adherence.

So, in general, we can simply answer to “What is RegTech?” in these words –

RegTech solutions are regulation-driven data and analytics platforms to efficiently and effectively streamline any FinTech business to comply with regulatory requirements.

RegTech Trends and their Impact on the Fintech Market

From being a promising sector in 2015, the RegTech market has rapidly grown into a major Fintech-enabler to tackle modern issues related to an uncertain macroeconomic and financial environment that is putting pressure on the fintech sector’s profitability.

FinTech Predictions: The Future of Fintech at CES 2020 with AI, Crypto, Threat Intelligence and So Much More…

- The International Monetary Fund (IMF) has also underlined RegTech’s importance in today’s economy. IMF clearly indicates a common concern about cybersecurity, money laundering, and payment services and a need for greater international cooperation in Fintech.

RegTech definitions would continue to evolve, based on their market penetration.

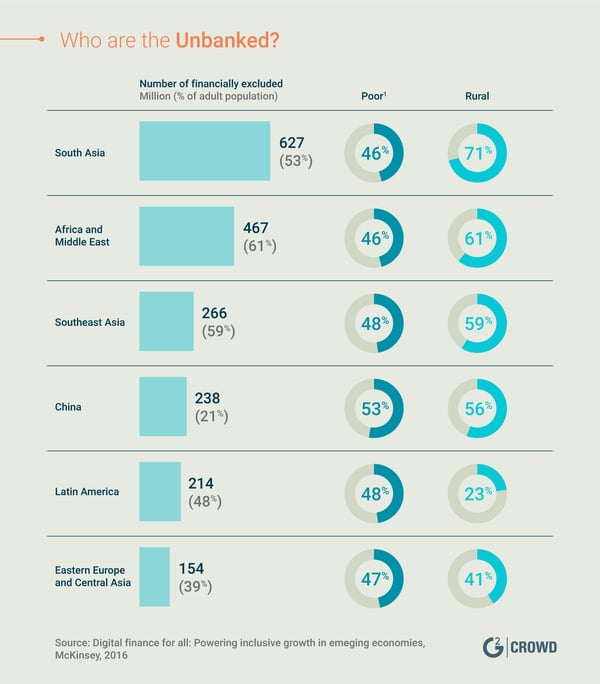

IMF sees Europe as a leader in RegTech delivery and adoption. In the future, Africa and Asia would generate a large volume of RegTech demands, leading RegTech vendors to encourage fintech innovation and explore regulatory responses proactively in these continents.

- In 2018, companies have been penalized $26 billion in fines. These had been imposed for non-compliance with Anti-Money Laundering (AML), Know Your Customer (KYC) and sanctions regulations in the last decade. The highest single fine ever levied against a bank by one regulator – $8.9 billion! (Fenergo)

- 77% expect to adopt blockchain as part of an in-production system or process by 2020; SaaS-enabled RegTech adoption by banks will grow at nearly 20% per year, according to Gartner.

- Local challenges resulting from corporate data breaches, consumer privacy concerns, and a wave of new GDPR-like regulations ( such as the CCPA and the China Password Law) would create demand for technology tools that help enterprises meet compliance challenges.

- Mexico had passed the Fintech Act in 2018. We can expect many countries to follow the provisions laid down in The Mexico Fintech Act as issued on 9 March 2018.

- According to Accenture, the global RegTech market revenue at $2.3 billion for 2018. By 2023, the RegTech market is projected to reach $7.2 billion by 2023, growing at more than 25% CAGR between 2020 and 2023.

- Forrester is expecting RegTech investments to double-up in 2020. In the first three quarters of 2019, the RegTech industry witnessed a 103% growth YoY.

- According to a leading Fintech market reporting firm, RegTech will be heavily disrupted by Data Analytics (62%) and AI (62%). Robotic Process Automation (RPA), Distributed Ledger, and Cloud Computing would continue to accelerate the Fintech/RegTech adoption in the next 2-3 years.

According to IBM, AI and Machine Learning are a game-changer for RegTech and the Financial Services industry.

IBM stated –

“Much like how AI systems help oncologists determine the best cancer treatments, financial institutions can now be armed to make more informed decisions to manage risk and compliance processes and obligations.”

- Blockchain is a key RegTech-enabler in the industry. According to the Consultancy Quinlan & Associates, blockchain, could cut the costs that banks incur to comply with anti-money laundering rules by $4.6 billion a year – or 32 percent of current annual costs – through RegTech adoption.

- Other interesting technologies that could help RegTech gather momentum in the next 5 years include Face Recognition (to detect deep-fakes), AR VR, Voice detection, and Natural Language Processing. Optical Character Recognition (OCR), Image Processing, and Neural Networking platforms could also be associated with RegTech growth.

- New banking applications such as Behavioral biometrics for both Online (web) and, Mobile banking, Social engineering, and IoT could pose unique challenges to the Fintech market. RegTech framework would enable companies to successfully wade through these challenges.

In 2020, we should expect RegTech to move beyond mere automation and account verification processes.

Read Also: Let’s Test Your CCPA Preparedness!

RegTech definitions would get more teeth as we see larger fintech companies adopting RegTech to ultimately speed up the cumbersome Fintech process of vetting millions of accounts in real-time, perform an advanced risk assessment and target money laundering and other financial crimes with better use of Predictive Analytics and Preventive Intelligence.

RegTech Solutions

- AlgoDynamix

- Elliptic

- Fenergo

- Veridate

- FixNix

- Rubrik

- Netskope

- IBM RegTech

- Verafin

- Virtusa xLabs

- Wipro HOLMESTM

(Please write to us at sghosh@martechseries.com to share your RegTech definitions, insights, opinions and start-up stories in RegTech applications)