Introduction

Online “fintech” lenders, which are not banks, may look at “alternative data,” such as the regularity with which a borrower pays their rent or utility bills, to establish the borrower’s creditworthiness. There are potential benefits to expanding access to loans through the use of alternative data.

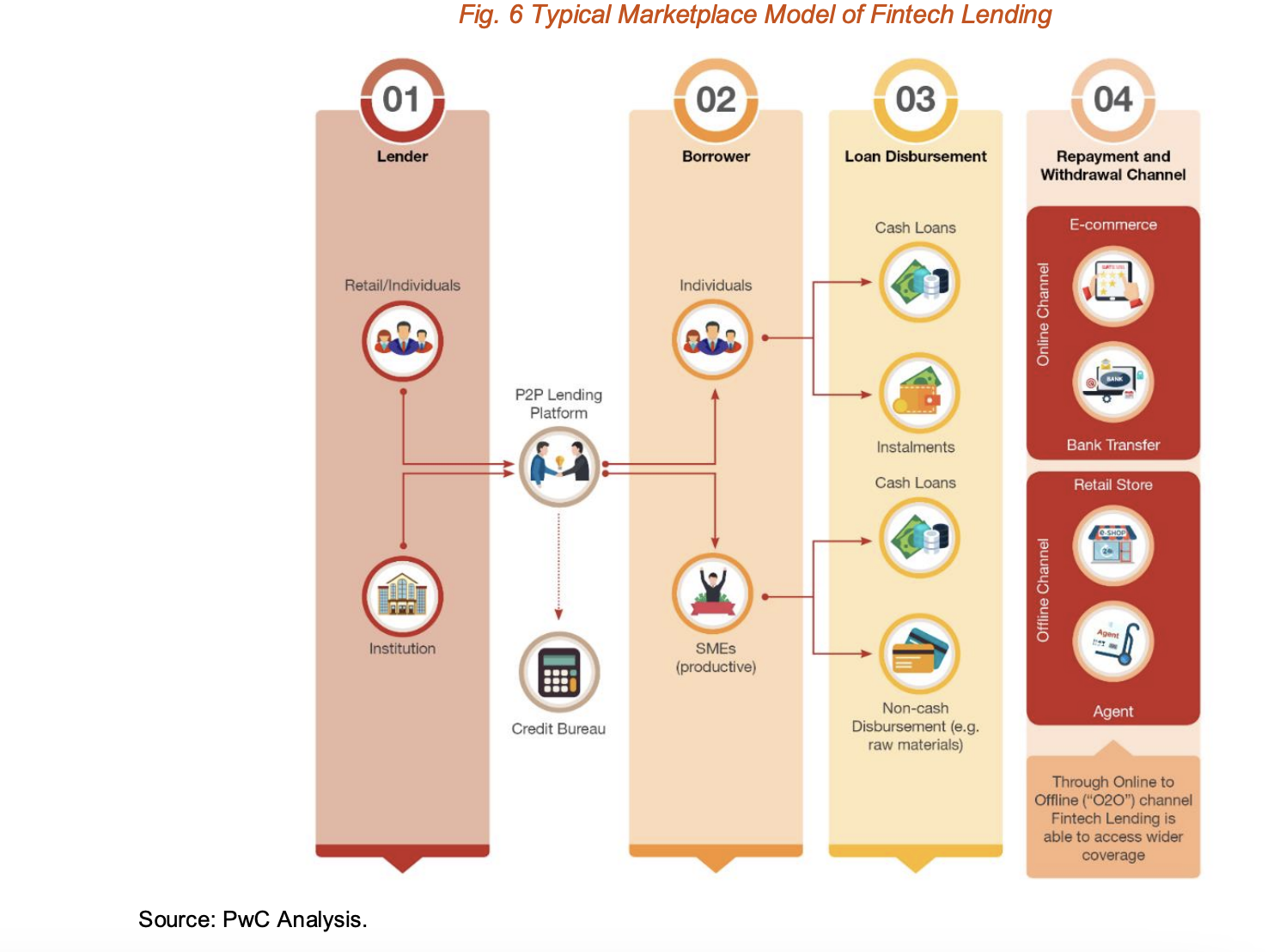

Lenders can now easily issue loans over the internet or via mobile apps thanks to the use of fintech. P2P lending, mortgage lending, company loans, and investor loans are just a few of the many financing options available through fintech.

