DeFi has disrupted the traditional financial services industry by providing a decentralized, transparent, and secure environment that eliminates intermediaries, resulting in more efficient transactions. This innovation has revolutionized the way financial services are provided, and has the potential to create a more open, inclusive, and accessible financial system for everyone.

What is DeFi ?

Decentralized Finance or DeFi, is a system of financial applications and protocols that operate on a decentralized, blockchain-based network. It offers several advantages over traditional finance, including greater financial freedom, increased transparency and security, lower transaction fees, and more opportunities for investment and earning. DeFi is also accessible to anyone with an internet connection, making it an inclusive and global financial system.

Also Read: Why Visibility and Control are Key to Reducing OpEx

What is Institutional DeFi ?

‘Institutional DeFi’ refers to decentralized financial products built on blockchain technology that are customized to meet the strict compliance requirements of institutional players, such as banks, asset managers, and corporations. While DeFi started as a grassroots movement aimed at providing decentralized financial services to individuals and small investors, institutional players are now increasingly interested in leveraging blockchain technology’s benefits to enhance their operations and introduce new services to their clients.

Real world assets can be tokenized as Digital Assets, a shift from siloed records to a transparent and connected ecosystem. Investors can be protected with better control and security for a stable financial system using public blockchain. Reconciliation and settlement can be automated using smart contracts evolving additional financial services in lending, trading, insurance, investment and asset management.

Why Institutional DeFi ?

- Large companies have a high desire to participate in DeFi but have faced challenges deploying assets due to compliance hurdles.

- Major DeFi products are rolling out KYC’ed versions of their products to cater to the demand, and ensure participation is with the known counterparties.

- New DeFi products are coming to the market bringing the benefits of borderless liquidity to real-world assets.

Institutional DeFiUse Cases

- Asset Management: Institutional investors can use De-Fi protocols to manage their digital assets more securely and efficiently. De-Fi protocols can provide real-time tracking of asset performance, automated rebalancing, and other features to help investors optimize their portfolios.

- Tokenization: De-Fi protocols can facilitate the tokenization of traditional assets such as real estate, art, and other illiquid assets. This can unlock new investment opportunities for institutional investors and increase liquidity for asset owners.

- Settlement and Clearing: De-Fi protocols can improve settlement and clearing times by eliminating the need for intermediaries such as custodians and clearinghouses. This can reduce costs and increase efficiency, particularly for cross-border transactions.

- Trading: Institutional investors can use De-Fi protocols to trade cryptocurrencies and other digital assets in a more secure, transparent, and efficient manner. De-Fi protocols can also provide access to new liquidity pools and enable cross-chain trading.

- Lending and Borrowing: DeFi lending protocols can provide institutional investors with a new source of income by allowing them to lend their digital assets to borrowers in return for interest. Borrowers, on the other hand, can use DeFi protocols to access liquidity without the need for a traditional credit score or collateral.

