Elemental.io and Flash Labs Corporation—of Big Sun Holdings Group, Inc., and a member of Hyundai BS&C family of companies—announced a strategic partnership and joint venture to advance software development, distribution and availability of consumer credit, using financial technologies in Latin America and Asian markets.

Read More: Solovis Launches New Risk Analytics Platform Designed for Asset Owners and Allocators

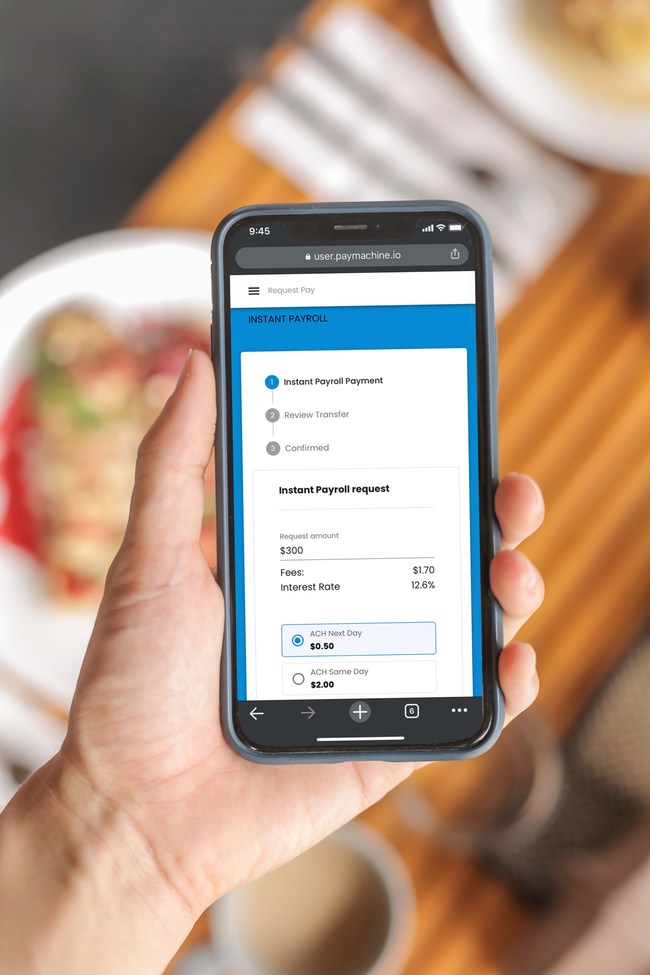

Elemental’s payroll solution, PayMachine, is an end-to-end loan origination platform focused on delivering accessible micro-loans and flexible payment options to gig workers, contractors and employees of small-, medium- and enterprise-size businesses. PayMachine is also designed to interoperate with blockchain-based payment methods—including central bank digital currency and stablecoins. This unique feature enables payment service providers (PSPs), credit unions and banks to provide currency choices above and beyond that of legacy payroll solutions, using the PayMachine brand, or a white label solution.

Flash Labs will provide software development, integration services and funding to further expand the flexibility, availability and footprint of Elemental’s payroll software solutions. The team at Flash Labs is comprised of experts in Internet of Things (IoT) and blockchain technology, creating and enhancing solutions focused on the security, sanctity and usability of data. In conjunction with its Hyundai BS&C affiliates, Flash Labs offers “best of block” blockchain development and consulting services to companies looking to integrate their hardware and software products to public or private blockchains.

“Elemental set out with a mission to bring affordable consumer credit access to the millions of employed people currently unable to access affordable credit, instead relying on payday lenders and loan sharks, who charge usury interest rates,” says Oliver Gale, Founder and CEO of Elemental. This partnership with Flash Labs will accelerate the deployment of fairer solutions for all that need them.”

The PayMachine payroll and lending solution utilizes best-in-class machine learning, credit-scoring technology and smartphone delivery of funds. Elemental, by partnering with Flash Labs, is now in a position to become the market leader in emerging market consumer credit solutions.

“Elemental’s payroll and micro-loan solutions offer a perfect platform and synergy with the services provided by Flash Labs,” says Michael Woods, CEO & COO of Flash Labs Corporation. “Our knowledge of blockchain and its ability to provide secure immutable records with excellent transaction speed will help grow Elemental’s business throughout the globe.”