Introduction

One of the fastest-growing economies, Latin America has great promise as a future economic powerhouse in the region. Increased digitalization and a priority on rapid infrastructure development, in particular, to update national and international financial systems, are driving this shift.

Nium estimates that $14T in payments have been made due to the proliferation of internet and mobile phone use as well as the growth of mobile money accounts and the receipt of remittances.

The rise of Latin America across borders

Latin America’s booming digital economy gives a huge opening for multinational corporations looking to expand into more rapidly developing regions. Cross-border business in the e-commerce and software as a service sector is expanding at double-digit rates through 2025 in the region, on average.

Read more: Top 10 Fintech CEO Watchlist

Every major tech company is currently focused on improving its cross-border digital payment systems.

Every major tech company is currently focused on improving its cross-border digital payment systems.

Let’s clarify what the “international digital payments system” is before diving into the nuts and bolts of how it works, its basic principles, the parties involved, the parameters that need to be changed, and the bottlenecks of the current system.

Are Fintechs Ready to Adapt to the Changing Landscape?

In order to facilitate quicker and easier payments, fintech companies are continuously pursuing innovation and customer-oriented features. For instance, neobanks have developed new licenses and infrastructure to provide greater services without going through traditional banks.

Like banks, non-bank financial institutions can support direct international wire transfers if they have the proper authorizations and underlying systems in place.

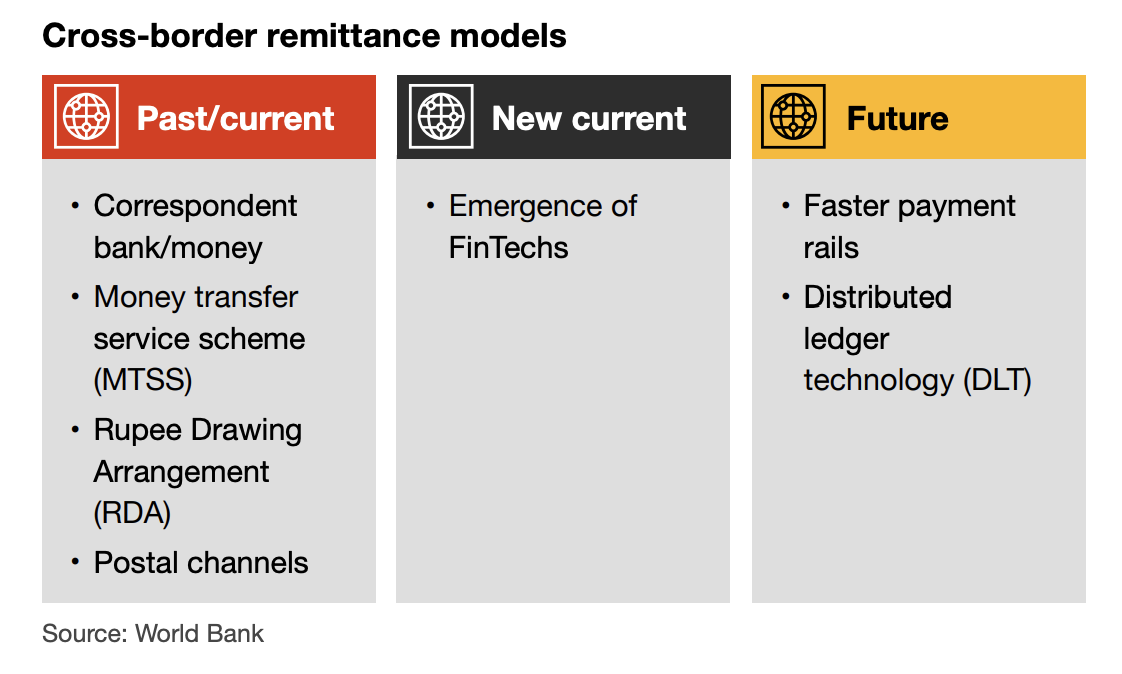

Fintechs use distributed ledger technologies (DLT) to improve transaction monitoring and transparency, and they do so by collaborating with expert development teams. Within their banking system, they can provide same-day settlements.

Automated compliance, algorithm-based transaction evaluations, and sophisticated Know Your Customer (KYC) systems are all examples of how fintechs are adjusting to meet the needs of regulators. Fintechs have raced ahead of traditional banks in developing solutions for international financial transactions by taking advantage of the digital environment and cutting-edge technologies.

Latest Read: Can Fintech Survive Without IT Support? Let’s Know With Experts!

Exploring the Benefits of Cross-Border Payment

Cross-border payments can be made for a wide range of reasons, including international trade, remittances, travel expenses, and investment transactions, and are typically made between individuals, businesses, or governments in separate countries. It might be difficult for businesses to make international payments.

Transparency and visibility are both essential for international money transfers. With Swift gpi, one can trace a cross-border payment in 90% of cases and settle in 30 minutes. The services we provide to our customers are evolving as a result of technological advancements. In the realm of foreign exchange, price transparency is equally crucial. The FedEx business model is a fantastic illustration of this.

One out of every five US dollars travels to J.P. Morgan, and they are the top two providers of euro clearing in Germany, as well as having about 20% market share in LATAM’s Swift market for Financial Institutions. In reality, the bank processes 12% of all LATAM payments made in euros and over 30% of all payments made in euros from Brazil.

Read : Global Fintech Fest 2023 – Outcomes

LATAM: A lucrative expanding market?

-

Over 670 million people call this place home—that’s roughly 64% of the entire American continent—and they’re progressively settling in its cities.

-

Latin America is predicted to increase by more than 20 percent through 2027 when it will have more than 300 million digital buyers.

-

The rise in lucrative investment, over $23B solely by fintech businesses over the past three years, is another powerful indicator of LATAM’s payments transition. In addition to establishing the tone for aggressive consumer protection, regulators are actively striving to promote the innovation boom by updating appropriate legislation.

-

In the payments and fintech area, where 25% of businesses are homegrown, many foreign firms are eyeing Latin America as a potential market for expansion.

-

Growth in alternative payment methods, digital inclusion, financial literacy, and improved payment capabilities all point to a bright future, especially for enterprises, on the road to fully upgraded B2B cross-border payments in Latin America.

[To share your insights with us, please write to pghosh@itechseries.com ]