What Is a Mobile App for Loan Lending?

One can borrow money from a bank at an interest rate with the aid of the loan lending mobile app after analyzing numerous possibilities to determine which is most suitable and the one that can lend you money for a specified duration. This app will function like a credit card, enabling users to obtain an immediate loan. One of these apps must be installed, and the user must register. After determining their eligibility, customers must enter their personal and financial information.

How Do Mobile Apps for Loan Lending Operate?

Gone are the days to fill the lengthy forms and wait in queues. In this era, all the work is done by the app. One just needs to register himself on the app and convert the payment into a loan format. User can thereafter also link their bank account to their loan accounts.

Why invest in the advancement Of Loan Lending Mobile applications?

It is anticipated that this year alone, the transaction value in the marketplace lending sector will increase to USD 20,391.5 million. By 2024, this market’s size will gradually be up to USD 24,914.

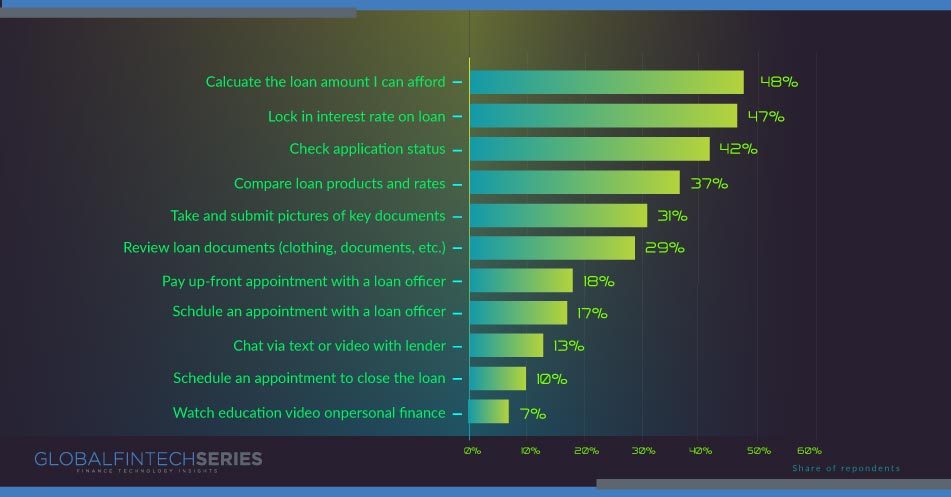

Consumers Demand These Benefits In A Loan Lending App

The Essentials of Money Lending Apps

Read: Let’s Understand Crypto In A Layman Language

Read: Let’s Understand Crypto In A Layman Language

The following cutting-edge features ought to be present in the loan lending app:

1. Push notifications

Get the most recent information on activities and the balance of your EMI using this tool. Also, it assists consumers in learning about the most recent promotions offered by the personal loan lending program. Undoubtedly, we are living in the age of artificial intelligence.

2. Online Assistance

Online support staff are ready to speak with customers and get information about their loans. They can immediately inform users of their most recent transactions and remaining loan balances.

3. Management of Bank Partners

The app can work in tandem with the collaborating banks thanks to this capability. This functionality has been added to a personal loan app, making it more user-friendly.

4.Admin Dashboard

Users can go to this admin dashboard at any time for assistance, acting as though it were a rescuer. It displays the real-time analytics of the app, which allows one to see all activity occurring there as well as transactions between borrowers and lenders or between banks and borrowers. Also, it is simple to acquire data on the overall amount of money lent, the total number of app users, and the total amount of money gained through interest.

5. Built-in cloud storage

Users’ privacy and information are of the utmost importance, and application owners are responsible for keeping it secure and private. Only with the aid of integration with cloud storage is this possible.

7. Calculate a loan

There’s no need to pinch yourself to realise this: Gone are the days when a layperson needed a middleman and had to use a manual calculator to figure out how much interest they would have to pay over the course of a loan. The app, which displays all the loan possibilities available to the client, also manages this task. Undoubtedly, we are living in the age of artificial intelligence.

8 Analytics

App owners can monitor their app’s performance thanks to real-time reporting. They can quickly add or delete any feature based on the needs of the app users with the aid of this data.

9. Supports Different Currencies And Languages

The consumers can use this option to communicate with the app support.

Factors to think about when creating a loan-lending app

-

Financial adviser to take care of the government and regulatory terms and conditions of a country.

-

Legal adviser to advise you on the financial matters of the app.

-

Public Relations company to help you promote your app through various platforms and help it earn recognition amongst users.

-

Banking partner to lend the loan amount to your users.

-

Marketing company for achieving success among your target users.

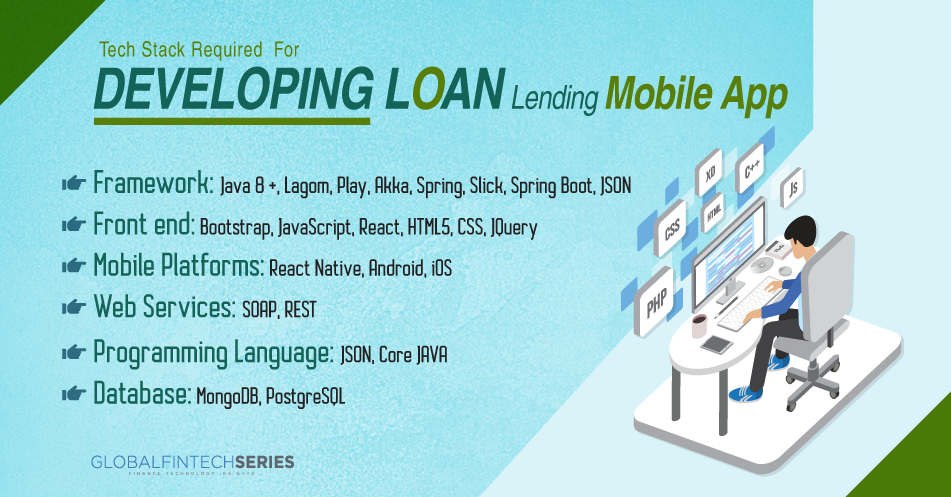

The Tech Stack Need To Create A Smartphone App For Loan Lending

Top Loan Lending Mobile Apps Across The World

Top Loan Lending Mobile Apps Across The World

1. PaySense

If you are in search of an app that provides you with a loan in merely a few hours, then this one fits the bill perfectly for your need. This platform shall be providing short-term personal loans to salaried professionals. The loan is sanctioned within five hours once the client gives an online application. After the application is considered, the borrower has to select the EMI option he wishes to pursue, and soon the required money will reflect in the account within 5 hours.

2. CASHe

This is another tech app that disburses fast loans. This one offers short-term personal loans to young salaried professionals. The user needs to sign up with the help any of social media profile like Gmail or applied and get the eligibility done. And within two hours of application, the amount shall reflect in the bank account within minutes.

3. MoneyTap

Offering cash on demand, this one is the first of its kind offering credit to self-employed people along with salaried professionals of 23 years minimum and earning at least 20 thousand per month. The process is as simple as creating a Twitter login. You can then begin to use the app with a single tap on your device screen. It can be used either as cash or a card. You can convert the loan amount into flexible EMIs. It will be credited to your bank account within minutes after application.

Read: Cybersecurity Timeline and Trends You Should Know Before Planning for 2023

Top Loan Lending Mobile Apps Across The World

Top Loan Lending Mobile Apps Across The World