Gita Salden, CEO of BNG Bank: “Even in these turbulent times, we stand firmly behind our clients. We want to be a reliable, predictable partner and support our clients in performing their social tasks enabling them to make an impact. In the first half of 2023, BNG Bank once again managed to achieve this ambition.

“We granted EUR 6 million in long-term loans. BNG Bank also managed to attract sufficient funding at good conditions in terms of volume, maturity and pricing. We retained our AAA credit rating, enabling us to borrow at favourable rates in the international markets.

“The conclusion of a survey that was conducted in the past six months is that our clients rate our services very highly. The availability and low costs of the loans we provide are especially appreciated. Our clients gave us a score of 7.9. I am proud of that.”

Latest Fintech News: How Does A Bitcoin Wallet Work?

Financial results

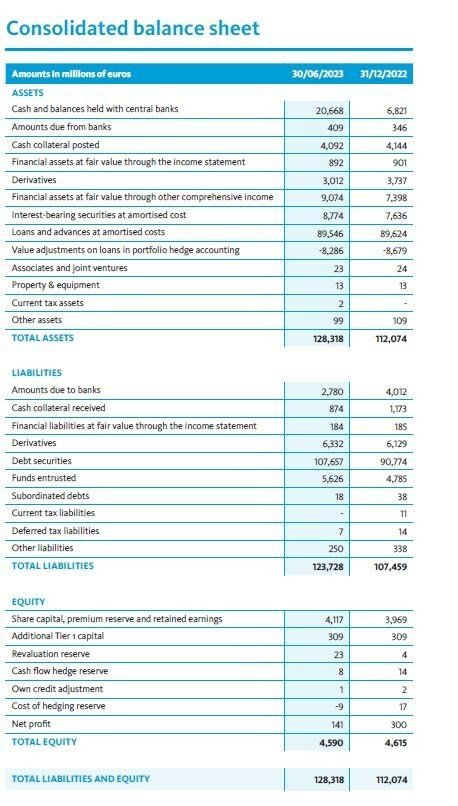

In the past six months, the activities of BNG Bank generated a solid interest result. Our interest result increased by EUR 49 million from EUR 220 million to EUR 269 million. This was due to several factors, including higher interest rates and longer maturities of loans to clients. We have realised a net profit of EUR 141 million for the first half of 2023. Our net profit for the first half of 2022 came to EUR 206 million. The decrease of the net profit was mainly due to a lower result on financial transactions arising from the liquidity portfolio.

The long-term loan portfolio remained stable at EUR 87.8 billion. The demand for credit from municipalities has decreased due to the following factors. Some of our clients brought their demand for credit forward in anticipation of higher interest rates. Furthermore, the demand for credit from municipalities was dampened due to building projects being postponed and delayed as a consequence of staffing and materials shortages and the continuing uncertainty about the long-term availability of financing in the coming years.

Latest Fintech News: What Is Microloan Management Software: How To Choose One For Your Needs

BNG Bank’s capital position remained strong. At the end of June 2023, the Common Equity Tier 1 ratio and the leverage ratio came to 38.5% and 8.9% respectively. Both these ratios remained therefore well above the minimum levels set by the regulator.

We once again raised a large part of our financing by means of ESG bonds. In the first half of 2023, our sustainable bond portfolio increased from EUR 3.5 billion to EUR 4.2 billion, which is 38% of the total amount issued.

In the second half of this year, BNG Bank will continue on the course it has set, based on its Our Road to Impact strategy. We will ensure that our clients are offered access to the financing at attractive conditions and we will keep on investing in our people and processes.

Latest Fintech News: Zip Launches Global Partner Program to Meet Growing Demand for Finance and Procurement Visibility

[To share your insights with us, please write to sghosh@martechseries.com]