Even members have accessed more than $250 million in wages instantly since July

Even, a leading financial benefits platform designed to provide financial resiliency and control to employees, announced that millions of hourly workers across the U.S now have instant access to their earned wages. Real-time payments (RTP) from J.P. Morgan is the latest addition to Even’s platform, providing members with even more options to access their pay in real time. RTP is a secure and frictionless payment method that instantly delivers funds to an Even member’s bank account, giving them access to their earned wages in seconds rather than days, regardless of the time of day or day of the week. Since the beta launch in July, Even members have accessed more than $250 million in earned wages instantly. Within the Even platform members can access wages at the push of a button through digital instant disbursement options which include Push to Card and now RTP.

“At Even, we believe that access to earned wages should never be a barrier to financial health,” said David Baga, Even CEO. “We’re excited to leverage Real Time Payments from J.P. Morgan to ensure that US workers, especially the 60 percent living paycheck to paycheck, are able to access their wages, instantly, when and where they need them.”

Read More: Paymints.io Launches MuniPay to Simplify Property Tax Payments for Real Estate Title Agencies

Research shows that allowing employees to access the wages they have earned on-demand increases both engagement and retention, offering financial peace-of-mind through greater certainty and control over their finances. Employers who offer the Even platform as a financial benefit to their employees can offer RTP with no additional implementation requirements and zero changes to payroll. For employees, gaining access to their earned income in real time provides them with the flexibility to cover costs as they arise, avoiding the need to turn to undesirable lending methods. In fact, in a recent survey 75% of Even members reported that using Even has had a positive impact on their financial health.

“At JPMorgan Chase, we are committed to improving the financial well-being of the workforce at large, including our communities, customers, and employees. RTP provides an instant payment solution with 24×7 flexibility putting Even members in control of their finances and when they access their pay,” said Cyrus Bhathawalla, Global Head of Real Time Payments, J.P. Morgan. “As founding partners of the Financial Solutions Lab (FSL), we are thrilled to support Even, a member of the very first FSL cohort, as they enable real-time access to earned wages.”

Read More: Octane Completes $340 Million Asset-Backed Securitization to Drive Continued Growth

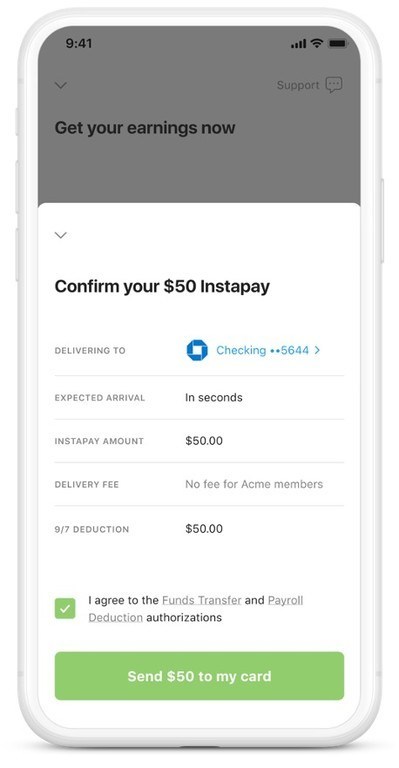

As income volatility remains a key challenge for hourly workers across the U.S., RTP enables financial freedom and support for Even members by giving them access to their earned wages right when they need it. When a member requests an Instapay, Even’s earned wage access feature, they have the option to instantly transfer the money to their connected bank account. Once confirmed, they can expect the funds to be deposited in a matter of seconds. By pairing this functionality with powerful tools for budgeting, emergency savings, and visibility into projected net earnings, Even’s financial benefits platform helps employees to safely resolve cashflow emergencies today while building financial resilience for the future.

Read More: MVIS Launches the BlueStar US Listed E-Brokers and Digital Capital Markets Index

[To share your insights with us, please write to sghosh@martechseries.com]