A new study by Metia involving 500 financial marketers from a cross-section of US and European banks and credit unions reveals that the old ‘ build it and they will come’ mentality of IT-led digital banking transformation will not cut it in the new banking world.

COVID-19 has created a powerful inflection point for banks and credit unions. Emerging stronger, smarter and more connected to customers is the only banking imperative right now.

It might be easy to imagine that a shift to exclusively digital banking would be a seamless transition for most financial institutions. It isn’t.

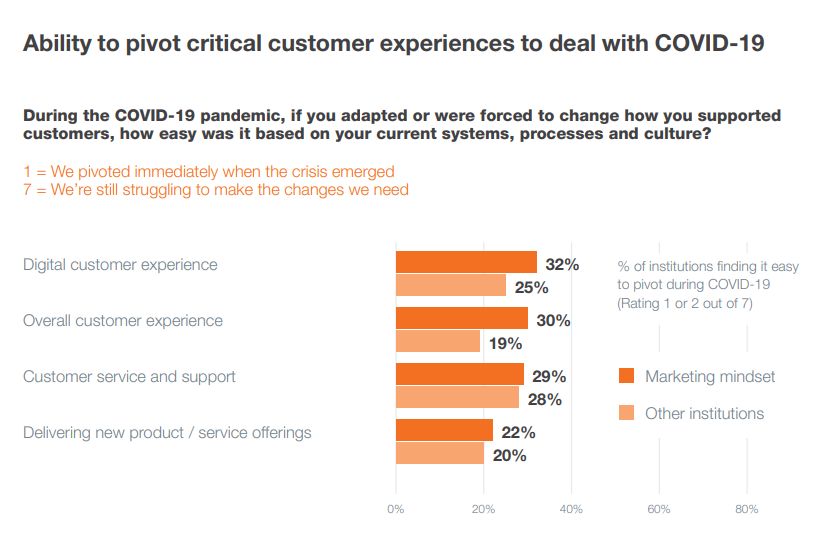

Our study showed that only 27% of banks and credit unions were able to immediately pivot their digital experience and only 21% were able to deliver new product and service offerings to address immediate needs when the pandemic hit.

Read More: The Influence of Mobile Apps WeChat Pay and Alipay Extends Far Beyond China’s Borders

Considering that US and European financial institutions were expected to deliver state and national relief packages to COVID-19 disrupted businesses, this is a significant barrier to effectively supporting both customers and the economy.

Figure 1:

So why was the transition so difficult? In 2019, Metia conducted research for banking software provider Temenos about the state of digital banking transformation in the US’s largest banks. We estimated that big banks had already invested $162 billion dollars in their currently live digital transformation initiatives, yet only 25% of their customers reported any discernible difference in the digital experiences offered. This represents a significant digital banking transformation gap.

At the hiatus of COVID-19, IDG stated that 61% of IT and business leaders are immediately poised to accelerate investment in digital transformation. The key question for bank and credit union leaders is: If the previous twenty years of investment in digtial transformation has not delivered meaningful digital banking experiences for customers, how will increasing spend at a faster rate, on exactly the same things bring about a more positive outcome?

One group of banks and credit unions stood out in our research: the 38% that gave their senior marketers a leading role in their institution-wide digital transformation.

Giving senior marketers a seat at the digital transformation table delivered:

- Digital capabilities that outplayed direct competition (60% of institutions with a marketing mindset versus 35% those that relied on traditional IT leadership)

- Better asset growth. Banks and credit unions with a marketing mindset were 2.5 times more likely to report that investment in digital transformation could be directly attributed to a significant increase in asset growth.

The institutions with a marketing mindset closed the digtial banking transformation gap. They were significantly more likely to have seen increases in customer satisfaction (57% versus 45%) than other banks or credit unions.

Most importantly, banks and credit unions with a marketing mindset had already rethought their overall strategy for post COVID-19 (51% versus 36% of other institutions).

So, what is about the marketing mindset that delivers?

There are five unique perspectives

Marketing mindset 1: Brand is the only real battleground left

Successful marketers understand that banks and credit unions need to support technology investment with a compelling narrative that is relevant, authentic and provokes a positive emotional reaction.

Marketers know that a meaningful brand and branded experiences are the future of banking. Bytes, bits, features and function are a zero-sum game.

Marketing mindset 2: Launching is cool, consumption is critical

The marketing mindset takes digital initiatives out of the old world of ‘specify, build and deploy’— into the new world of launch readiness, usage, optimization and growth. The marketing mindset ensures that institutions understand that the job is not done when the solution is built. Successful banks and credit unions show customers and Members why and how they should use new digital experiences.

Read More: Doxim Announces Omnichannel Loan Origination and Account Opening in Partnership with Mobetize

Marketing mindset 3: Data gives context

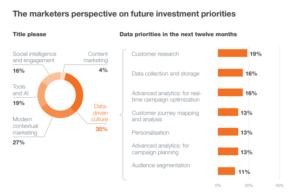

Financial marketers believe that success will ultimately require a data-driven decision making and customer experience culture. Figure 2 shows the financial marketer’s perspective on the investment priorities for future banking success. Data-driven culture is priority number one.

Figure 2:

Marketing mindset 4: Context is everything

Data is key to modernizing marketing and customer engagement by enabling banks and credit unions to deliver experiences that are personalized, resonant, omni-channel and real-time. Effective service and sales will require the right offer reaching the right person at the right time. Marketers recognize that in the new banking normal, those times and places will be different. It will be when customers and prospects are thinking about major life events more than when they have a specific transactional need with their bank.

Marketing mindset 5: Human + digital will be the new normal

Financial marketers are embracing a vision of the future where the benefits of AI and RPA empower banks and credit unions to focus on high value engagement with their customers. Senior marketers have been through their own digital transformations – they were the first of the banking disciplines to embrace technology. They have witnessed and benefitted from the proliferation of martech solutions. They know that digtial will never replace human interaction but have seen technology free valuable and skilled marketers to deliver better, deeper and more resonant relationships because technology can be trusted do the transactional heavy lifting.

The future of new banking will inevitably be jointly redefined by banks and customers. Historically, it was tellers and branch employees that delivered and defined the banking experience. In a dominantly digital future, marketers will become the key interface for both listening to and communicating with customers. As consumers and banking professionals envision new ways of interacting, the marketer’s role will grow in significance.

Embracing a marketing mindset brings a culture, infrastructure and a future vision that is customer-first, emotionally engaging and positively impacts the lives of customers. The future is challenging, but it’s a perfect time for banks and credit unions to think like a brand, not just a bank.

Marketers have earned their seat at the digital transformation table.

Read More: GlobalFintechSeries Interview with Jill Homan, President at DeepTarget