After two years of dampened outlook and growth, more companies are optimistic about the future, according to the Treasury Perspectives Survey sponsored by Strategic Treasurer and TD Bank.

The study probed both banks and corporate treasury and finance departments about their practices, expectations, outlooks, and perspectives across multiple dimensions of business and technology. The new results show returns to mostly pre-pandemic outlooks.

“The year-over-year data shows that there was quite a descent into the trough the past two years, but we seem to be coming out of it strong now,” according to Tom Gregory, Head of Treasury Management Sales, TD Bank. “Some of the growth metrics are showing even more positivity than before the pandemic. The recovery does not appear to be rapid, but it does appear to be significant.”

Latest Fintech News: CoinZoom Launches New App Providing Complete Crypto Investing and Online Banking Experience

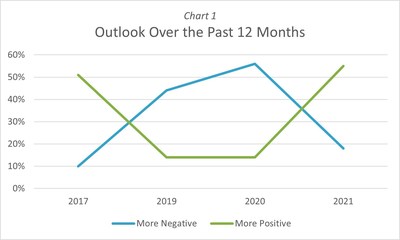

Organizational outlook over the past 12 months shows net positive movement. The percentage of companies with a more or significantly more negative outlook has almost reached

pre-pandemic lows, and those with a more or significantly more positive outlook exceed

pre-pandemic numbers.

Latest Fintech News: 2022 Signals “Regime Change” for Markets and Corporates, MUFG Says

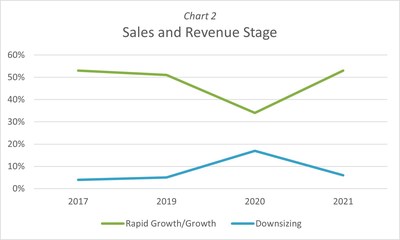

When asked about sales and revenue projections, respondents were highly positive, with greater growth and less downsizing compared to 2020. A total 76% of companies expect their sales/revenue to increase or significantly increase in 2022, with only 3% expecting a decrease or significant decrease.

COVID’s effects appear to be settling into some level of permanence including policies that govern remote work, security, forecasting, electronic adoption, etc. Fifty-six percent have seen enduring changes to work from home policies in their treasury operations attributable to the pandemic. Treasury teams ranked “security & control procedures” and “cash flow forecasting” in a tie for second on this list of recognized changes, each with 38%. Additionally, AR and AP groups noted ongoing willingness to accept more payment types (31% of respondents for AR) and increased adoption of EFT coupled with reduced use of checks (48% of respondents for AP).

The Treasury Perspectives Survey ran September through November of 2021, with participation from 250+ respondents.

Latest Fintech News: Relay Payments’ New Offering For LTL Carriers Streamlines Complex Processes

[To share your insights with us, please write to sghosh@martechseries.com]