Miniter Group announces a July webinar to complete the six-part blog series “Challenging the Force-Placed Insurance Model.”

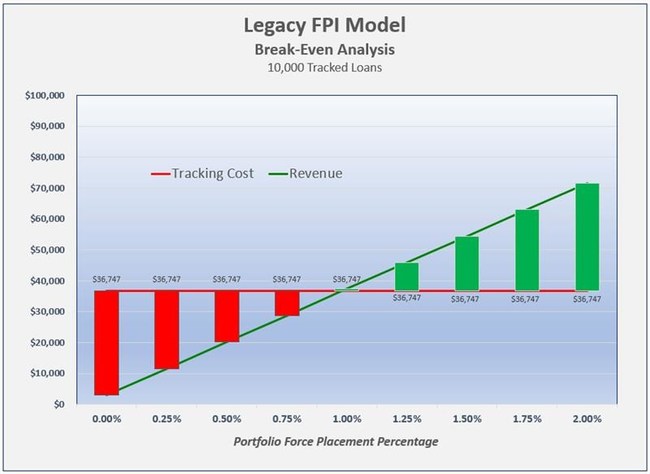

The webinar will focus on a new business model where lenders will reduce operational expenses associated with insurance tracking. At the same time, the insurance trackers’ revenue stream will stabilize and not be dependent on commissions generated from borrower force-placed insurance policies.

Read More: Simple Announces Launch of Tax Refund Feature to Automate Savings for Customers

The blog series reviews force-placed insurance from both a lender’s and insurance tracker’s perspective. By reviewing lender-placed insurance history, the blog describes how the legacy business model developed and why it has to change.

Read More: Healthfully and Paya Deliver Expanded Patient Care and Payments Through New Partnership

Jim Gilpin, EVP & COO of Miniter Group, commented today:

“The new force-placed insurance business model we are introducing at this webinar is the result of implementing our Borrower-CentricSM insurance tracking solution at over 100 lenders nationwide. We are looking to share this model’s success with bankers, insurance companies, and trackers to provide a win-win-win scenario for lender, trackers, and borrowers.”

Miniter Group is a leading provider of collateral risk transfer solutions to the lending industry, providing blanket and lender-placed insurance solutions to over 600 lenders in 41 states. Miniter’s in-house software development team continues to work with lenders to enhance the fast-growing Borrower-CentricSM Insurance Tracking System.

Miniter’s solutions include Vendor Single Interest Insurance, Lender Placed Insurance, Collateral Protection Insurance, and Mortgage Impairment Insurance.

Read More: GlobalFintechSeries Interview with Ashish Singhal, CEO and Co-Founder at CRUXPay