Introduction to Financial Wellness

Behind every successful CFO, there is a secret financial software tool. The vision is to not only manage finances but also enhance corporate performance and achieve sustainable growth. In this article, we shall be focusing on a compiled list of the top 15 software tools for 2023 that will help you to make the right choice.

Come, let’s unveil their secret!

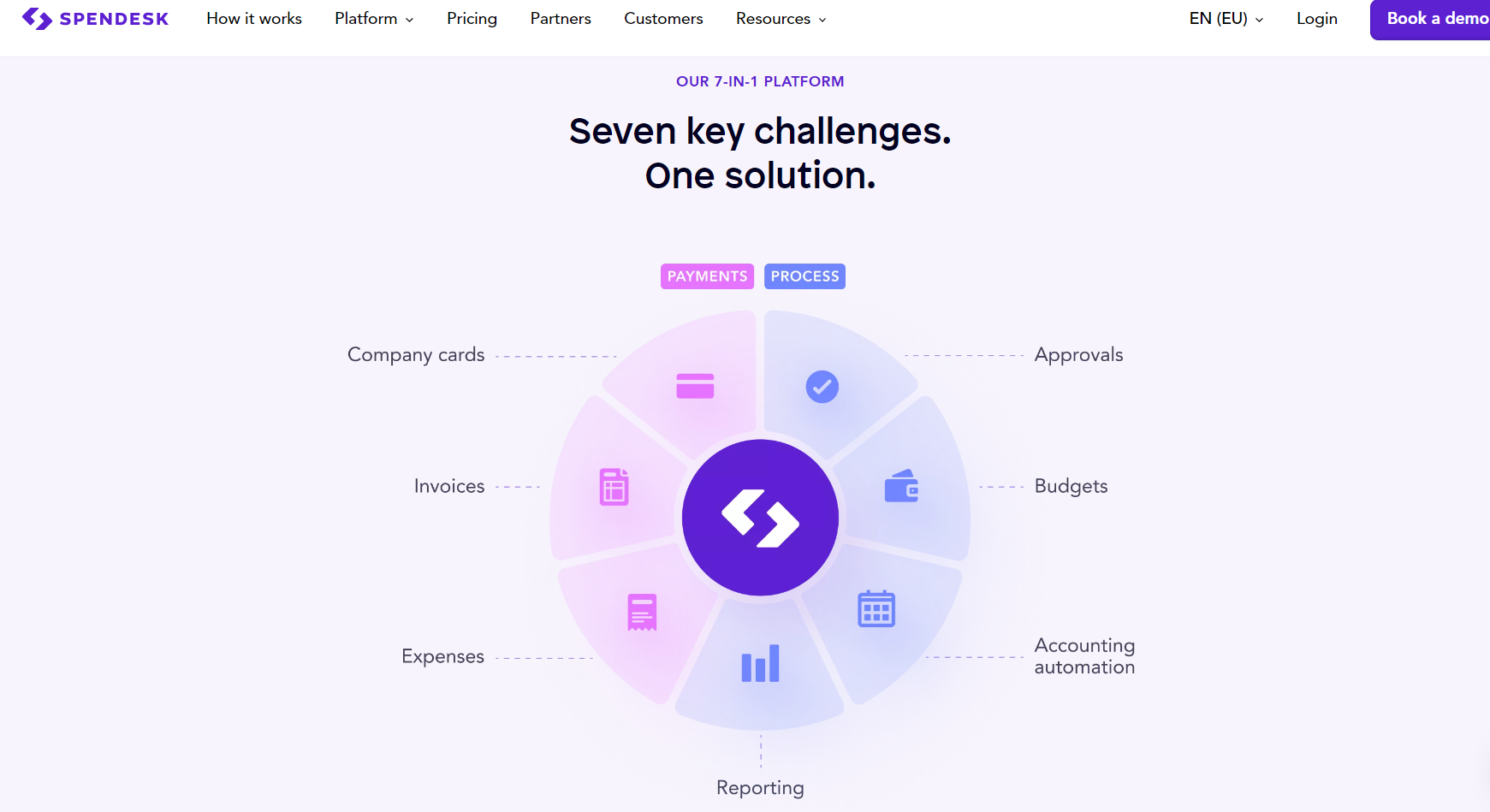

Spendesk

Spendesk is used every day by CFOs, financial controllers, treasurers, and accountants to optimize expenditure and provide their employees greater autonomy.

