Integration with more than 40 BNPLs and growing, Optty increases retailer conversions and gives shoppers more choice

Optty, the world’s first Buy Now, Pay Later integration platform, has in stealth raised over $9 million USD in private funding and announced its solution for retailers and payment gateway providers to revolutionize the fast-growing sector with transparency, simplicity, and speed. Optty customers are using the platform to increase conversions and give shoppers more choice.

Available in more than 59 countries and 36 currencies, Optty brings together the world’s BNPL providers in one simple and rapid integration. The platform currently has 185 global integrations with 41 BNPL providers including Afterpay, Affirm, Grab, Klarna, Scalapay, and Zip. By 2023, Optty plans to have more than 100 BNPL brands, digital wallets, and other alternative payment methods integrated into the platform.

Until now, to add a new BNPL technology, retailers had to dedicate, on average, one week of internal development work. With Optty, retailers can integrate a new BNPL in just a few minutes. Once integrated, the platform provides retailers with data and insights that drive better decisions, and the ability to promote responsible lending.

Latest Fintech News: OneVest Raises CAD $5 Million and Launches Canada’s First Embedded Wealth Management Platform

“Buy Now, Pay Later is a revolution in retail. And Optty is a revolution in BNPL,” said Natasha Zurnamer, CEO of Optty. “Our technology is the single source that empowers retailers with intelligence, speed, flexibility, and responsibility in the world of BNPL. We are the honest broker that elevates results for retailers, and choice and experience for consumers.”

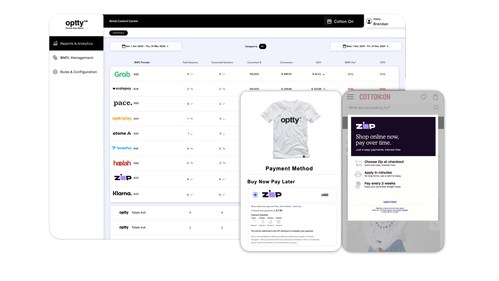

Optty is an independent, vendor-agnostic software integration platform that connects retailers and the BNPL providers in one place and keeps them accountable with its centralized sales reporting. Within the platform, the Optty Retail Control Centre allows retailers to apply to more than 40 BNPL providers by country, speeding up the application process. Once a new application is approved by the BNPL, it takes just one click to go live with that provider. Optty allows merchants to maintain a direct relationship with each BNPL provider while managing all their providers on the one-stop platform.

Optty is free to integrate with a click fee per successful transaction. It currently has integrations with Salesforce, Adobe Commerce, BigCommerce, WooCommerce, Bold Commerce, and payment gateways creating access for potentially millions of customers, with more channels to be added throughout 2022.

Afterpay’s Country Manager, APAC, Katrina Konstas, said: “Optty plays an important role in the BNPL landscape. The platform will accelerate flexible payments availability around the world. With more than 16 million active customers globally, Afterpay is excited to work with Optty and we look forward to connecting even more merchants to our engaged young shoppers worldwide.”

Optty helps retailers and payment gateways bring BNPL offerings online easily and manage the BNPL user experience and performance. The ultra-fast deployment, coupled with Optty’s transparency of all BNPL terms and conditions, arms retailers with the insight to make better business decisions while accelerating sales, increasing conversions, and improving the experience for shoppers. The solution enables direct retailer messaging to consumers, supporting responsible lending practices. BNPL providers also benefit from Optty, as easing the retail integration process allows them to reach more consumers faster.

Latest Fintech News: Juniper Research: Digital Wallets Transaction Value to Grow by 60% by 2026 Globally

“Buy Now Pay Later is becoming hugely popular among shoppers,” said Brendan Sweeney, Group General Manager E-commerce and Loyalty, Cotton On Group. “Before Optty, integrating new BNPL applications was a difficult and lengthy process. Now we have a platform that allows us to almost instantly add BNPL providers to our system, which means we can give our customers more choice and flexibility. And the platform allows us to make informed decisions and provide a better experience for our customers. A five day integration effort per BNPL has become 5 minutes.”

Optty was founded in 2021 in Singapore with teams in Sydney, London and South Africa. The company is led by CEO and Founder Natasha Zurnamer, a seasoned retail and ecommerce marketplace strategist, technology developer, and merchant acquisitions expert. The leadership founding team includes Mark Russell, Chief Product Officer, David Peck, Chief Operating Officer, and Andrew Stott, Chief Information Officer, and brings more than 25 years of experience in retail, ecommerce, and customer experience.

Latest Fintech News: Instant Cash Access to Bitcoin Arrives in Vermont

[To share your insights with us, please write to sghosh@martechseries.com]