According to studies, 40% of invoices and 48% of B2B payments are still made on paper.

That represents a sizable proportion of organizations that continue to work with outdated invoice and payment systems. A potential explanation? People and companies are reluctant to fix an unbroken system.

Naturally, that only holds true for as long as the premise is accurate.

Introduction

Accounts payable are a company’s short-term liabilities, such as bills owed to suppliers. Processing expense reports and invoices as well as seeing to it that payments are made fall under the purview of AP departments.

We’ll also examine the best procedures for automating the AP department. Automation is a crucial factor to take into account when developing new and better rules as more businesses go digital.

It is best to support the policies that promote best practices in the accounts payable process with AP automation. The work your firm puts into new automation will also translate into building a best practices policy if your organization is not already employing business process automation or your software is outdated. Reliable automation software helps your company’s financial objectives while making it easy to set policies that support accounts payable processing in your business.

Read the latest article: 10 Best Applications Of AI In Banking

Exclusive Insights- Why do businesses need AP Automation?

We had a one on chat discussion with Cigniti Technologies Chief Delivery Officer, Raghuram Krovvidy below are his insights and thoughts in the domain of AP automation.

We had a one on chat discussion with Cigniti Technologies Chief Delivery Officer, Raghuram Krovvidy below are his insights and thoughts in the domain of AP automation.How to select an accounts payable automation software?

Companies wishing to automate accounts payment should carefully evaluate the various AP automation options to make sure it is the best fit for their company. To ensure complete automation of AP processing and significant time and money savings, it is essential that the accounts payable automation software chosen can cover all invoice processing use cases required by the business.

It is also important to understand how an organization’s AP automation software integrates with its ERP in order to guarantee data synchronization and effective processing. Through ERP integration, master data may be sent from the ERP to the AP system. Connectors for various ERP systems are typically provided as part of, or as an add-on to, AP automation solutions.

Read: How Can Banks Stay Competitive With A Secured IT Security Infrastructure?

One of these tools will probably be able to address your specific needs more effectively than the others. In order to determine which of the following checks the right boxes for your company, read through our list.