Spendesk delivers a real-time version of credit cards, expense reimbursements, billing, and automatic accounting management systems on a single, user-friendly platform. It also has automated accounting guidelines that map expenses automatically, reducing mental strain. There are various plans available on the website, depending on your usage.

Spendesk delivers a real-time version of credit cards, expense reimbursements, billing, and automatic accounting management systems on a single, user-friendly platform. It also has automated accounting guidelines that map expenses automatically, reducing mental strain. There are various plans available on the website, depending on your usage.

Expensify

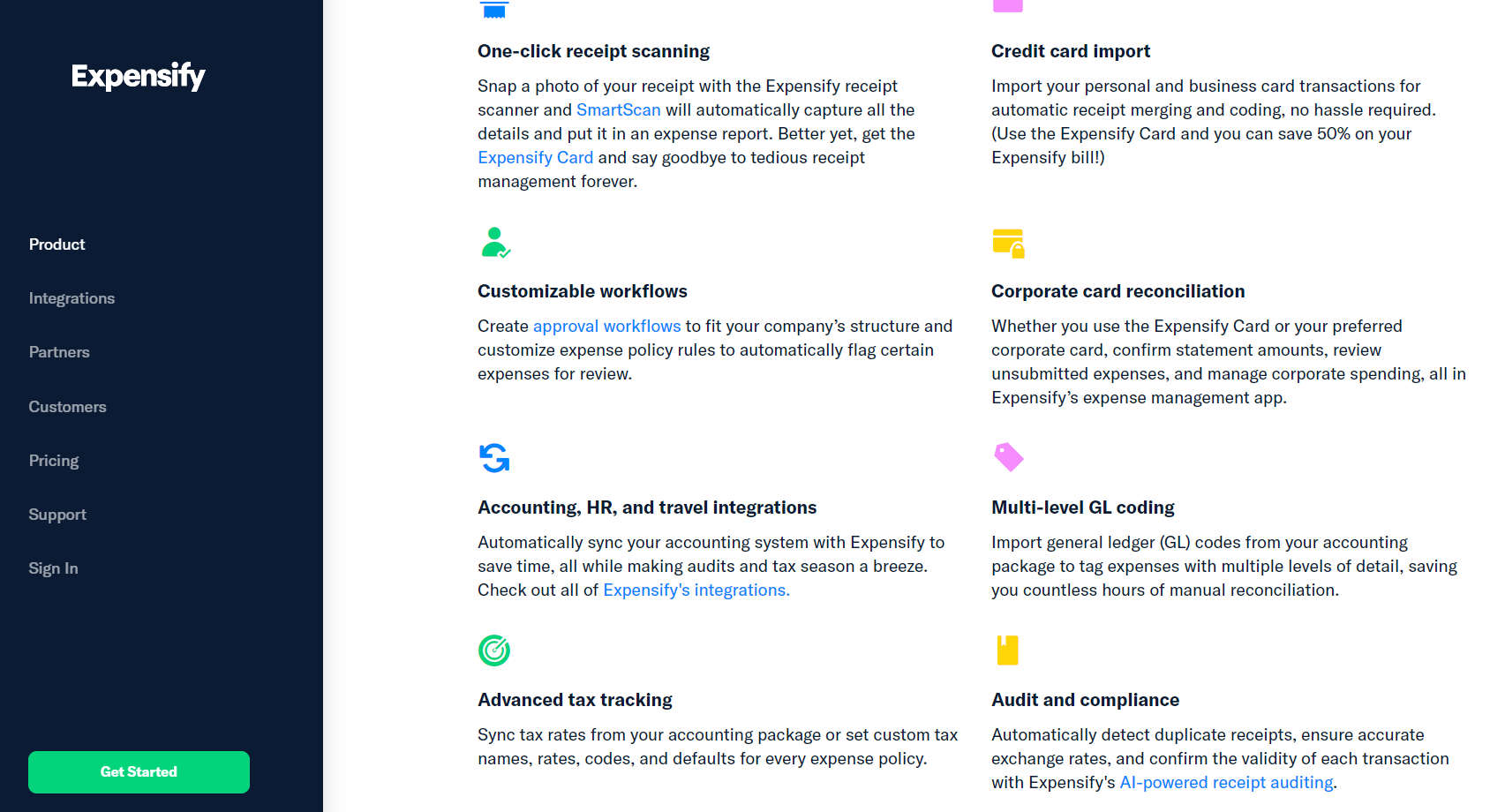

One must ensure that any business costs incurred by your workers are legitimate and accurately recorded before paying them back. This is where cost management comes into play: with the proper procedures in place, workers can submit their expenditures quickly and get paid, and you can precisely track and record them.

However, the inefficiency of conventional expenditure management methods is a concern. No employee wants to manually input the cost of each Uber ride they took while traveling for work, and no administrator wants to spend hours reading through reports that were clumsily put together.

Fortunately, these difficulties are a thing of the past thanks to Expensify’s expenditure management software. Expensify is made for those who are busy and have other responsibilities to attend to. It has time-saving features, AI-powered technologies, and a simplified, user-friendly layout.

Are you weary of tracking your daily expenditures? Expensify will relieve you of the responsibility of organizing and storing physical receipts for small business expenses. It is simple to separate personal finances from business finances. Using the mobile cost-tracking software Expensify, employees can easily rebill cash payments, account for expenses, and receive reimbursement.

