Financial advice tends to be a localized business. Where other financial services have digitized and fractured, relying on mobile apps and decentralization to boost margins and cut overhead, many advisory firms haven’t followed suit.

The introduction of the coronavirus has largely changed that. And the changes the virus has ushered in are unlikely to fade, even once a vaccine is widely available.

Read More: GlobalFintechSeries Interview with Irwin Grossman, CEO and Co-founder at Delta Payment Solutions

A new kind of crisis

For investors, the uncertainty caused by the coronavirus has been different than that of previous recessions. Consider the five most significant concerns for investors identified by Natixis: unexpected costs, health care costs, taxes, maintaining their standard of living and not having enough money to save.

While a “typical” standard recession impacts us in the wallet or threatens our employment, maybe hitting two or three of these points, COVID impacts four of the five. In a pandemic, concern around healthcare costs, which can be opaquer and more difficult to plan for than these other issues, adds a layer of uncertainty.

This is likely why investors have reacted to the pandemic by being more proactive about their finances where possible. In a response to a Facebook survey in March, 60% of respondents said that the pandemic meant that they needed to be more proactive about financial planning.

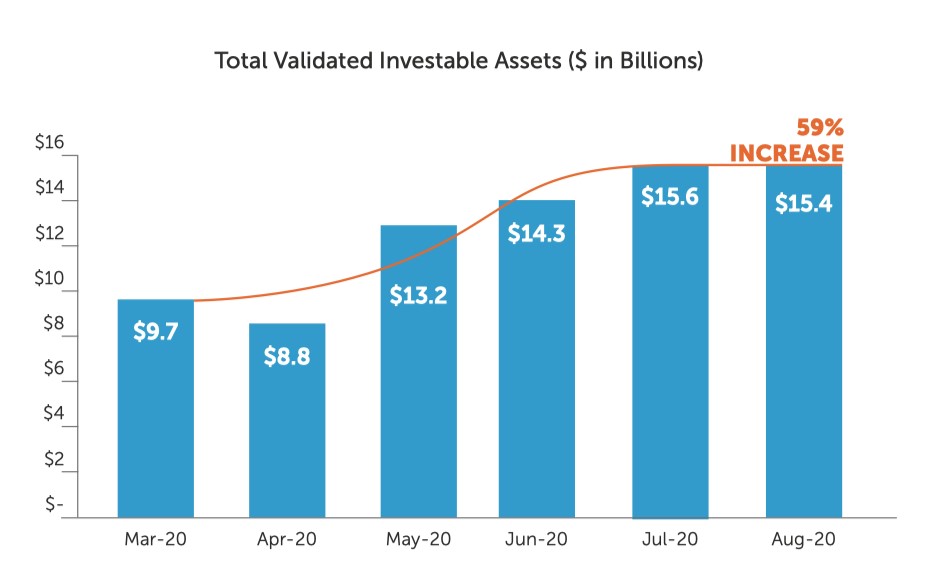

At SmartAsset, we’ve also seen a notable uptick in the number of investors across the country who utilize our website to find a financial advisor. While the average investable assets of our investors has stayed the same, the total assets matched each month through our platform has nearly doubled since March.

Covid changes the nature of discovery

Advisors tended to rely on in-person business development in part because it worked. Consumers also liked meeting advisors through informal referrals, local meetups and/or expert networks. While some turned to the Internet to assist their search and information-gathering efforts, most didn’t.