Also Read: How Blockchain and WEB3 Will Change the World in 2023

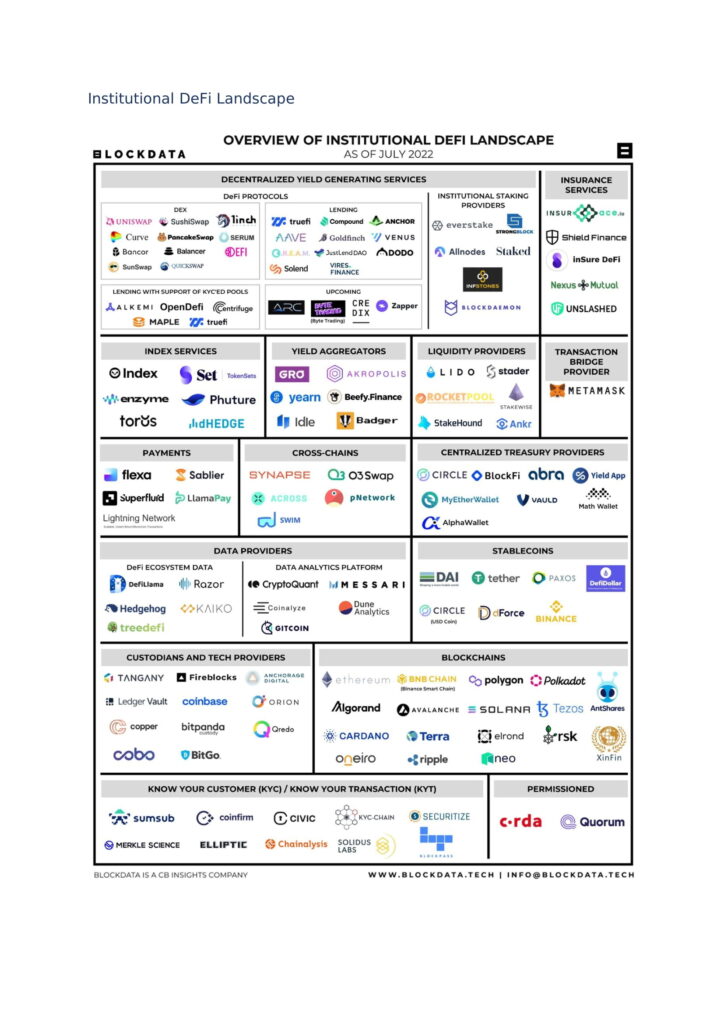

Institutional DeFiLandscape

Institutional De-fi Implementations Changing the Traditional Financial Services

- In mid-2021, Broadridge launched its Distributed Ledger Repo (DLR) solution, quickly achieving $31 billion in average weekly volumes. That figure is now $50 billion daily or a trillion dollars a month. So far, UBS and SocieteGenerale are two banks that have confirmed they are active on the platform, and it’s expected the number of participants will reach double digits this year, with three currently onboarding.

- In November 2022, DBS became one of the first banks to use DeFi protocols for foreign exchange (FX) and government securities transactions through Project Guardian, a collaborative initiative set up by the Monetary Authority of Singapore (MAS), DBS, J.P. Morgan, and Marketnode.

- Onyx(JP Morgan) is paving the future of Institutional DeFi through Project Guardian, a collaborative initiative led by the Monetary Authority of Singapore (MAS) to explore the economic potential and value-adding use cases of asset tokenization, including tokenized deposits, on public blockchain.

- In July 2022, BNP Paribas Securities Services announced it was working with two fintechs, Fireblocks and METACO, to develop its digital custody offering. Also in July, BNY Mellon and Goldman Sachs settled the first securities lending transaction using a DLT platform provided by the fintech firm HQLA.

- UBS on November 3 2022,UBS issued the first digital bond listed and publicly tradable on the classic stock exchange ‘SIX’, and the digital assets exchange ‘SDX’ (SIX Digital Exchange).

- Project Mariana: The SNB, together with the BIS Innovation Hub, the Banque de France, and the Monetary Authority of Singapore (MAS),are using DeFi protocols to explore automated market makers (AMM) for the cross-border exchange and settlement of hypothetical Swiss Franc, Euro and Singapore Dollar wholesale CBDCs.

- Project mBridge: The Hong Kong Monetary Authority, Bank of Thailand, People’s Bank of China, and the Central Bank of the UAE ran a pilot to support real-time, peer-to-peer, cross-border payments and foreign exchange transactions using CBDCs.

Future of Institutional Adoption of DeFi

Institutional DeFi has the potential to unlock new possibilities for financial services, including greater transparency, accessibility, and efficiency. As the DeFi ecosystem continues to evolve, we are likely to see more innovative use cases emerge, driving further adoption of this disruptive technology by institutional players. The future of Institutional DeFi will augment traditional finance with a streamlined exchange of assets between the two systems. There will be a few hurdles along the way, but with high funding, close collaborations, innovation, product iterations, and regulatory alignment, DeFi will carve its place in the financial ecosystem of institutions.

Also Read: Small Businesses Benefit Most from Real-time Payments Technology