Read: Most Trending Crypto Wallet Of 2023 – Phantom

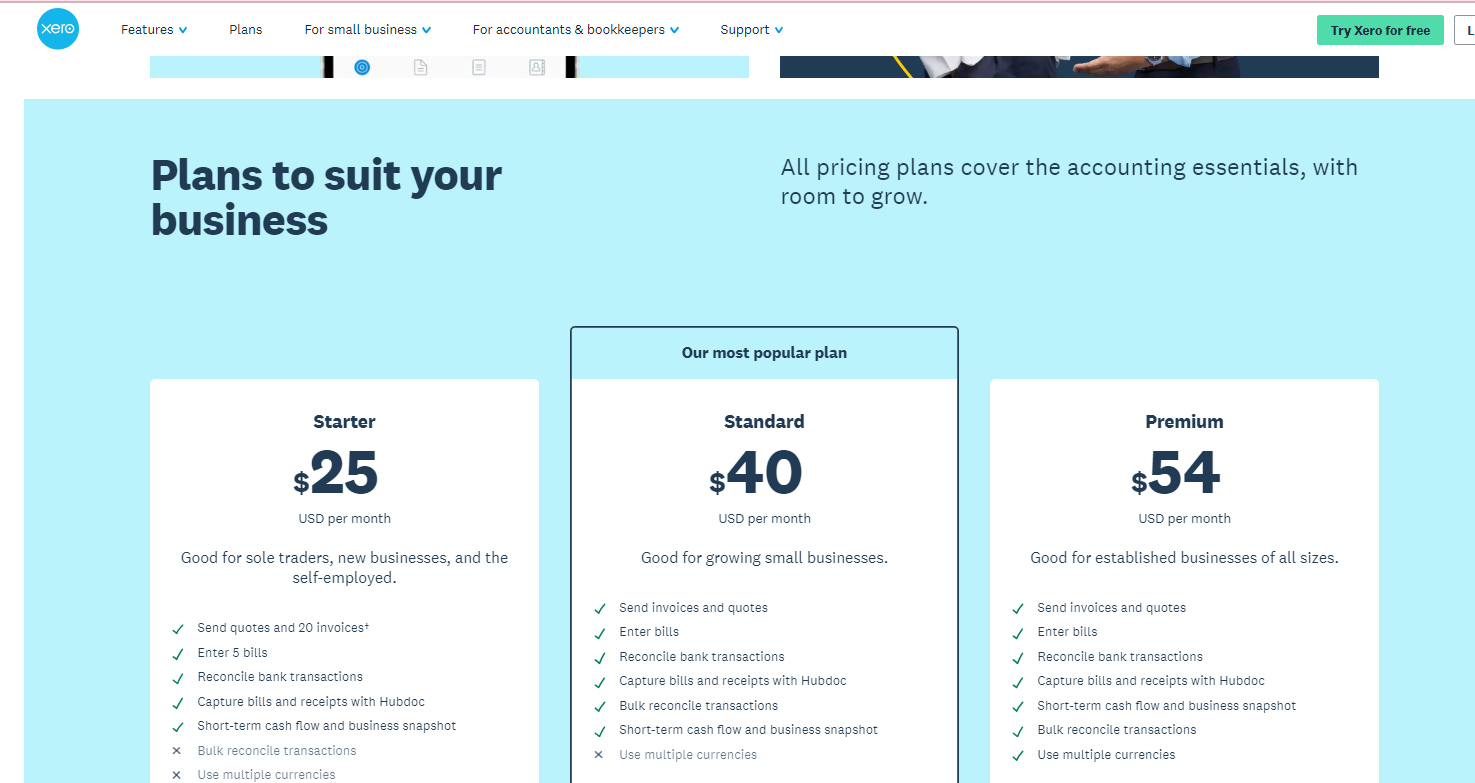

Xero

One can connect his bank to Xero and set up bank feeds by which the transactions flow securely straight into Xero every business day.

Also, one can easily accept online payments from Xero invoices using a credit card, debit card, or direct debit. Allow consumers to pay whatever they want to, and you’ll enhance the probability that you’ll get paid on time and spend less time pursuing payments.

Many businesses and individuals use Xero to simplify their financial processes. Some of its functions include the creation of reports, automated record-keeping, expense computation, and billing. Additionally, Xero can be used to manage inventory holding and sales orders, eliminating the need for manual data entry. Xero is available for a nominal monthly fee of $20.

