Introduction

The global embedded finance market was worth USD 83.32 billion in 2023, and it is expected to be worth USD 622.9 billion by 2032, expanding at a compound annual growth rate (CAGR) of 25.4% between 2023 and 2032.

Embedded finance’s rapid growth trajectory has attracted a lot of interest from the venture capital and growth equity communities. As the addressable market grows thanks to new use cases, the industry will continue to attract numerous investments.

In other words, the availability of financial services application programming interfaces (APIs) is expected to drive explosive growth in the industry. Embedded finance players should expect substantial revenue growth as a result of a large addressable market opportunity.

Read: Top 15 Business AI Tools For You

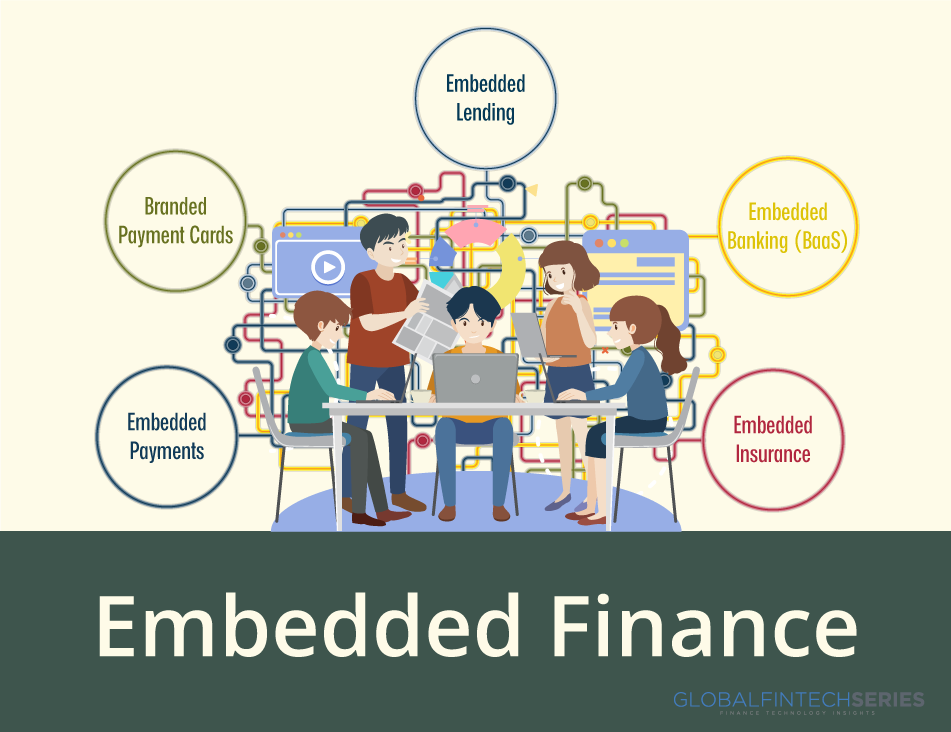

Understanding the Basics of Embedded Finance

When non-financial organizations implement financial services, this is known as embedded finance because of the seamless nature of the integration. The ways in which we deal with money and businesses have been profoundly altered by the integration of non-financial firms and embedded finance services.

Financial services including banking, payments, lending, and insurance provide the backbone of most of these offerings. Procurement inside marketplaces, human capital management (payroll and benefits), and tax and accounting compliance are some of the newer categories to develop.

Depending on the platform’s capabilities and desired risk/reward profile, embedded offerings can be constructed using a spectrum of integration patterns, from heavy reliance on enabling partners for infrastructure and domain expertise (“thin stack”) to being entirely insourced and owned by the platform directly (“full stack”).

Read: Unveiling The Indispensability: 5 Crucial Financial Reports For Your Company’s Success

The expanding field of embedded financial services has shaken up the status quo of conventional banks. In the past, we relied heavily on banks to facilitate monetary transactions like loans and payments.

Exploring the Key Players in Embedded Finance

In 2022, 26.0% of the embedded finance market was located in North America. The presence of key businesses in the region’s market is likely to fuel the region’s economic development.

In addition, embedded finance startups in the region are actively engaging in funding in an effort to speed up the industry’s widespread acceptance.

Below are the key players in this domain:

- Stripe, Inc.

- Adyen

- Plaid

- Marqeta

- Affirm

- Lemonade

- PAYRIX

- Cybrid Technology Inc.

- Walnut Insurance Inc.

- Lendflow

- Fortis Payment Systems, LLC

- Transcard Payments

- Fluenccy Pty Limited

How Embedded Finance is Transforming the Financial Landscape

Approximately 74% of European shops have implemented embedded financial offers by May 2022, as shown by a survey conducted by Aion Bank. Furthermore, 73% of the merchants reported that embedded financial items were in high demand among their clientele.

Non-financial businesses are increasingly relying on embedded finance to smooth out their customers’ journeys and boost their loyalty. This expansion will be hastened by the development of open banking and open finance. Consumers’ new relationships with their money will be largely influenced by embedded finance.

As a result, consumer confidence in businesses will shift. Increasing specialization among new enablers will both lengthen and shorten the value chain. As a result, platforms will have many options from which to select partners that meet their specific requirements. Therefore, users will have continued exposure to improved contextualization, seamlessness, and availability of financial services.

Conclusion

The market for embedded financial systems is predicted to grow rapidly over the next few years. Advances in Artificial Intelligence (AI) technology are responsible for the expansion. When used in embedded finance, AI has the potential to help service providers increase service utilization and revenue by providing clients with more streamlined and tailored experiences.

Read: How Can Banks Stay Competitive With A Secured IT Security Infrastructure?

Over the projection period, the market is expected to be bolstered by the rising adoption of APIs, which facilitate the transfer of data between financial institutions and other companies, ultimately leading to the creation of new financial products.

[To share your insights with us, please write to pghosh@itechseries.com ]