Fintech thought-leader and CEO/Founder of VoPay, Hamed Arbabi joins us in this GlobalFinTechSeries interview to talk about his fintech journey and what his observations and predictions for the Fintech segment in 2020 are.

______

Can you tell us a little about yourself Hamed (including your hobbies!) and what your fintech startup journey has been like so far. How did the idea/inspiration for VoPay first come about?

I’ve been recognized in the fintech industry as an innovative thought leader and serial entrepreneur. I’ve built multiple companies and leveraged my knowledge of business expansion to develop them into successful, disruptive organizations.

With over fifteen years of executive-level experience in spearheading comprehensive strategies and business developments, I have an in-depth knowledge of the global payment industry. My overall vision for VoPay revolves around innovation and transformation in the payments space. What began as a simple idea, that global payments should be easy, affordable and accessible to all, ultimately founded the pillars of the company.

I am most proud of my commitment to community, particularly those who are underserved and underprivileged. I founded Vision 4 Kids, a non-profit organization that focuses on helping children gain access to technology and the transformative opportunities it holds for them. By giving kids the tool on the market, they are taking control of their future, connecting to the latest information and academic resources, ultimately improving their performance at school and improving the outlook on their future.

Read More: GlobalFintechSeries Interview with Lil Roberts, CEO & Founder at Xendoo

We’d love to know what some of your top FinTech predictions for 2020 are?

Here’re our top five predictions for the year ahead:

- Continued adoption of invisible banking

- Mobile payment volume will hit record levels

- Broader support for open banking as the benefit to consumers continues to grow

- A focus on financial wellness apps to promote good spending and budgeting practices

- New developments in payment security and authentication, especially via AI and machine learning

Can you talk about some of the most innovative fintech apps and platforms in the global payments industry that according to you are set to create new benchmarks for this segment?

Some companies that come to mind include Revolut, Currency Cloud, Plaid and Hydrogen. See our complete list!

How according to you will AI and other innovations impact how Finance Technology Solutions for global payments will evolve in future?

In my view of how fintech and banks will evolve in the future is that banks will act as a platform for fintech, bank challengers companies, similar to telcos. In early 2000 when new services such as Skype began disrupting telcos main lines of revenue such as voice and text messages it caused a major concern as telcos had large investments on building their networks which was focused on those two services and the Skypes of the world were directly targeting those services.

The telcos responded by offering more VAS but they still could not keep up with the speed of innovation from tech companies. Eventually as customers started consuming more data, telcos realized that this could be their major revenue stream and they needed to invest on improving data capacity available to end users rather than offering more VAS suchs as MMS/VM etc. Telcos are currently focused on consistently increasing bandwidth on mobile by introducing 5G that will help consumers access more services on the APP and now act as platform for apps.

Read More: Three Ways AI Enables Personalized and Engaging Customer Experiences in Financial Services

What are some of the biggest challenges in fintech that innovators and other startups often face, what are your top best practices that you’d like to share to help future fintech entrepreneurs in this space?

The lack of knowledge about the financial industry is one of the biggest challenges to overcome.

Best practice: Don’t underestimate the complexity of the building a successful fintech company and the regulatory hurdles you may need to cross

Tag (mention/write about) the one person in the fintech industry whose answers to these questions you would love to read!

Jack Dorsey, because he has navigated both Twitter and Square through significant ups and downs and successful IPOs!