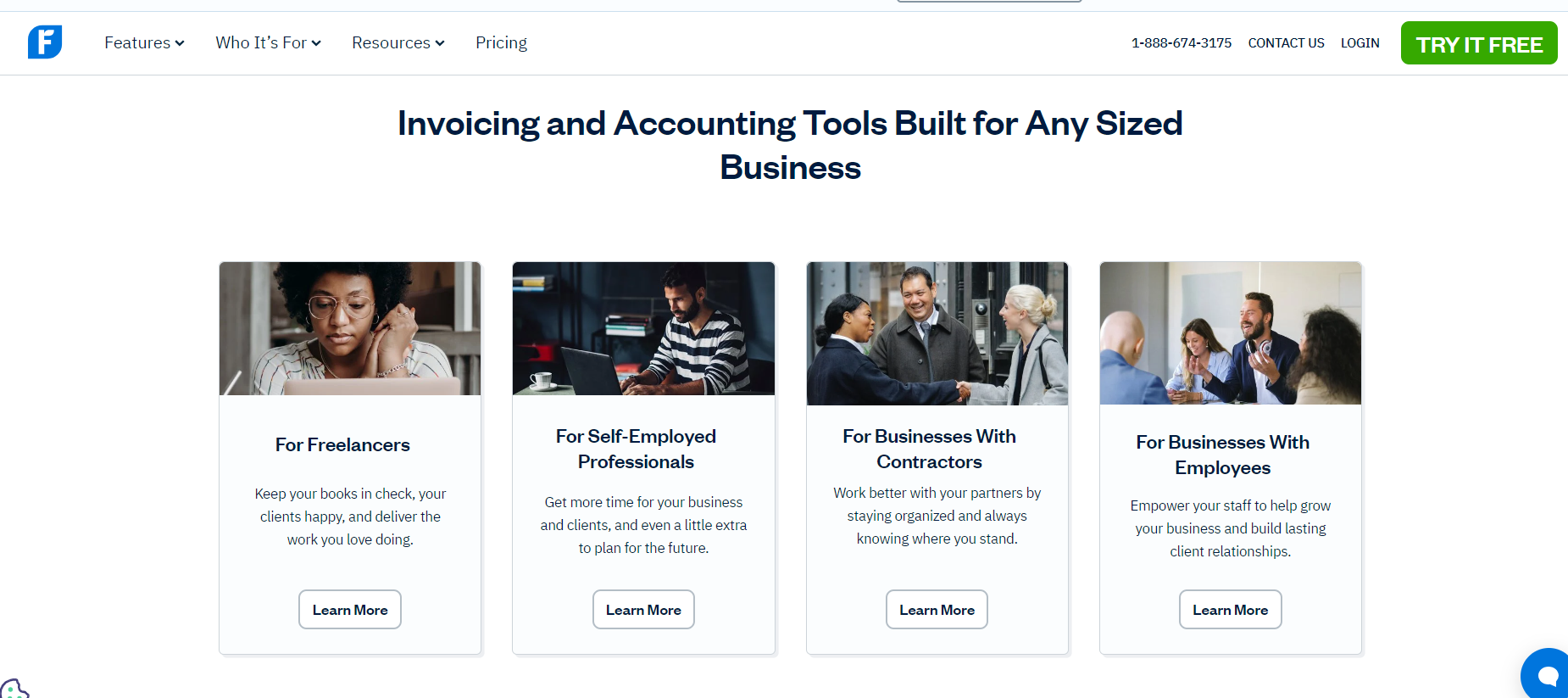

FreshBooks

A complete, simple, and appealing double-entry accounting experience is provided by FreshBooks. Better than rivals in its class, it anticipates the requirements of independent contractors and small firms. Invoice production, payment acceptance, expenditure tracking, billable time tracking, and financial reporting are all automated using FreshBooks.

This accounting software solution simplifies and automates all of the most important accounting processes. You can easily generate, modify, and manage ledger entries, and data can be exported without complication. Since this tool is cloud-based, you can access your files from any location on the planet.

This accounting software solution simplifies and automates all of the most important accounting processes. You can easily generate, modify, and manage ledger entries, and data can be exported without complication. Since this tool is cloud-based, you can access your files from any location on the planet.

PlanGuru

PlanGuru is a small business budgeting program that allows you to examine your spending plan and identify potential financial issues before they become severe. Utilizing information from balance sheets, cash flow statements, and income statements, it achieves this objective. PlanGuru has a monthly price tag of about $100.

PlanGuru is a small business budgeting program that allows you to examine your spending plan and identify potential financial issues before they become severe. Utilizing information from balance sheets, cash flow statements, and income statements, it achieves this objective. PlanGuru has a monthly price tag of about $100.

Read: Financial Forecasting Tools

SOS Inventory

Don’t be surprised by automated monitoring and tracking of inventory in real-time. This SOS tool saves time and money by tracking purchases from order to sale via an integrated cloud-based solution accessible directly from the POS for additional technological features. Inventory management is essential to your company’s efficiency, so this tool is an absolute yes.

Wave Accounting

Wave Accounting was created for small businesses with features such as billing, invoicing, payment tracking, and finance management, which streamline bank reconciliation and enhance bookkeeping efficiency. Accounting software from Wave is entirely free, with no hidden fees.

