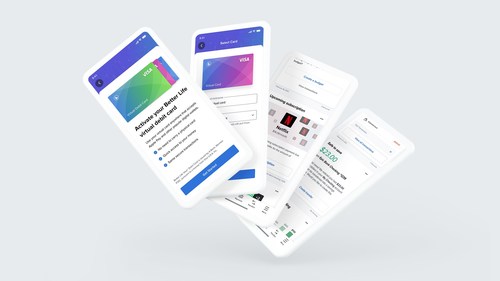

MXmobile provides customers of financial institutions and fintechs with a stunning view of their financial health

Three new use cases–simpler user onboarding, greater user personalization, and enhanced mobile banking–include new features such as account origination and personalized insights

MX, the financial data platform and leader in modern connectivity, announced its popular mobile banking app, MXmobile v6, previously called Helios. MX is raising the standard with MXmobile by increasing focus on growing and engaging users to expand the bottom line of the financial institution or fintech.

“As mobile banking adoption continues to accelerate, financial services providers are looking to offer users a more personalized and all-around better mobile banking experience,” said Brett Allred, Chief Product Officer, MX. “MXmobile helps organizations deliver on that promise by offering simpler user onboarding, greater personalization and enhanced mobile banking features to drive engagement and increase the bottom line.”

Read More: DeFi Enabled, Enterprise Grade Hybrid Blockchain, XDC Network, Gains Compliance Edge

MXmobile offers customers:

Simpler user onboarding. MXmobile makes it easier and faster for institutions to onboard new customers. From signing up, to funding the account, to transactions, users can be set up and ready to go live with their mobile banking app in a matter of minutes—versus months.

Greater user personalization. Once users are set up with an account, virtual cards, and money movement capabilities, data-based, AI-powered financial insights immediately provide recommendations in real-time so users can charge and strengthen their financial well-being.

Read More: Financial Services are Experiencing Massive Adoption in the Philippines Through GCash

Enhanced mobile banking. As new generations continue to demand financial services on the go, MX is allocating resources to continue to transfer the brick-and-mortar banking experience to mobile.

MXmobile works on any platform and any device, and side-by-side with the current experience—for clients who want to deliver a differentiated service to a segment of their users, or test new features before a full go-to-market, in tandem with a core mobile banking application.

[To share your insights with us, please write to sghosh@martechseries.com ]