Why is technology important in fintech?

It’s important to recognize the exponential growth being seen by the FinTech sectors as a result of technological advancements in the sector. New concepts are being refined into usable tools. Today, FinTech plays a more defined, significant, and fundamental role, especially for businesses that aim for annualized growth rates of 2X.

Currently, the size of the global FinTech market is projected to increase to USD 124.3 billion by the end of 2025, representing a compound annual growth rate of 23.84%.

Nobody wants to go to a physical bank, stand in long queues, and fill out tonnes of paperwork.

According to estimations provided by McKinsey, the implementation of AI technology in banks might result in an increase in yearly value of up to one trillion dollars.

Read: Trust in Banking Explained With 10 Live Examples

In addition, fintech firms leverage technology and its possibilities to automate a wide range of processes. By doing this, they save money on payroll. As a result of the convenience of using a smartphone, some fintech apps are also rendering the traditional bank obsolete.

Thanks to the advancements in financial technology, firms in the modern era are no longer required to adhere to antiquated practices. There are now a variety of payment methods available to businesses, from net banking to mobile payments.

Financial technology is rapidly adopting automation to increase productivity.

The correct tools can aid financial institutions in being more productive, precise, collaborative, secure, and capable of making data-driven judgments as opposed to relying on intuition about customer wants and market trends.

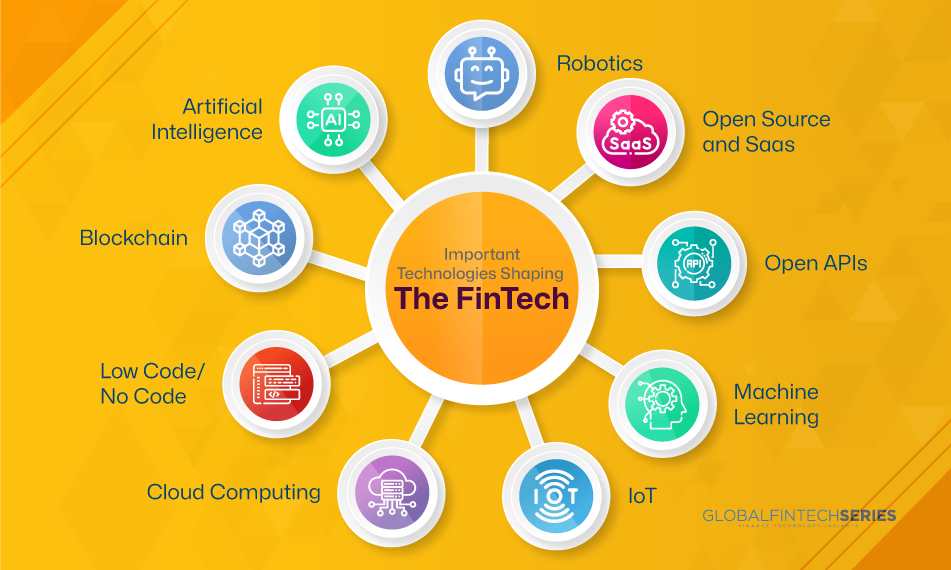

Artificial intelligence (AI) and blockchain are at the forefront of the FinTech industry. To be more precise, today’s financial services companies that fail to utilize technology will be left behind by the losers.

Exclusive Fintech Insights- Can Fintech survive without IT support? Let’s Know With Experts!

Zur Yahalom, Senior Vice President, Head of Financial Services at Amdocs

The reality is that the execution of all financial transactions today are technology-based. To build the right user interface and execute efficiently on the transactions, fintechs must master the technology that underlines this business. This requires strong IT support. Additionally, having good IT support enables any business in today’s highly competitive fintech field to have access to the right info needed in real time to make faster decisions, remain ahead of competitors and create better customer experiences.

The reality is that the execution of all financial transactions today are technology-based. To build the right user interface and execute efficiently on the transactions, fintechs must master the technology that underlines this business. This requires strong IT support. Additionally, having good IT support enables any business in today’s highly competitive fintech field to have access to the right info needed in real time to make faster decisions, remain ahead of competitors and create better customer experiences.