Zoho Books

Zoho is an online accounting tool offering end-to-end accounting techniques. Some of the software’s biggest features include accounts receivable, payables, inventories, banking, time tracking, and 1099 reports.It has integrated with more than 40 applications, which has made it tax compliant also. It’s free to use for companies with annual revenues of less than $50,000. The cheapest monthly plan costs $15.

Rydoo

You may set up how those transactions are handled for any kind of card, including debit, credit, prepaid, and shopping cards. Rydoo verifies that all data is input accurately and reconciles the information with a receipt or invoice. Rydoo creates and matches incoming transactions from Mastercard, Visa, and Amex automatically.

Rydoo is one of the popular expense claim management tools where we can easily track in real-time employee costs. It also enables the setting of spending restrictions to gain insights into bottlenecks and to take advantage of local compliance that is built in. The beginning price for the basic plan is seven dollars per month.

Rydoo is one of the popular expense claim management tools where we can easily track in real-time employee costs. It also enables the setting of spending restrictions to gain insights into bottlenecks and to take advantage of local compliance that is built in. The beginning price for the basic plan is seven dollars per month.

Read: Let’s Understand Crypto In A Layman Language

NetSuite

NetSuite Services offers the knowledge and skills necessary to assist your organization from the first go-live to continuous optimization thanks to hundreds of successful installs and a large pool of experienced individuals. The NetSuite Services team has in-depth knowledge of NetSuite and is able to provide helpful guidance based on observations from a variety of companies with varying sizes, locations, and business types. Accelerating your success and boosting ROI are the objectives.

NetSuite is a widely used cloud ERP platform and is a one-stop shop for ERP, CRM, business process development, and eCommerce. It allows users to store all of their sensitive information in a single, secure location.

NetSuite is a widely used cloud ERP platform and is a one-stop shop for ERP, CRM, business process development, and eCommerce. It allows users to store all of their sensitive information in a single, secure location.

Stripe

Stripe is a widely-used payment processing infrastructure platform for organisations of all sizes and in a variety of industries. In addition to simple APIs, this tool offers a variety of functions, including invoice generation, spending control, fraud prevention, and payment acceptance in multiple currencies.

Stripe is a widely-used payment processing infrastructure platform for organisations of all sizes and in a variety of industries. In addition to simple APIs, this tool offers a variety of functions, including invoice generation, spending control, fraud prevention, and payment acceptance in multiple currencies.

Read: What Is Data Science?

PayPal

PayPal is a crucial piece of financial software used by CFOs that enables them to accept payments from customers in a variety of ways and locations. It meets a variety of requirements, including checkout solutions, recurring payment solutions, and BNPL solutions. PayPal has varying rates for commercial transactions, so be sure to read the fine print.

PayPal Holdings, Inc., headquartered in the United States, is a worldwide financial technology company that operates an online payment system in most countries that allow online money transfers which is the best seen alternative yet.

Workday

Workday provides best-in-class financial and HR solutions with AI integrated in, in contrast to fragmented ERP systems. The outcome? Faster confident decision-making, perfect company and financial processes, and employee empowerment for top performance are all possible.

Workday is a well-known financial tool for human capital management that features self-service interfaces, advanced analytics, time tracking, payroll, and benefits administration. This tool also incorporates cognitive automation that eliminates human involvement throughout the entire attract-to-pay cycle. The price of the basic package begins at $100 per month.

HR Breezy

HR Breezy is an all-inclusive CFO tool that provides your team with recruiting solutions to streamline the entire hiring process. Included are functions such as applicant sourcing, career portal, candidate management, job advertisement, and reporting. The basic plan begins at $143 per month.

Breezy has been selected by more than 17,000 businesses of all sizes and shapes to automate tedious recruiting activities so that they may spend more time interacting with a wide range of high-quality prospects.

