Latest version of market-leading disputes management solution helps banks speed case resolutions

Pegasystems Inc., the low-code platform provider empowering the world’s leading enterprises to Build for Change, announced new enhancements in Pega Smart Dispute to help retail banks streamline time-consuming chargeback processes. By infusing its Pega Process AI technology into the software, Pega helps banks make smarter decisions to resolve each case, enabling them to save time, money, and effort while accelerating the resolution of transaction disputes and fraud claims for its customers.

Chargebacks – the process by which consumers dispute the validity of a card transaction – are on the rise around the world, partially driven by an increase in fraud. Each request kicks off a time-intensive process for the card-issuing bank, which needs to carefully investigate these disputes, determine if a refund is warranted, and work with the various payment networks‘ complex and ever-changing rules to process them.

Latest Fintech News: PayLink: Atomic’s Answer to Creating a More Open Banking System in the US

Adding AI to Pega Smart Dispute to drive chargeback efficiencies

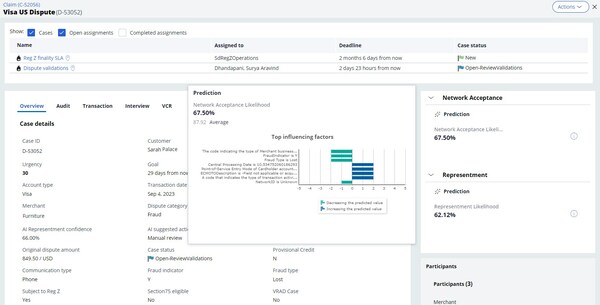

By using Pega Process AI within Pega Smart Dispute, the software automatically analyzes a transaction dispute to predict the likelihood of it being approved through the validation rules of payment networks like Visa. With that critical information, banks can optimize an efficient and low-cost path to resolution. For example, the bank might automate cases with a high success probability while assigning more human resources to investigate low probability cases. This not only saves banks labor costs but also leads to faster resolution for their customers.

Pega Process AI combines Pega’s industry-leading workflow automation with real-time AI-powered decisioning, natural language processing (NLP), and complex event processing to optimize and automate business processes. It simplifies complex real-time decisioning with data-driven, AI-infused arbitration to resolve cases quickly and efficiently. Pega Process AI continuously learns from the outcomes of its previous predictions and decisions, helping to improve accuracy and effectiveness over time. Pega Smart Dispute comes preconfigured with Pega Process AI use cases to predict chargeback outcomes for network acceptance and representments. Pega Process AI can also escalate work that may be in danger of missing a deadline or to optimize workflows to make processes more efficient. Clients around the world leverage Pega’s AI engine to make hundreds of millions of decisions every day.

Latest Fintech News: XTM’s Today Gratuity Payout Solution Launches in US on QRails AnyDay

Extending the value of Pega Smart Dispute

In addition to Pega Process AI, the latest version of Pega Smart Dispute includes several other significant updates to its proven solution to help banks further streamline the disputes process, including:

- Expanded support for different payment types: Building on Pega’s pre-built workflows for Visa, Mastercard, and American Express, Pega Smart Dispute now provides improved workflow templates that help banks quickly build workflows to manage new and emerging payment types. The solution ships with pre-configured resolution pathways for Zelle or ACH exceptions.

- Support for Regulation II: The software also supports compliance with new Regulation II rules from the US Federal Reserve System for cases of card-not-present (CNP) transactions.

- Updated compliance rules: Pega updates Pega Smart Dispute with the latest chargeback rules from Visa and Mastercard twice per year (effective in April and October), helping clients process disputes against the latest guidance.

Pega Smart Dispute governs payment dispute and exception processes throughout the payment lifecycle across any channel – managing all aspects of this unique ‘moment of truth’ in banking. It provides a centralized resource to both guide employees in agent-assisted channels and automate processes within self-service channels. This helps issuers unify dispute and fraud claim operations to increase efficiency, customer satisfaction, and compliance. Built on Pega’s leading low-code platform, Pega Smart Dispute also enables clients to adapt rapidly to changing conditions and new payment types for rapid extensibility.

Latest Fintech News: Acra Lending Partners with Tavant, Deploys Touchless Lending Collateral Analysis

[To share your insights with us, please write to sghosh@martechseries.com]