38% of financial services executives expect the business recovery from COVID-19 to take one- to -two years

More than half of financial services companies plan to accelerate implementation of their next generation technology strategies, according to a new global survey of 500 financial services C-Suite executives and their direct reports released by Broadridge Financial Solutions, a global fintech leader.

Read More: GlobalFintechSeries Interview with Erick Pinos, Ecosystem Lead at Ontology

“Financial services players have shown they can adapt and change during the pandemic. Going forward, they will continue to drive digitization and mutualization to improve client experience, resiliency, and cost,” said Tim Gokey, CEO of Broadridge. “Prior investments in digital, cloud, and mutualized technologies have enabled companies to be more resilient during the crisis, and executives are taking careful note as they plan for the future.”

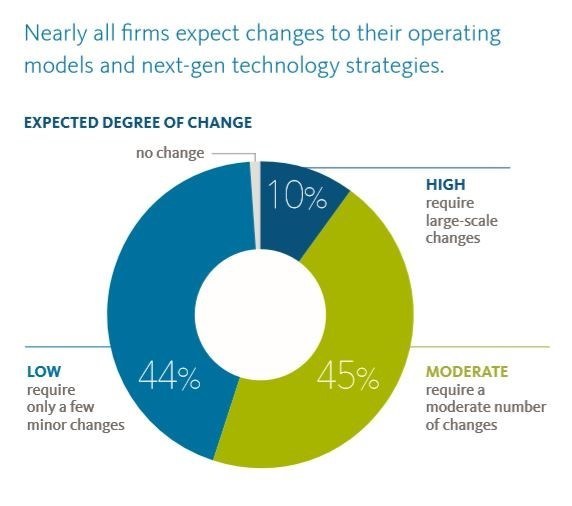

Virtually all financial services companies expect the pandemic to affect their operating model and strategy toward next-generation technology. In the next six months, companies plan to focus on:

- Increasing cybersecurity and risk management (63%)

- Enhancing multi-channel client communications (60%)

- Improving customer engagement and experience (53%)

- Making significant cost reductions (45%)

Read More: Simple Announces Launch of Tax Refund Feature to Automate Savings for Customers

Prior investments that were most beneficial in managing the pandemic were interactive digital technologies (72%) – defined as digitizing customer and employee experiences, workflows and operations along with cloud technologies (59%).

As a result of the pandemic, many firms have reprioritized their investment strategies. Businesses may never return to the old “normal”, leaving firms little choice but to accelerate their digital transformation.

- 58% plan to increase investment in interactive digital technologies

- 54% plan to increase investment in artificial intelligence (AI)

- 49% plan to improve their ability to quickly gather and analyze data moving forward

The pandemic has also changed the role of fintech service providers, with 70% of respondents stating that fintech providers’ ability to offer innovative uses of next-generation technology is now more important as a result of the outbreak. Almost half of respondents agree that the pandemic increased the need to mutualize – in other words, share or outsource – processing functions to reduce costs and increase resiliency.

Read More: TerraPay Announces Readiness for the New World by Strengthening Management