New Premier Members join including Apptio and Nordcloud to cap a year of rapidly growing interest in FinOps tooling and best practices

The FinOps Foundation, a part of The Linux Foundation’s non-profit technology consortium and focused on advancing the people and practice of cloud financial management, announced new Premier Members Apptio and Nordcloud as well as continuous framework updates, and new certification courses and milestones to cap a year of momentous growth.

Top Globalfintechseries.com Insights: Binance Labs Makes Strategic Investment in MOBOX to Bring the Gaming Platform Next Level

As part of adding the new Premier Members, Eugene Khvostov from Apptio and Fernando Herrera from Nordcloud will join the Governing Board. In addition, practitioners from Spotify and Domo have joined the Technical Advisory Committee. The Governing Board sets the strategy of the program, including where to invest resources and funds in support of the Technical Advisory Council’s work.

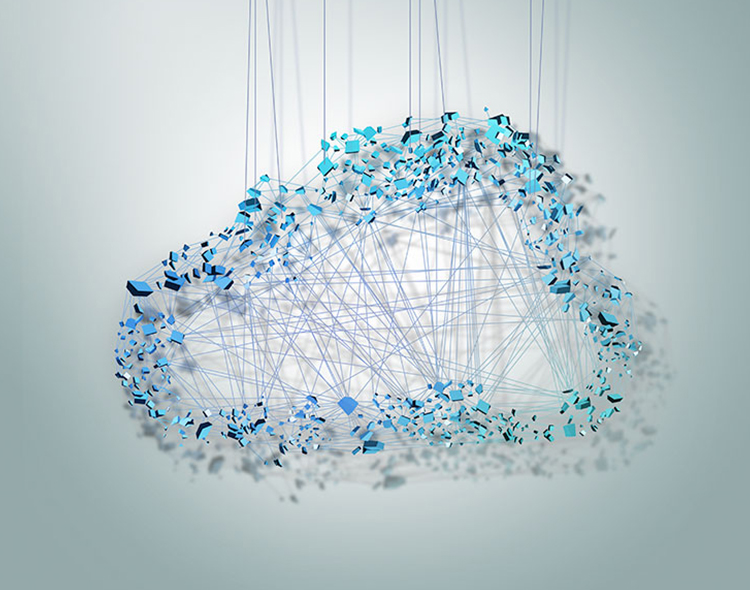

FinOps is the discipline of bringing financial accountability to the variable spend model of cloud, enabling distributed teams to have the control and visibility to make business trade-offs between speed, cost, and quality. The FinOps Foundation provides a vendor agnostic framework that is integral for managing operating expenditures (Opex) in the cloud and for helping distributed teams running in the cloud take advantage of the economic benefits that cloud deployments offer.

“The shift to remote-first over the past 19 months spurred a meteoric move to the cloud by companies, making FinOps an even greater necessity for small and large companies in all industries,” said J.R. Storment, Executive Director of the FinOps Foundation. “The foundation’s growth the past two years underscores the need and value of FinOps best practices and learnings to better meet challenges, including cost optimization. I could not be more proud of our growth.”

The foundation will close 2021 with over 4,500 active members and practitioners contributing to an industry-leading framework, which includes best practices and learnings from innovative organizations and cloud providers such as the Mayo Clinic, Chevron, Target, Box, Expedia, Atlassian, HSBC and Google Cloud Platform.

Browse The Complete News About Fintech : Polygon Makes Strategic Investment into Social NFT Platform DeFine

Of note, the FinOps Certification Program, which helps individuals in a large variety of cloud, finance and technology roles to validate their FinOps knowledge and enhance their professional credibility, has seen expansive growth over the past year and recently passed over 1,000 certified practitioners underlining the demand for skills in the FinOps category. The FinOps Foundation has also recently announced a new “FinOps Certified Professional” certification program to begin in early 2022, which is designed for those who plan to lead or hold a significant position or responsibility on a FinOps or cloud financial management team and offers those level practitioners a more intensive certification program focused on implementation for scale.

The need for standardization across cloud providers was further reinforced by the inaugural State of FinOps report launched earlier this year. This report sheds light on the following areas:

- Top challenges facing FinOps practitioners, including getting engineers to take action on cost optimization, allocating shared and unallocated costs, forecasting variable spend and aligning tech and finance teams.

- The fact that challenges faced by those spending $5 million per year were similar to those spending $500 million per year, which supports the notion that it is good to develop and standardize best practices early on.

- Fast growth of FinOps teams, which creates opportunities and challenges.

- Data showing a large portion of practitioners feeling the need for FinOps as spend reaches $1 to $10 million annually and up.

Read More About Fintech News : Uplift, the Buy Now Pay Later Leader in Travel Offers 3 Month Interest-Free Payments in First Ever “Zero Percent Event” Black Friday/Cyber Monday Promotion

[To share your insights with us, please write to sghosh@martechseries.com]