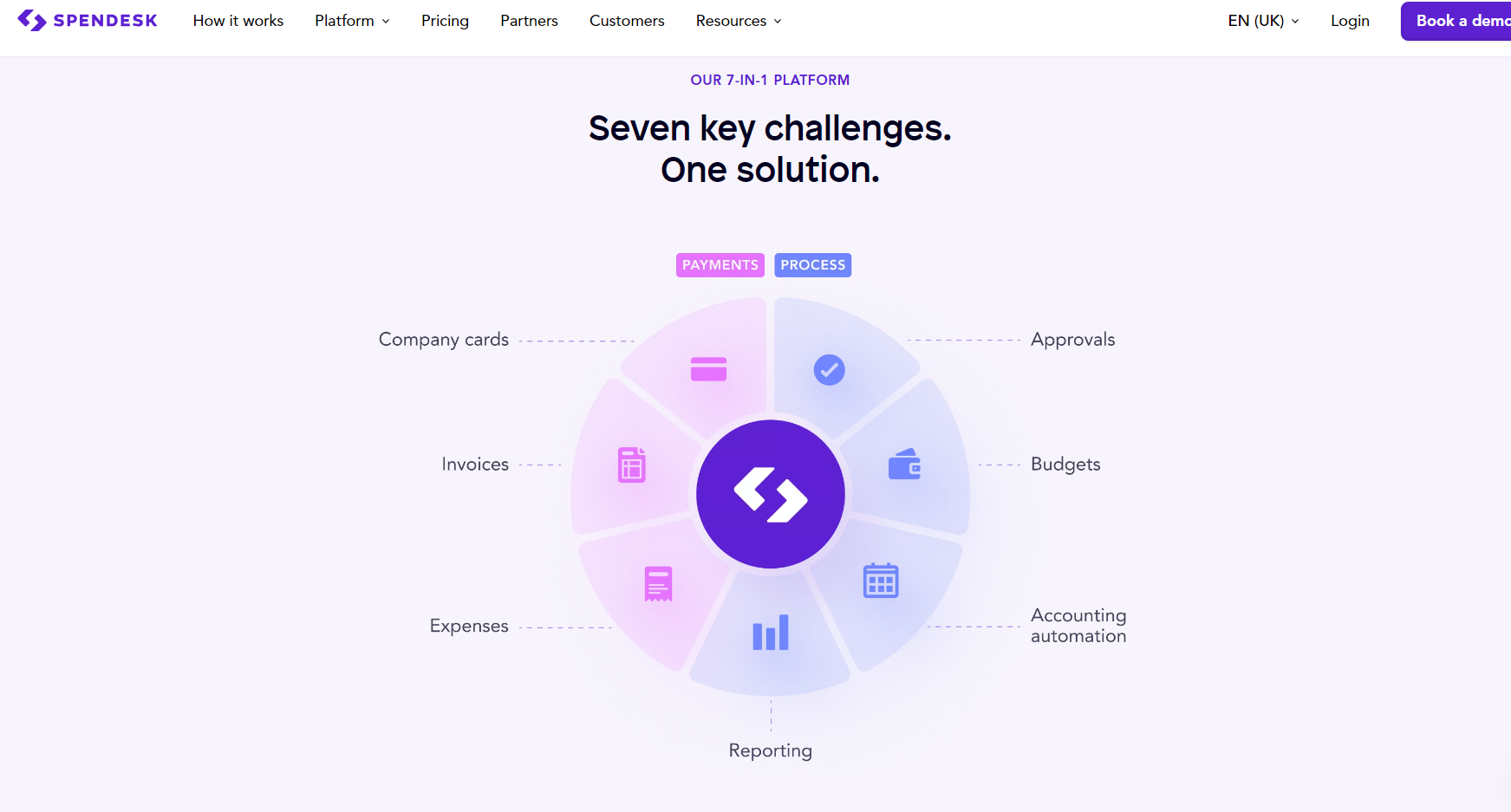

Spendesk

Spendesk wasn’t designed exclusively for accounts payable. Instead, it’s a thorough spend management solution that automates the worst parts of invoices, expenditure reports, and business credit cards.

The benefit of this is that all of your operational expenses can be managed on one platform. Employees will rapidly pick up on the proper ways to submit expense claims, make purchases while traveling, ask for additional subscription tools, and pay consultants and independent contractors for their work.

The benefit of this is that all of your operational expenses can be managed on one platform. Employees will rapidly pick up on the proper ways to submit expense claims, make purchases while traveling, ask for additional subscription tools, and pay consultants and independent contractors for their work.

Use the same platform and essentially the same methodology to manage each of these processes.

Read: Unleashing The Power: How Tech Giants Harness Generative AI Chatbots

Key benefits

- Keep all kinds of payment in one tool for faster gains and less individualized instruction.

- Utilizing OCR software, automatically scan and enter data from invoices.

- Instead of having each employee contact the finance or procurement team, let them handle their own purchases.

- Set precise expenditure caps for team or user, and easily keep track of all managerial approvals.

- Every evidence of purchase should be automatically verified and saved on the platform as soon as a transaction is completed.

Beanworks AP Automation

Beanworks is an AP automation program created for accountants, as the ironic name implies. For businesses undergoing an audit, the program automates invoicing and reporting and is particularly beneficial.

Read: Let’s Dive Deep Into Fintech Vs The Conventional Banking

Of course, the fact that it’s simple to use for staff members with various levels of financial and technological expertise explains why it works so well for accountants. As a result, the finance team receives requests that are properly written and can easily transfer data into accounting software.

Key benefits

- Automatically imports and scans invoices.

- Important AP paperwork, such as purchase orders and invoices, is kept centrally.

- Automatically matches invoices to purchase orders.

- Includes processes for requesting and monitoring management approvals.

Gatekeeper

Gatekeeper bills itself as “the AI-driven all-in-one contract management platform” for finance as well as operational teams. It’s fantastic for businesses that handle numerous contracts, especially with recurring providers.

The specialized Vendor Portal is among the most intriguing features. By doing this, you can grant regular suppliers the use of (a constrained version of) the tool that bears your branding. They can save time and work for both parties by updating purchase orders and uploading invoices on their own.

The Kanban Workflow Engine, which enables your entire team to see who is responsible for each step of the process, will also be appreciated by agile teams.

Key benefits

- Through the Vendor Portal, vendors can build their own invoices within the system. Therefore, there is no requirement for your team members to scan or distribute invoices.

- Contracts may also include supplemental documentation like photos, invoices, and memos.

- The system incorporates approvals, which streamlines the procedure and reduces pointless communication.

- To connect contracts with other customer records, Gatekeeper interfaces with CRM software.

Stampli

Similar to Spendesk, Stampli automates the processing of invoices but lacks alternative payment options like business cards and expenditure automation. Your team members only input the invoices that contractors and suppliers deliver to the system for processing and approval.

Thanks to Billy, a bot that reads your bills and pulls important information, this process moves along more quickly. The more you use the tool, the more Billy learns, which makes coding invoices simpler.

Trusted vendors can also upload invoices directly into the system using the supplier portal provided by Stampli. But the tool’s approval procedures, which are well-liked by 96% of reviewers, are its most well-known feature.

Key features

- Billy the Bot extracts data from invoices after scanning them.

- Approvers have access to a central list of all outstanding invoices.

- Invoices are completely digitalized.

- Has good financial software integration with accounting software.

Conclusion

As the world progresses towards automation how can we forget AP (Accounts Payable) automation in the business houses?

In this blog, I have tried to justify the best tools for AP automation although there are many in the market as of today it wasn’t possible to incorporate all of them at the moment. We have created a trail of articles based on accounts payable automation which you can access for more information and detailing for accounts payable automation.

[To share your insights with us, please write to sghosh@martechseries.com]