Avantis Regtech is India’s most comprehensive employer compliance SAAS platform and helps 1500 legal entities track over 69,000+ compliances, 6700+ filings and 3,500+ annual changes

TeamLease Services, India’s leading Human Capital and Staffing firm, announced increasing their stake in Avantis Regtech, the industry leader in digitization of Compliance Management to 61.5%. Along with this equity infusion, the strategic partnership will be expanded by changing the name of the company and brand to TeamLease Regtech.

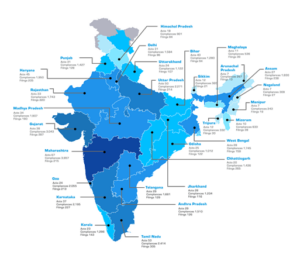

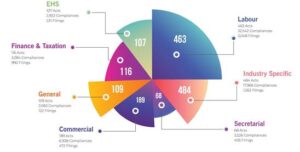

TeamLease Regtech will offer a state-of-art web SAAS based web and mobile based digital platform to over 1,500 entities, 20,000 enterprise users across 45 industries for the stock and flow of Indian employer compliances. For stock, the platform supports the centralized creation and management of over 5 million compliance documents via a customized database of 1,536 Acts that create 69,233 unique Compliances applicable to corporate India. For flow, it digitizes over 3,500 annual regulatory updates from over 2,200 regulatory websites. In addition, the company serves as a platform that enables over 2,000 CAs (Chartered Accountants) and 1,300+ PCS (Practicing Company Secretaries).

Commenting on the partnership, Ashok Reddy, Managing Director, TeamLease Services, said, “COVID has accelerated the digitization of employer plumbing by ten years. Simultaneously, policy makers are adopting a new policy thought world that moves beyond the now discontinued World Bank EODB ranking to an employer perspective. Regtech is important infrastructure for Putting India to Work and in anticipation of the addressable market expanding by 20X, we are excited to expand our partnership with Avantis”.

The increased space and demand for Regtech is driven by three new thought worlds among policy makers, companies, and board members. Policy is pushing for a new approach to ease-of-doing-business around rationalize, decriminalize and digitize. Companies are adopting a new control and compliance thought world of paperless, automated, and real-time systems. And board members are increasingly asking their companies to embrace ESG and report progress. The statutory compliance market is currently pegged at 5000 crores, largely serviced by offline unorganized players. Only 1% of this market offers tech enabled solutions. A 25 fold increase is expected in technology enabled compliance space in the next five creating an exponential market opportunity.

Read More: Flutterwave Enables New Europe-Africa Payment Corridors via Stellar

*Rishi Agrawal, Co-founder & Director, TeamLease Regtech, said**, “Corporate India faces rising demands for robustness and transparency in governance, risk and compliance. Traditional, manual, ad-hoc, paper based and people dependent compliance fail to scale. Avantis started in 2015 and entered into a strategic and equity partnership with TeamLease Services in 2018; expanding this partnership was logical as policy makers target multiple ease-of-doing business metrics to expand formal job creation”.*

Of India’s 63 million enterprises, we believe every one of the 1 million employer based social security payers represents an addressable market, but in the first phase we are targeting the roughly 25,000 companies with a paid-up-capital of more than Rs 10 crore. The company has architected its offering into two stacks; DIY (do it yourself) that targets corporate customers in self-service mode and DFM (do it for me) that targets service providers (CAs, CSs & Labour Consultants). Avantis has also been closely working with several union and state government departments to help them rationalize (reduce the number of compliances), decriminalize (reduce the number of criminal provisions) and digitize (build a national open compliance grid that allows paperless, presence less and cashless compliance).

Open architecture policy intervention precedents in payments (UPI) and taxes (GSTN) provide useful templates to reimagine the future of compliance that will create huge opportunities for Regtech players. The current challenges and opportunity is summarized by the infographic below:

[To share your insights with us, please write to sghosh@martechseries.com]