Breezy has been selected by more than 17,000 businesses of all sizes and shapes to automate tedious recruiting activities so that they may spend more time interacting with a wide range of high-quality prospects.

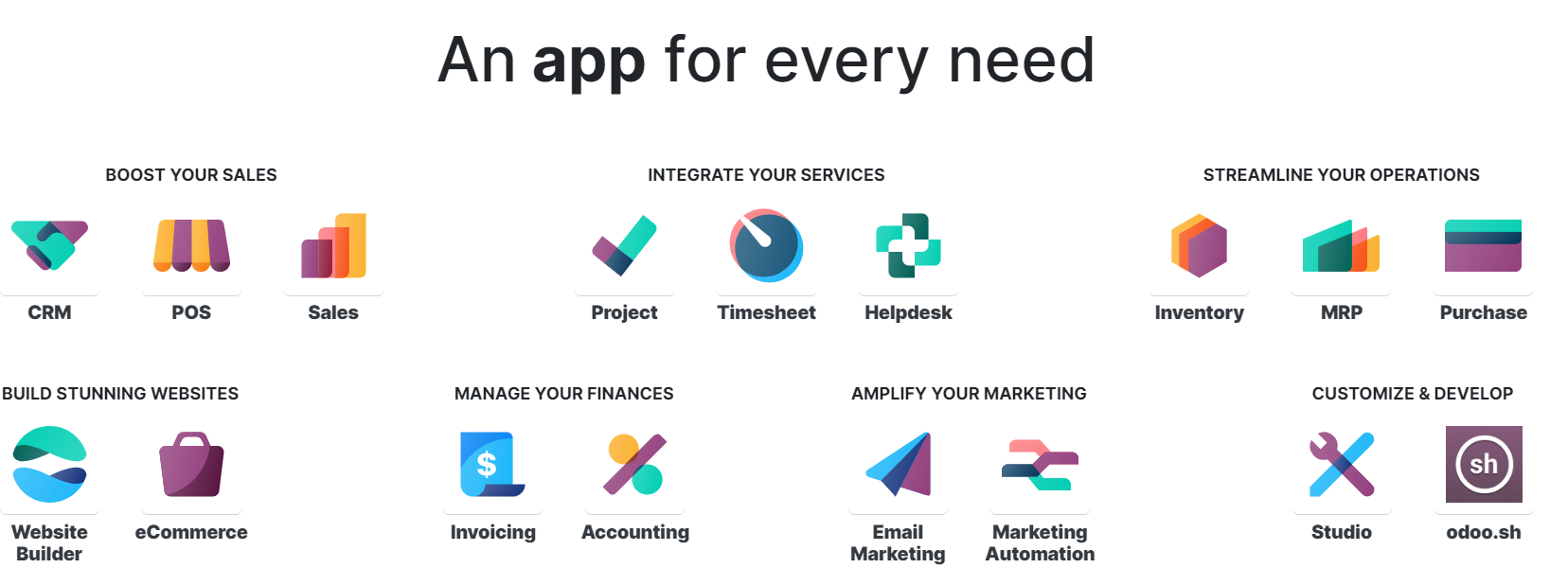

Odoo

Odoo facilitates the optimization of CFO operations. It is an open-source ERP that integrates services from multiple business sectors, including inventory, marketing, sales, and finance, allowing you to gain a 360-degree view of your company’s operating business expenses.

Conclusion

This blog was quite appealing in context to the choices which can be opted for a healthy financial ambiance by top-notch executives. Although this blog focused on the Top 15 software accessible in the global market today, to no surprise, there exists a hundred more like them. But as we know we need to scoop the cream out and serve a dessert that is eye-catching, in the similar way CFOs can extract the maximum and deck their information up. With a perfect software tool, one can stay organized and have an upper hand on expenses too.

Hey, all the executives out there, think-wise, adapt financial software!

Read: Top Features Of Digital Payments App

[To share your insights with us, please write to sghosh@martechseries.com]