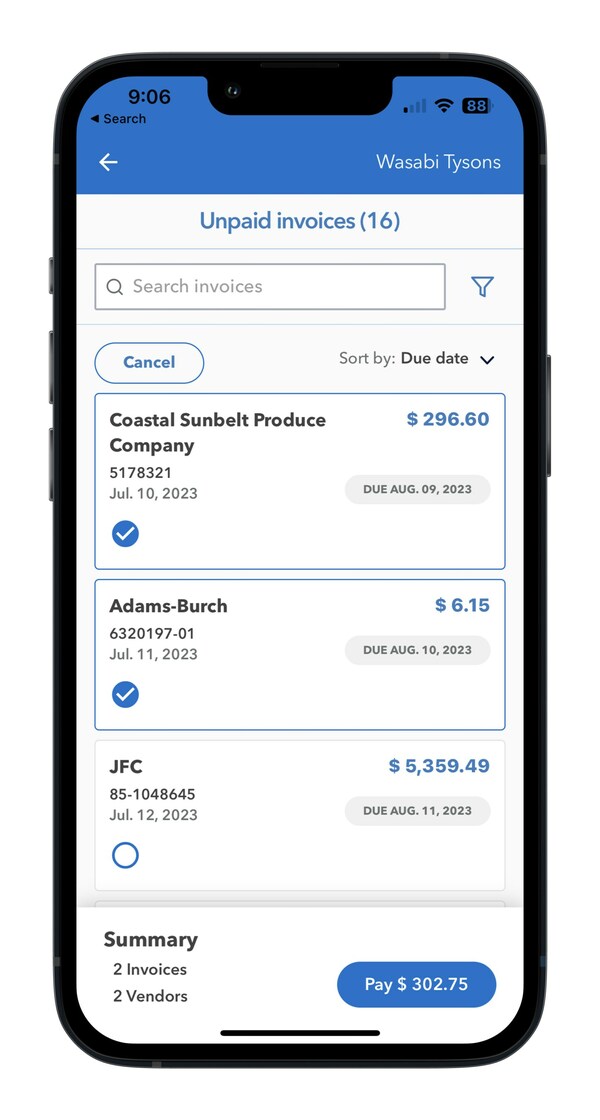

MarginEdge, the leading restaurant management and bill payment platform, announced the launch of its mobile bill payment capability, which enables operators to effortlessly settle payments using just their smartphones. This latest addition to their suite of mobile tools represents the culmination of complete operational fluidity – enabling operators to upload, approve, and now pay their invoices on the go.

Available and free to every U.S.–based MarginEdge customer, MarginEdge Bill Pay is the first and only payments provider exclusively dedicated to B2B payments within the restaurant industry.

Latest Fintech News: Praxent Helps Insurance Systems Create Compelling Digital Experiences for Insurance Companies

“We are witnessing a momentous shift as digital payments revolutionize the way businesses operate,” emphasized Bo Davis, CEO of MarginEdge. “At MarginEdge, we are dedicated to ensuring that every restaurant can thrive in this new era. This new capability empowers restaurants to embrace the speed, security and convenience of mobile payments while maintaining complete control over their financial processes.”

With its ability to quickly digitize invoice line item details, including handwritten adjustments and credits, its 2-3 day payment transmission time to the MarginEdge vendor network of 55,000+ and its robust array of inventory, recipe and reporting capabilities, MarginEdge equips accountants and operators with everything they need in order to run a more profitable restaurant and gain better control over their cash flow.

Other Key features and Benefits of MarginEdge Mobile Bill Pay Include:

- Free & Unlimited Payments Included: Unlike competing bill payment software, MarginEdge does not charge any additional fees outside of its normal monthly subscription.

- Multiple Payment Options: Pay each vendor the way that works best for them.

- Cash Flow Management: Set up auto-payments, schedule payments for a future date, or even make partial payments.

- Pay Any Vendor Imaginable: Enroll your own vendors in digital payments for faster and more secure transmissions.

- Backed by Tier-1 Banks: Payments are processed through the #1 ACH originator in the country.

Latest Fintech News: Rightfoot Launches Zero-Login Financial Data for Financial Institutions and Lenders

MarginEdge Mobile Bill Pay sets a new standard for payment efficiency, designed just for restaurants – propelling the industry into the future of efficient and effective financial management.

“The time it takes calculating bills and organizing payments is time stolen from where operators want to be in their restaurant,” said Brandie Coley, MarginEdge Product Manager. “Bill Pay in the mobile app allows operators to take care of bills wherever they are, so they can spend less time in the back office and more time on the floor with their guests.”

Latest Fintech News: MarketVector Indexes and Token Terminal to Provide Exclusive Web3 Data, Product Offerings

[To share your insights with us, please write to sghosh@martechseries.com]