This article has been co-authored by Lindsay Juarez, Director

Budgeting — tracking expenses and planning how much to spend in specific categories — is often heralded as invaluable. But is it?

To test whether budgeting actually helps people save money or reach financial goals, we partnered with a large fintech partner to run a behavioral science experiment.

Top Fintech Insights: Buy Now, Pay Later Trends Can Hurt Your Financial Health

The experiment

We randomized just over 9,000 people into three conditions. To eliminate selection bias, we showed all users the same first screen, prompting them to “Take control of your budget”:

Users that clicked through were randomized into one of three conditions:

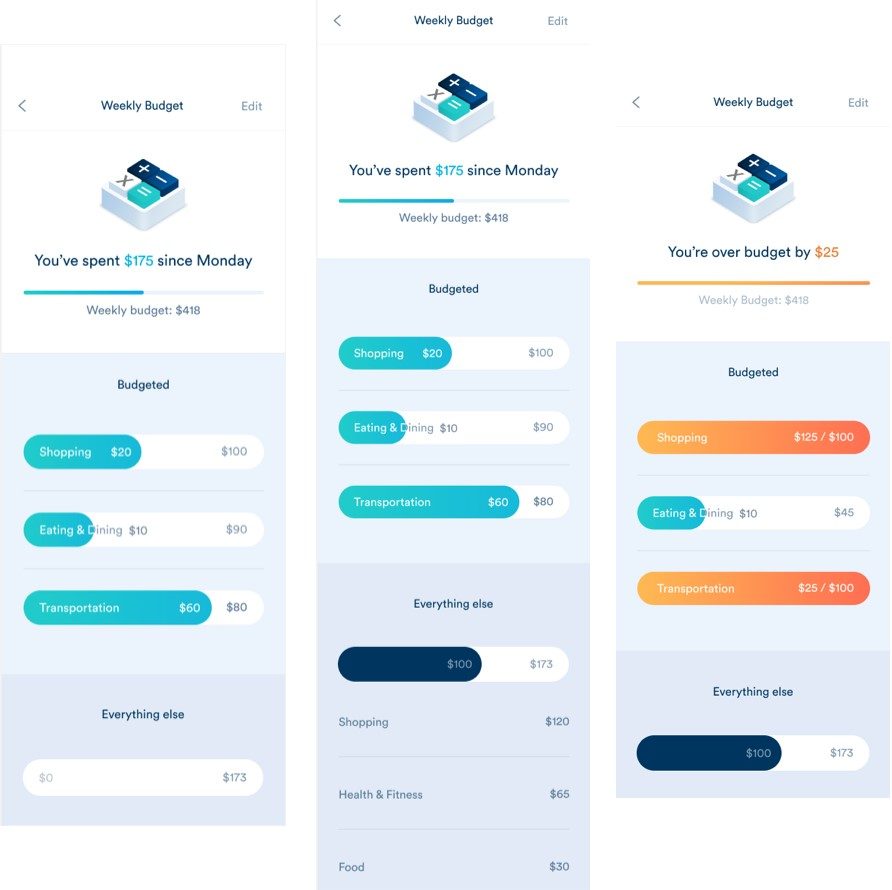

Informational Control: This group saw a sum of their weekly spending, by category:

One-Number Budgeting: This group set a budget for the week:

One-Number Budgeting: This group set a budget for the week:

Category Budgeting: This group set an overall number and sub-categories:

Category Budgeting: This group set an overall number and sub-categories:

We then tracked how budgeting affected spending.

We then tracked how budgeting affected spending.

The results

People in the experimental groups looked at their budgets more than those in the control (from once a month to once every 3 weeks).

But did that help them stick to them?

In a word, no.

We found no statistically significant difference in spending across conditions.

That’s right — there was no significant difference (positive or negative). Plus, budgeters were overly optimistic. They made budgets 25% lower than their regular spending, then continued spending exactly as they had.

This begs the question: If budgeting doesn’t help people meet financial goals, what does? What can fintech companies and others do to help people save money and meet goals?

What to do instead

First, we suggest testing the impact of simple rules of thumb. One study showed that teaching rules of thumb to small business owners improved their accounting, bookkeeping, and even revenue relative to a standard accounting course (Drexler, Fischer, & Schoar, 2014). Our research suggests that applying the “number of times per week” heuristic (e.g., “I’ll only dine out once this week”) could be promising.

Read Fintech News: ZebPay Appoints Geetika Mehta As CHRO As It Plans To Grows The Team By 2x

Second, harness the power of community, support, and feedback. People assigned to create and track savings goals in peer groups contributed 3.7 times more to new savings accounts than those receiving a high-interest rate (Kast, Meier, & Pomeranz, 2014). Capitalizing on social ties and feedback, like having people share savings goals or celebrate paying off debt with friends and family, keeps people motivated.

Third, help people establish direct deposits from paychecks into savings accounts from which they infrequently spend. We already know retirement savings increase through defaults and automatic deposits; this behavioral approach should be replicated to increase short-term savings, too.

Our experiment clearly demonstrates that budgeting doesn’t always change spending habits. Instead, we recommend that fintech companies and financial experts innovate with and test other approaches to improve people’s financial health.

[To share your insights with us, please write to sghosh@martechseries.com]