Here’s What UA marketers Can Learn From Fintech Apps’ Explosive Growth in 2020

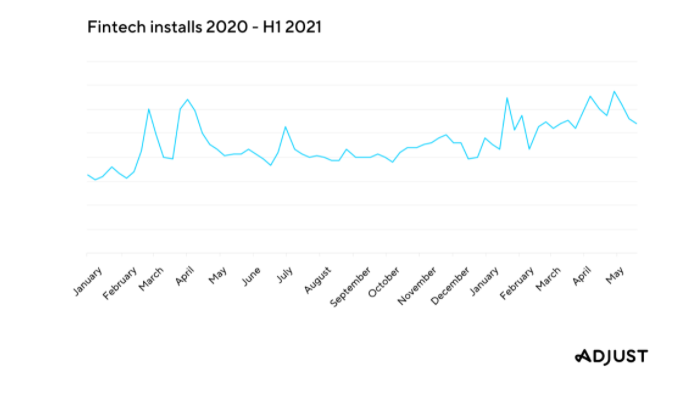

Fintech has had an explosive year. Between lockdowns that prevented people from getting to a physical bank, forcing them to look for alternatives and people — and retailers — looking for new, contactless payment options, 2020 was an unexpected boon to fintech apps. While all verticals saw an increase in installs, fintech apps posted the best year-on-year growth at 51%, and installs are up by 23% for the first half of 2021, according to our recent Mobile App Trends Report 2021.

![Image 2 [Source: Adjust Mobile App Trends Report 2021] Source: Adjust Mobile App Trends Report 2021](https://globalfintechseries.com/wp-content/uploads/2021/10/s2.png)

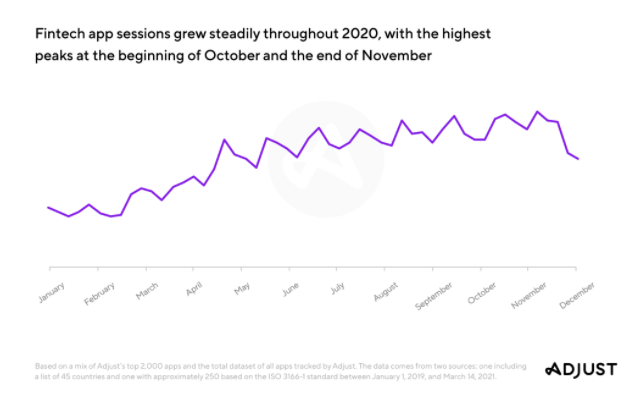

Ultimately this led to an increase in fintech sessions — increasing 85% compared to 2019 and are already up 35% in 2021. In fact, we found that sessions grew steadily throughout 2020, with the biggest weeks at the beginning of October (22% above average) and the end of November (24% above average). Another peak took place in the first week of July, which was up 15%.

Fintech seems to have cracked the code on retention, keeping users who may have downloaded their apps out of necessity, or just plain boredom, engaged for the long haul. More consumers than ever are using apps. To be competitive, you have to be smart, data-driven, and UX-focused. As the entire mobile ecosystem grows, so does competition.

Let’s dig into the data to see what else we can learn from fintech’s 2020 growth.

Top Fintech News: Spreedly Adds Ability to Access Stripe via its Connect Platform

The nuances of fintech

Understanding the nuances of a vertical is the key to successfully marketing an app within it.

When thinking about fintech it’s important to understand how your users are likely to use the app. For instance, a neobank may not expect a user to check into the app multiple times a day the way a social media app might expect, and it’s important to keep this in mind when looking at retention and engagement rates. A trading app may expect users to check in more often to see how their portfolio is performing or to make a trade.

But ultimately, fintech users are loyal.

Fintech apps posted the best year-on-year growth at 51%, and installs are up by 23% for the first half of 2021.

Fintech apps come out on top of the retention rates with the highest number of returning

users: 18% on day 7 and 12% on day 30. The average user now has 2.5 finance apps installed.

Unlike game users, fintech customers are not constantly on the hunt for the next best thing. When they find an app they like, they stick with it.

If you’re struggling with retention in your fintech app, it’s time to understand how users are behaving in-app, when they’re returning and why. By drilling down into your retention rates, you can troubleshoot onboarding issues, work out if you’re providing enough content to keep users engaged, and test the success of introductory offers or specials.

Within the fintech vertical, it’s about focusing on your app’s function and USP. A banking app will take a very different approach to bringing in users than a payment or trading app. The subtle differences within the sub-verticals can then be capitalized on further to yield impressive results. Companies that target the right users will be able to count on loyalty and lifetime value (LTV). So what does this mean for user acquisition (UA) marketers?

UA opportunities for fintech

UA marketers are constantly trying to perfect their approach to finding the right users — the right users being the people who are likely to stay engaged, retained, and spending money.

Our research finds that the highest overall share of paid installs took place in Q1 and Q3 of 2020. There were 0.45 paid installs for every organic. It remains relatively consistent throughout the year, however, with the 0.39 in Q2 the lowest point. Fintech has a comparably low share of paid installs, with payment slightly higher than banking, hovering from 0.1 to 0.13 and 0.08 to 0.2, respectively.

Overall, Q4 was the most expensive quarter to acquire users overall at a median of $1.88 per install. Fintech, however, had its most expensive period in Q1, at $1.57, and dropped as low as $0.53 in Q2.

The report also shows us that the median number of partners per-app hovers at around five for all verticals, increasing to six in Q4 of 2020. However, the median fintech app works with just three partners. This indicates an opportunity for the fintech vertical to diversify the number of partners it works with to potentially find a new pool of potential users.

Additionally, depending on your risk profile, you can float different amounts while you wait for the LTV of your acquired users to start returning on your investment. By tracking eCPI (Effective Cost Per Install), you can project how long it will take for a user to turn profitable, and figure out where you want to invest — and how much you want to risk. This is true for all verticals, but fintech apps with their built-in monetization models and loyal users may be able to tolerate more risk.

As 2021 throws marketers a new curve with the implementation of i0S 14 and app tracking transparency (ATT) puts added pressure on marketers, even fintech apps need to recalibrate their campaigns. The importance of A/B testing and deep user understanding to create a well-rounded strategy incorporating highly personalized campaigns, automation, and real-time measurement is more critical than ever before.