Amid this period of market volatility, new features offer users powerful investment balance and performance tracking capabilities

Quicken Inc., maker of America’s best-selling personal finance software, released a robust set of investment tracking features for Simplifi by Quicken, its award-winning personal finance app. The new capabilities and insights give Simplifi users the information they need to make smart investment decisions.

Simplifi, powerfully easy and highly customizable, helps users stay on top of their finances by connecting to 14,000+ financial institutions to provide a real-time, consolidated view of all bank accounts, investments, credit cards and loans. The new features expand on Simplifi’s investments dashboard, allowing users to see their entire investment portfolio in one place and monitor performance over time. In addition to the expanded features, users can track cryptocurrency investments across all brokerage accounts in one place, alongside their stock portfolio, bonds, retirement accounts, and other investments.

Latest Fintech News: The Standard Promotes Dickson Kasamale to Second Vice President of IT Finance and Analytics

“With the market volatility and challenging economic conditions we’re facing, it’s critical to have a real-time view into the value and performance of your investments,” said Quicken CEO Eric Dunn. “Quicken continues to offer the best tools on the market for managing investments, and now we’re bringing key investment features to Simplifi: real-time quotes, including for crypto; investment performance over time; and investment news tied to users’ holdings.”

Latest Fintech News: Acrisure’s New York Businesses Unite to Serve Clients Across the State

The new features include:

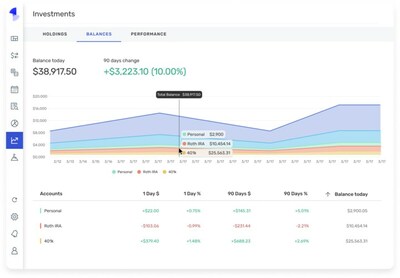

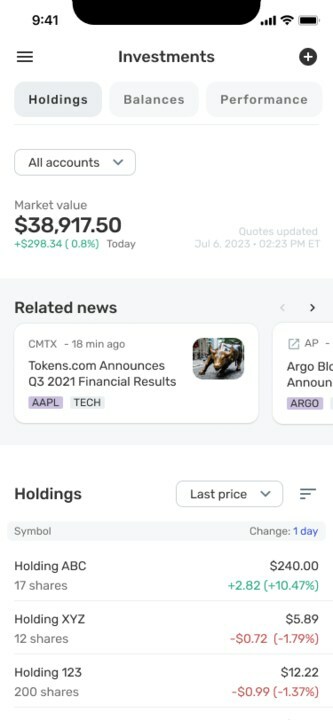

- Real-time Quotes and Investment Balance Chart: Simplifi’s quotes and balance chart features offer a detailed view of holdings (including market stats and related news), real-time quotes to show the value of holdings at any given moment and a view of balances over time.

- Performance: A detailed graph shows users the performance of their investments over time. Users can easily see the performance of their entire portfolio compared to each of their individual brokerage accounts. For example, a user may want to compare the performance of a brokerage account with higher-risk holdings to the performance of their 401K account. Performance is shown in both IRR and TWR. The IRR feature shows the performance of actual dollars invested and distributed over time. TWR shows your fund’s compounded rate of growth over a specified time period.

- News Feed: This feature shows news related to the companies in a user’s portfolio, offering a current view into factors impacting investment performance. The app currently aggregates news from CNBC, Motley Fool, PR Newswire and Businesswire, and will continue to add additional sources.

- Cryptocurrency Tracking: Simplifi users can connect their accounts to top financial institutions that support cryptocurrency to track real-time balances, performance over time, and relevant news about their cryptocurrency investments. Users can also manually add and track cryptocurrency.

- Investment Transactions: Simplifi users can easily view and edit their investment transactions from right within the app.

Latest Fintech News: Canadian Financial Institutions Have Ample Opportunity to Meet the Needs of the Modern, Digital Consumer

[To share your insights with us, please write to sghosh@martechseries.com]