Better prepared, those with a financial professional feel more confident about their finances

Primerica, Inc., a leading provider of financial services in the United States and Canada, released its Canadian Financial Security Monitor — a national survey that measures how Canadian families view their finances.

“As economic headwinds shift and inflation continues to negatively impact Canadians, those who are less affluent should have access to more resources, not less.”

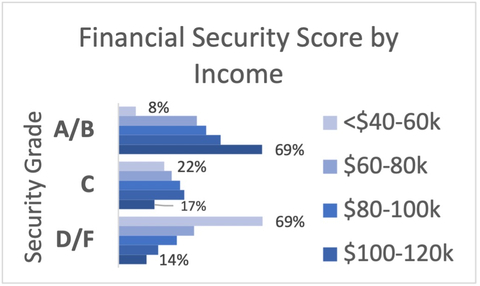

The survey found that while nearly two-thirds (63%) of Canadians rate their finances positively, about half (54%) say their financial situation is worsening amid the high rate of inflation and growing concerns of a possible economic downturn. Those who work with a financial professional are more positive while those without are more pessimistic — a trend that held for much of the survey. The same divide was found between high- and low-income households. Meanwhile, a majority (57%) of Canadians at all income levels rate inflation as their top concern, followed by their health (43%) and paying for food (36%).

Latest Fintech News: Bigeye Expands Its Customer Base Across Several New Sectors

“Canadian families are increasingly feeling the pinch of inflation and our survey data points to the benefits of having access to a financial professional, regardless of income,” said John Adams, CEO of Primerica Canada. “There is something to be said for having the ability to speak with an advisor versus relying on technology and families that are considered as low- and middle-income should not have to rely exclusively on a computer to seek financial guidance.”

Key Findings from Primerica’s Financial Security Monitor

- Positive outlook on savings, negative outlook on future. The majority (54%) rate their ability to save for the future positively. However, about two-thirds (65%) believe they will be worse off financially next year.

- Dipping into savings vs. increasing credit card use. Those with incomes in the $40,000 to $60,000 range are the most likely to report spending personal or retirement savings, with those in the $60,000 to $120,000 range are most likely to report increased use of credit cards and taking out a loan.

- Online resources not a suitable replacement for in-person guidance. Most Canadians (52%) are not comfortable making financial investments in stocks, bonds or mutual funds online without working with a financial professional. In addition, a significant percentage say they’re not comfortable securing a mortgage (39%) or buying life insurance (37%) under these circumstances.

- Canadians value financial professionals when it comes to big decisions. When making a major financial move, nearly half (49%) would choose to talk with a licensed financial professional, while nearly two-fifths (39%) would do their own research. Just 1% would use a robo-advisor.

- Higher income families more likely to have greater access to financial advice. More than half (54%) of Canadians who make more than $80,000 a year use a financial professional for advice, while less than two-fifths (36%) of those making less than $80,000 use one.

Latest Fintech News: Oklahoma Farm Bureau Insurance Selects One Inc Digital Payments Platform

“As Canadians mark Financial Literacy Month this November, the results of Primerica’s survey illustrate how middle- and low-income households are increasingly being left behind in today’s market,” continued Adams. “As economic headwinds shift and inflation continues to negatively impact Canadians, those who are less affluent should have access to more resources, not less.”

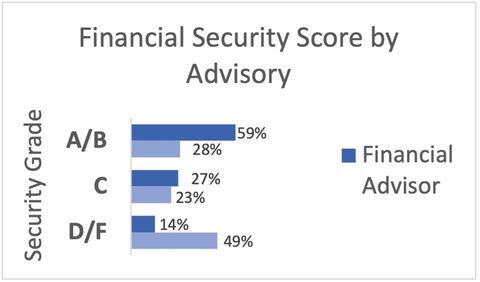

Scorecard Shows the Value of Professional Financial Advice

Primerica’s Canadian Monitor graded study participants based on whether they engage in five financial preparedness fundamentals, including saving for their future and protecting what they have through life insurance. The average grade was between B and C. The scorecard found that 59% of those who met with a financial professional earned a B or better, compared to just 28% of those who did not.

Latest Fintech News: Unqork and Securrency Launch Private Markets Asset Tokenization Solution Powered by Codeless Architecture

[To share your insights with us, please write to sghosh@martechseries.com]