Your favorite FinanceTech quote

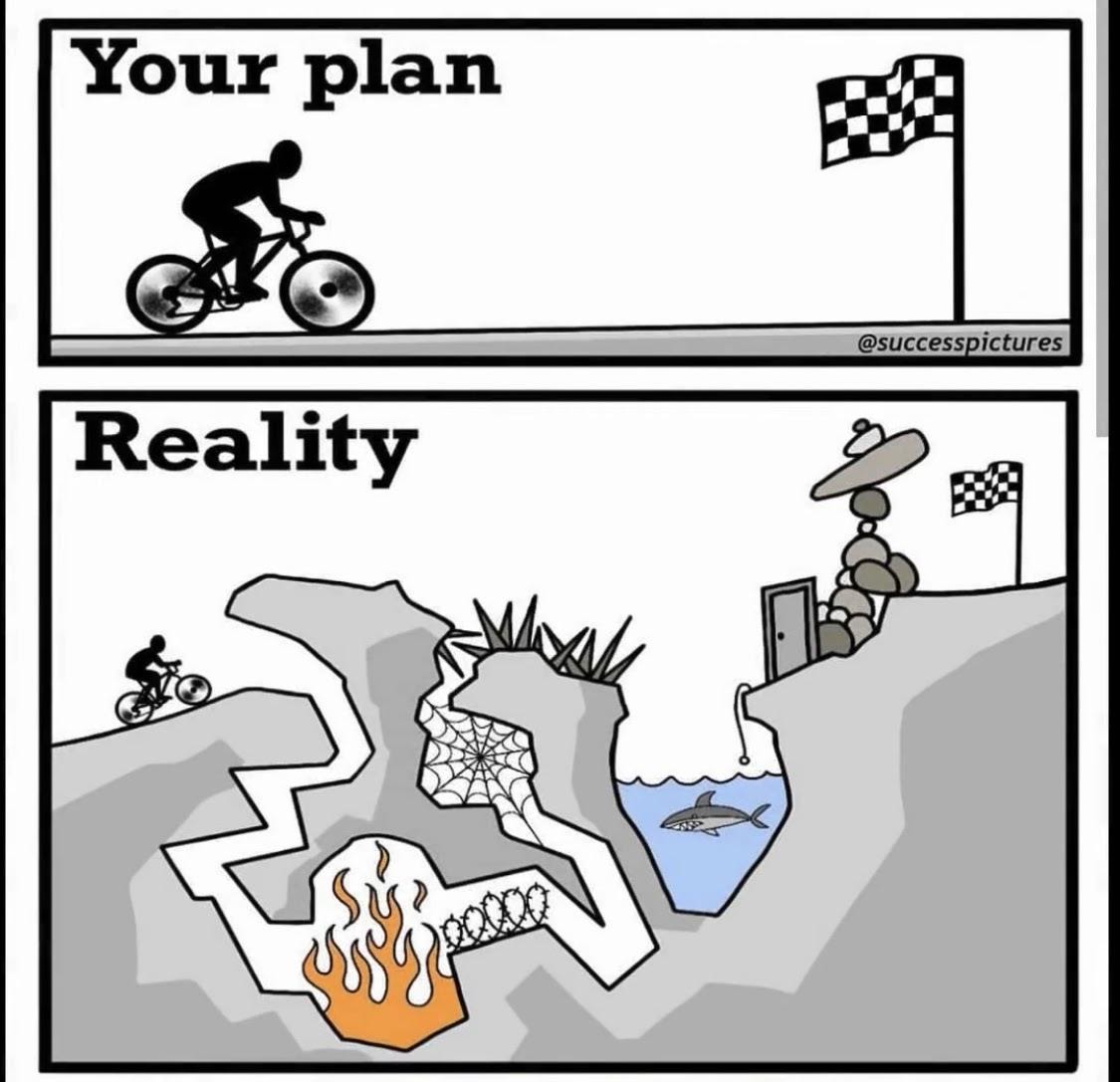

Instead of a quote I thought I would share this illustration!

We’d love to know what some of your future plans for VoPay are! Any other startup plans or fintech startups in mind?!

We’d love to know what some of your future plans for VoPay are! Any other startup plans or fintech startups in mind?!

We are currently expanding into the US market and will expand into overseas markets after that as we continue our mission to digitize online bank account payments and build a unified global ACH. This supports a vision of building a global digital commerce bank enabling fintech globally.

Read More: Why Banks will Benefit from Open API

VoPay is a leader in payment innovation, digitizing online bank account payments with speed and transparency. Our API connects digital enterprises to banking systems, enabling them to facilitate direct bank account payments just like credit cards – but better. At VoPay, we have one goal: to eliminate all payment inefficiencies, so businesses can focus on what they do best in today’s digital economy.

CEO and Founder of VoPay, Hamed Arbabi, is recognized in the fintech industry as an innovative thought leader. A serial entrepreneur, Hamed has successfully built and grown multiple startups and leveraged his knowledge of business expansion to develop them into successful, disruptive organizations. With over fifteen years of executive-level experience in spearheading comprehensive strategies and business developments, Hamed has a proven track record and an in-depth knowledge of global payment industry.

1 comment

Comments are closed.