BrandTotal study analyzed thousands of paid social media ad campaigns from the three leading buy now pay later solutions over the last 90 days

BrandTotal, a leading social competitive intelligence and brand analytics platform, released new data examining how leading ‘Buy Now, Pay Later’ platforms — Klarna, Affirm and Afterpay — have been advertising on top social media channels.

BrandTotal’s latest “Social Ad Snapshot: Buy Now, Pay Later” research report analyzed all paid social campaigns on Facebook, Instagram, YouTube, Twitter, and LinkedIn from the three leading BNPL solutions over a 90-day period, from June 13th to September 10th. Key findings are as follows.

Klarna Wins on Paid Share-of-Voice

In an analysis of paid Share-of-Voice (SOV), which is defined by percentage of sponsored impressions, Klarna dominated, with 51% paid SOV, compared to 35% for Affirm and 14% for Afterpay.

“‘Buy Now, Pay Later’ players rely heavily on social media to educate shoppers about their value and to drive adoption, and Klarna is leading the pack there when it comes to advertising,” said Alon Leibovich, CEO & Co-Founder, BrandTotal.

Read More: Grayscale Investments Doubles Its Suite of SEC Reporting Investment Products

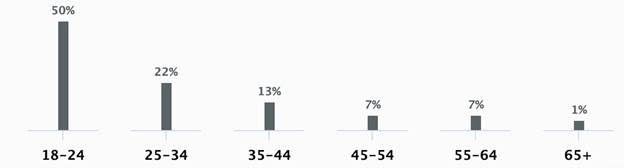

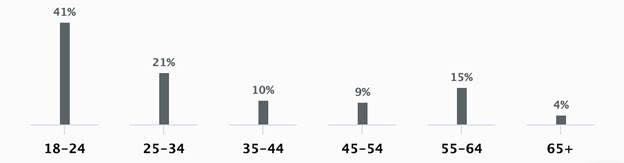

Klarna Most Aggressive in Courting Gen Z

Klarna was the most likely to advertise to Gen Z (18-24) on social, as half of its ad impressions (50%) targeted that demographic. For comparison, 41% of percent of Affirm’s impressions and just 8% of Afterpay’s impressions targeted Gen Z.

“Klarna was the most aggressive in going after younger audiences,” said Leibovich. “Seventy-two percent of their impressions were served to people between 18-35. Only 62% of Affirm impressions reached that group, with just 22% for Afterpay.”

“Targeting a younger audience is a strategic move to capitalize on digital natives who not only grew up in a world of social media and ecommerce, but who are also more open to new, technology-enabled payment models,” added Leibovich.

Additionally, 83% of all ‘Buy Now, Pay Later’ social media ads targeted women, with just 17% targeting men.

Most Popular Social Channels

Klarna, Afterpay and Affirm split their social ad budgets on the following channels:

| Buy Now Pay Later: Klarna vs. Affirm vs. Afterpay | |||||

| YouTube | |||||

| Klarna | 6% | 23% | 9% | 40% | 22% |

| Affirm | 9% | 25% | 2% | 30% | 34% |

| Afterpay | 53% | 0% | 42% | 1% | 4% |

“Klarna and Affirm have very similar social ad strategies, allocating most of their social media mix on Twitter, LinkedIn and YouTube,” said Leibovich. “Afterpay has opted for a very different strategy, focusing heavily on Facebook and Instagram, while investing nothing on YouTube.”

“Buy now pay later is a revolutionary new model that will upend the way products are bought and sold,” added Leibovich. “It acts as a parallel network with SKU level information, that bypasses the issuing bank, card network, and merchant acquirer. It’s enticing to both merchant and consumer demand and we’ll continue to see this model gain popularity over time.”

Read More: Novo Hires Executive Vice President of Engineering and Chief of Staff