Cigniti Technologies Chief Delivery Officer, Raghuram Krovvidy.

Fintechs in capital markets and payments businesses handle substantial transaction volumes and provide 24/7 services. They need to handle them efficiently with increased customer experience. So, automated

Fintechs in capital markets and payments businesses handle substantial transaction volumes and provide 24/7 services. They need to handle them efficiently with increased customer experience. So, automatedAlex Zeltcer, CEO nSure.ai

In my opinion, the answer is largely no. FinTech is fundamentally reliant on extensive scalability due to the need to handle massive transactions. Unlike retail, where limited sales can support an entire operation, FinTech demands processing tens of thousands to millions of transactions in real-time to be effective. This operational scale necessitates a robust infrastructure that existing tools might struggle to support. Even smaller FinTech entities, like those processing a billion dollars a year, encounter bottlenecks due to tool limitations. Hence, substantial infrastructure is imperative. Many FinTech firms develop proprietary systems not due to a “not-invented-here” syndrome, but rather as off-the-shelf solutions often lack the required scalability. This underscores that without significant infrastructure, building a substantial FinTech business is improbable,

In my opinion, the answer is largely no. FinTech is fundamentally reliant on extensive scalability due to the need to handle massive transactions. Unlike retail, where limited sales can support an entire operation, FinTech demands processing tens of thousands to millions of transactions in real-time to be effective. This operational scale necessitates a robust infrastructure that existing tools might struggle to support. Even smaller FinTech entities, like those processing a billion dollars a year, encounter bottlenecks due to tool limitations. Hence, substantial infrastructure is imperative. Many FinTech firms develop proprietary systems not due to a “not-invented-here” syndrome, but rather as off-the-shelf solutions often lack the required scalability. This underscores that without significant infrastructure, building a substantial FinTech business is improbable, highlighting the pivotal role of IT teams in enabling FinTech’s success.

Without IT how would Fintech look like?

Any idea about the same?

Think, think harder!!

Let me help you out!

The world will seem like a myth and absolutely powerless with automation if we talk about it today. Now, a question might erupt in your mind that we are surviving without IT stuff before it created a revolution. Right!

But we need to understand the different eras and their structural advantages. If I would ask you to imagine a world without a smartphone which wasn’t earlier present 25 years ago.

Read: How Can Banks Stay Competitive With A Secured IT Security Infrastructure?

Would it be possible for you to live like this?

I am sure the answer would be a BIG NO from you all. In the same way, Fintech without IT would be like eating food without salt, rather I can say, it would be like a body without soul. That is the power of IT in fintech which has led to several automation and enhanced acceptance of artificial intelligence (AI) and people are running after tools of machine learning (ML) and deep learning techniques (DL).

Read: Most Trending Crypto Wallet Of 2023 – Phantom

Is automation necessary for fintech?

Operational automation will be required. Key financial activities can be automated to provide flexibility and agility in business operations and planning.

Eliminating IT from fintech will have hazardous effects like high cost on data management, low productivity, and low efficiency. It will not stop here, rather, it will have an effect on real-time data with clients standing in queues waiting for their turn in financial institutions since nothing will be online anymore. No more hassle-free trading and easy one-click button at home facilities. It will be a dream to extract the important data hidden among the massive data sets. Forget about the tailored experiences. It will be a dream which no one can dream.

And, IOT, cloud computing, and DLT will seem like a myth!

Hilarious!

Conclusion

Because banks still account for 75% of MSME lending in the nation, cooperation between banks and fintech businesses might increase credit availability for the underserved segment and SMEs. In 2023, there will still be a tonne of opportunity for fintech businesses in this area.

Blockchain and artificial intelligence are two of the most innovative technologies in the fintech industry. To be more precise, the great winners in today’s market will be the financial services organizations that utilize technology! Giles Sutherland predicts that customer-centric FinTech solutions will prevail in the end.

Read: Top Features Of Digital Payments App

[To share your insights with us, please write to sghosh@martechseries.com]