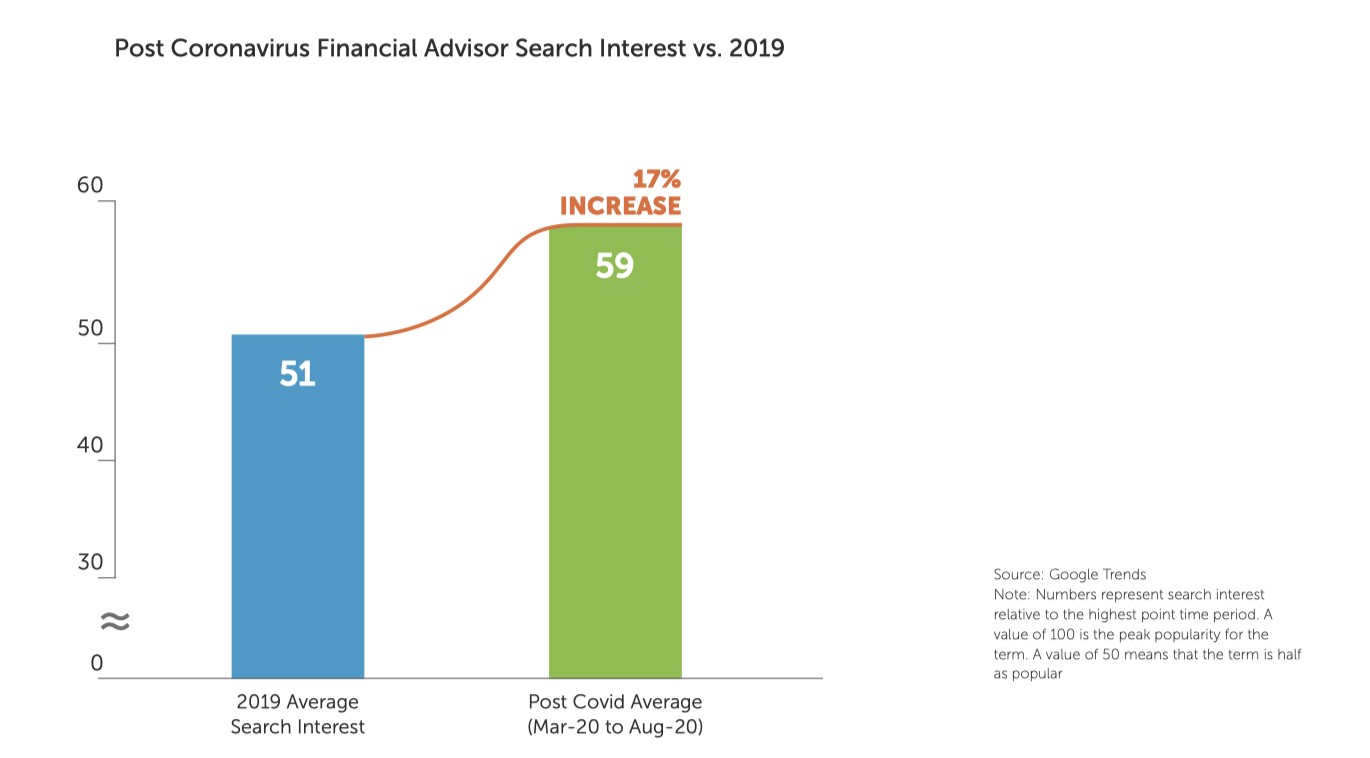

In March, however, with investors spooked by market volatility and stuck at home, those who realized that they needed financial advice turned to Google. The chart below shows how frequently a given term is searched for on Google relative to a historical baseline. During the first six months of the coronavirus, the relative frequency of user searches for the term financial advisor increased 17% compared to 2019’s average.

Read More: GlobalFintechSeries Interview with Konstantin Richter, CEO & Founder of Blockdaemon

The role of investor demographics

There are three trends shaping the market for financial advice. First, older generations — those that have historically been a target for advisors — are growing more comfortable using the Internet to find an advisor. The above chart from Google Trends illustrates this.

Second, we’re right at the tipping point where Generations X and Y are entering their prime earning years and inheriting massive amounts of wealth. These are digital-first generations: 53% of millennials would seek out a new advisor if their current advisor wasn’t viewed as utilizing satisfactory technology. Only 29% of baby boomers would do the same.

Finally, the coronavirus is changing the way that we consume. Record numbers of consumers now use digital channels to access entertainment, grocery stores and banking services, many of whom have done so for the first time in the past seven months. The market for telehealth alone grew from a predicted 36 million visits in 2020 to more than one billion visits (and counting).

Once consumers discover that there’s an easier way to do something, they’re unlikely to turn back. According to McKinsey, three-quarters of consumers who use a digital channel for the first time are likely to continue doing so.

What this means for advisors

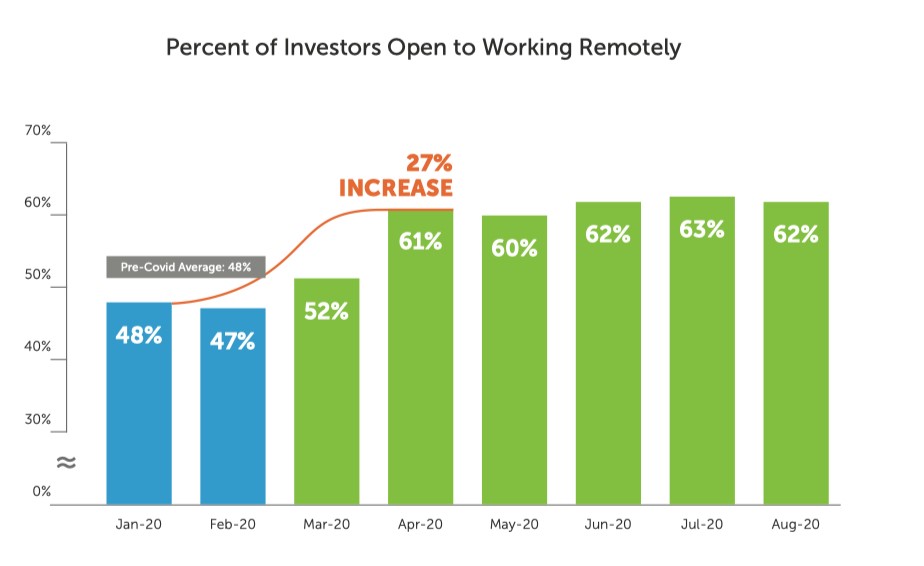

Investors are signaling that they’re not only turning to the internet to find an advisor, but that they’re largely comfortable building great relationships virtually. We’ve seen a 27% increase in investors’ willingness to work with a remote advisor, as the chart below shows.

It’s unlikely that this will revert to pre-pandemic levels, even as we slowly head back to in-person work. While some investors may prefer the old method of discovering and meeting advisors, they’ll likely still expect some of the conveniences that they’ve grown accustomed to. So even if advisors aren’t developing entire relationships virtually, they’ll need to be ready to provide client service that mirrors that of virtual firms.

To meet this need, firms’ investment in software can’t begin and end with video conferencing. Advisors will need to be able to support a remote client at multiple touch points, from onboarding to monthly reporting. Firms will even need to have a virtual solution for ancillary activities, like appreciation events, that improve client retention and help to develop a firm’s brand.

Read More: GlobalFintechSeries Interview with Jared King, CEO and Founder at Invoiced

Investors’ comfort with virtual advice also offers an opportunity to advisors to reimagine their practice. Historically, the highest density of firms has been in urban areas due to their greater density of high-net-worth individuals and higher average incomes.

Advisors’ comfort with virtual meetings isn’t only a boon for their firms. Investors now have more access and choice than ever. Individuals can now find an advisor whose niche focus, investment philosophy or personality meets their needs specifically, rather than being tied to the choices dictated by the physical proximity of their advisor’s office.

Explore the State of Technology Sales and Tips to Streamline Marketing and Sales Efficiencies with Leaders from Zilliant, Pipedrive, TeamViewer, Acoustic and more!