BitGo integrates Stacks to bring Bitcoin DeFi to institutional players in the form of direct BTC yield

BitGo, the market leader in providing institutional-grade liquidity, custody and security for digital assets, announced support for Stacks. Stacks is a network that has created the technology needed to bring applications and smart contracts to the Bitcoin network. In order to match the demand for institutions wanting to hold bitcoin, BitGo will now offer institutional token holders the opportunity to earn BTC rewards for holding Stacks’ native token (STX) in a process known as Stacking. This in turn makes Bitcoin DeFi immediately accessible to large financial institutions and BitGo’s massive network of clients.

Compared to other popular yield-earning solutions in the market such as NEXO, Celsius, BlockFi and others, the bitcoin yield from Stacking is not generated via a lending action, meaning that token holders do not need to lend their funds out in order to earn a reward. Instead, the yield is derived directly from the Stacks‘ consensus mechanism that ties the Stacks blockchain to the Bitcoin blockchain.

Read More: Valkyrie Funds Launches the Valkyrie Bitcoin Strategy ETF (BTF) Focused on Bitcoin Futures

In a regulatory environment which just saw Coinbase shutter its Lend feature, yield of this nature may be very attractive to institutions as well as everyday users looking to steer clear of potential regulatory uncertainty or penalties. It also eliminates one aspect of the risk typically associated with lending-based yield in that there can be no borrower defaults.

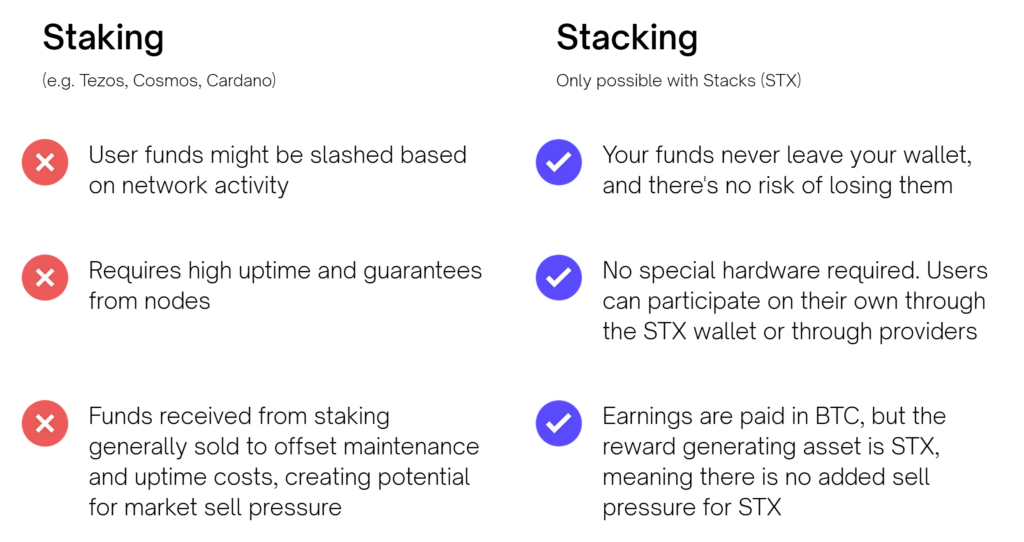

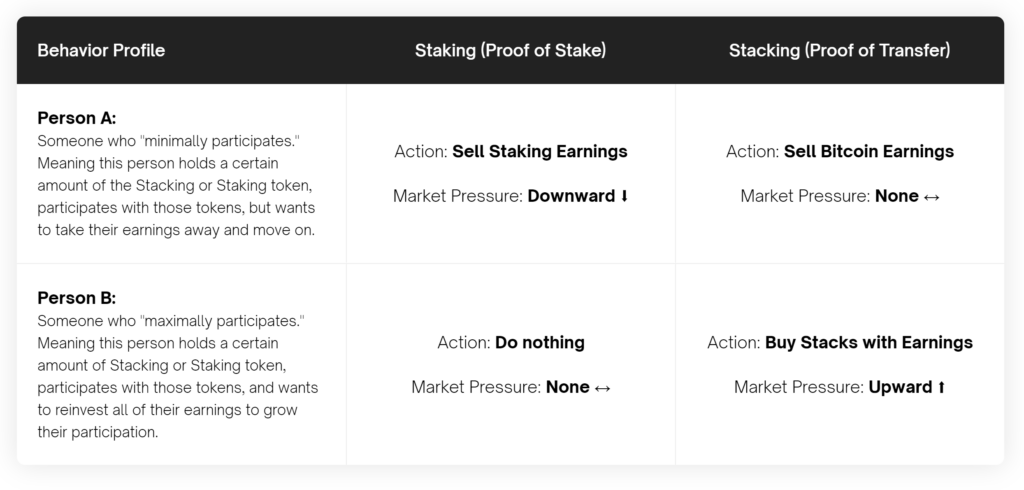

Stacking shares some properties with staking, with some key differences. First, in staking schemes, the yield is generally paid in the same asset that was staked and then often traded out of. In Stacking, the yield is paid to the ‘Stacker’ directly in BTC.

With the Stacks token (STX) added to BitGo’s platform, customers will have access to BitGo’s insurance, asset protection, portfolio management, and tax reporting tools. BitGo’s integration with Stacks also gives users more options to store Stacks tokens in custody, digital wallets, multi-sig wallets, or earn yield in BTC via Stacking.

With the Stacks token (STX) added to BitGo’s platform, customers will have access to BitGo’s insurance, asset protection, portfolio management, and tax reporting tools. BitGo’s integration with Stacks also gives users more options to store Stacks tokens in custody, digital wallets, multi-sig wallets, or earn yield in BTC via Stacking.

“BitGo’s support for Stacking and the Stacks is yet another example of how the Stacks ecosystem and its supporters are leading the Bitcoin DeFi movement,” said Mitchell Cuevas, Head of Growth at the Stacks Foundation. “Institutions can now get in on what thousands of Stackers have been enjoying since the launch of Stacks 2.0, a yield paid in bitcoin at industry leading APYs without the typical risks of staking options.”

Read More: TotallyMoney and Lendable Taking Credit to the Next Level

This integration underscores a strong institutional appetite for cryptoassets and cryptoasset yield at a time when major banks and institutional investors like Morgan Stanley and Goldman Sachs are launching their own Bitcoin products and services.

In a statement about the integration, BitGo’s co-founder CEO, Mike Belshe, said, “Financial institutions have been wanting a safe and secure way to enter the DeFi space. By onboarding support for Stacks and STX, we are giving our clients what they want – bitcoin and paradigm-shifting cryptoassets like STX, without the need for expensive infrastructure investments.”

Read More: Voya Selected as New Health Savings Account Provider for ABA Retirement Funds Program

[To share your insights with us, please write to sghosh@martechseries.com]