Latest Read: Can Fintech Survive Without IT Support? Let’s Know With Experts!

Who Are the Top Fintech Lenders?

1. SoFi

2. Avant

3. Affirm

4. Better.com

5. GoodLeap

6. Funding Circle

7. Blend

8. Fundbox

9. Prosper Marketplace

10. Sunbit

What Strategies Do Fintech Lending Companies Use to Make Money?

Fintechs often generate money off of interest rates, a time-honored financial business model. Loans that produce interest are an additional revenue stream for fintech companies that bring in clients for other services.

Who Benefits from Fintech Lending Companies?

Who Benefits from Fintech Lending Companies?

- Borrowers now have a new alternative in the form of Fintech Loans, which have a number of advantages over regular bank loans.

- By eliminating the need for paperwork and providing direct access to banking information and other financial data, fintech hastens the loan approval process and improves customer service.

- Borrowers can apply for loans quickly and easily online, eliminating the need to travel to a bank or other financial institution.

- As a result, firms are able to invest, expand, and generate new jobs as money is borrowed and lent.

- Borrowers whose credit histories may not have been strong enough to receive loans from traditional lenders may be eligible for loans from fintech companies.

- Fintech lenders have the potential to offer faster credit decisions and greater convenience to borrowers than traditional banks.

- Alternative data can be used by fintech lenders to authenticate borrower identities, increasing security and reducing fraud.

- Instantaneous resolutions and happy customers

- A bank without branches means one can get a loan whenever one needs it.

- Reaching more potential buyers – Access to all channels

- Interaction design based on user behavior

- Good balance between the use of non-traditional data sources and the disclosure of minimal customer data.

Read : Global Fintech Fest 2023 – Outcomes

What Are the Key Principles of Fintech Lending Products?

- Processes with STP and Digital First Priorities

- Digitally verified data sources are used for triangulation in a mobile-first operational model.

- Details about potential applicants are prefilled.

- Prioritizing Digital Products for Success in the Market

- Digital Cadre of DLCs, contact centers, and branches as Digital Catalysts for enabling digital and processing digital drop-offs

A Closer Look at the Fintech Lending Process

Automating and digitizing customer journeys, updating legacy programs, and streamlining ongoing projects are all ways banks are adapting to meet the demands of an increasingly discerning clientele.

With the bank’s help, borrowers can go from applying for a loan to receiving the funds in their account in a matter of mouse clicks and a minimum of paperwork. Customers may apply for loans and receive their funds without ever having to set foot in a bank branch because to this platform’s contactless and paperless loan approval and distribution process.

As an alternative to the traditional method of relying solely on a company’s balance sheet when extending credit, banks have developed credit models based on factors such as revenue, cash flow, digital data points, and alternative data.

The bank has established segment-specific risk scorecards and individualized lending products and processes for its various customer bases (viz., existing Bank customers, new-to-bank customers, new-to-credit, etc.).

Is Fintech Lending Right for You?

With the rise of new-generation lenders in India, who prioritize a fully digital model and a faster digital lending procedure, the country’s lending ecosystem is beginning to change toward a digital-first mentality.

Many credit-related problems could be solved by switching to digital lending, which has many advantages over traditional lending. Credit approval times are significantly reduced with digital lending. Digital platforms clearly have a shorter turnaround time for credit evaluations and loan disbursements.

Read the latest article: 10 Best Applications Of AI In Banking

[To share your insights with us, please write to sghosh@martechseries.com]