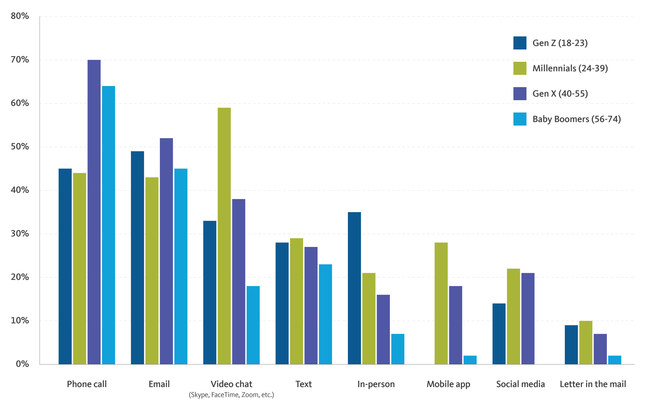

Changes in how investors and financial advisors collaborate, at first caused by Covid-19, are likely to remain long after the pandemic, according to a new survey from Broadridge Financial Solutions, a global Fintech leader. Over half (57%) of investors surveyed said communications with their advisor had changed in some way in light of new stay-at-home mandates. Sixty-two percent of those who reported a change in mode of communication said they would entirely or partially maintain their new methods after the pandemic ends. Fifty-eight percent cited phone calls and 46% cited emails as new ways that they communicated with their advisor during the pandemic. More than a third (36%) used video chat, even though only 9% prefer the method above all others. Millennial investors were most likely to use video chat with their advisor (59%).

“We are seeing an accelerated adoption of digitalization and personalization from investors, financial advisors, and wealth firms as a result of the pandemic,” said Michael Alexander, President of Wealth Management at Broadridge. “Advisors and investors adapted their behaviors to comply with stay-at-home mandates and social distancing rules, which led to an increase in digital communications and video conferencing, more personalized emails, and more frequent phone calls. These behaviors are broadening, deepening and changing the client-advisor relationship. As a result, investors don’t want a return to the past. They largely prefer this new normal.”

Read More: A Quick Review on Some of The Biggest Global Fintech Mergers & Acquisitions

Personalized and Individualized Advisor Communications

When asked what they like to see in communications from their advisor, respondents preferred information that is individualized to them:

- 44% – comprehensive view of their accounts

- 32% – money saving tips tailored for them

- 32% – ideas for new investment vehicles that could work for them

- 29% – personalized analysis of investing habits

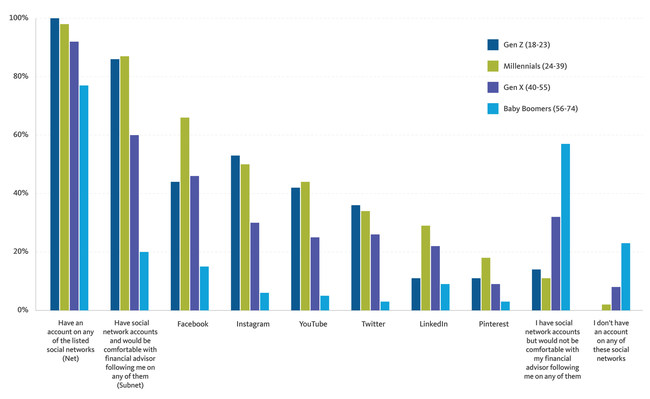

Social Media Remains Key to Connecting with Younger Clients

An overwhelming majority of Gen Z (86%) and Millennials (87%) said they are comfortable having an advisor follow them on social media to offer a more customized experience. Meanwhile, only 60% of Gen X and 20% of Baby Boomers are comfortable.

Read More: Equifax Launches Innovative New Solutions for Credit Monitoring and Identity Theft Protection