NetDirector, the most advanced cloud-based data exchange and integration platform for the default servicing industry, has released a new client-facing dashboard and analysis tool for their mortgage banking integration suite of services.

New Features, New Efficiencies

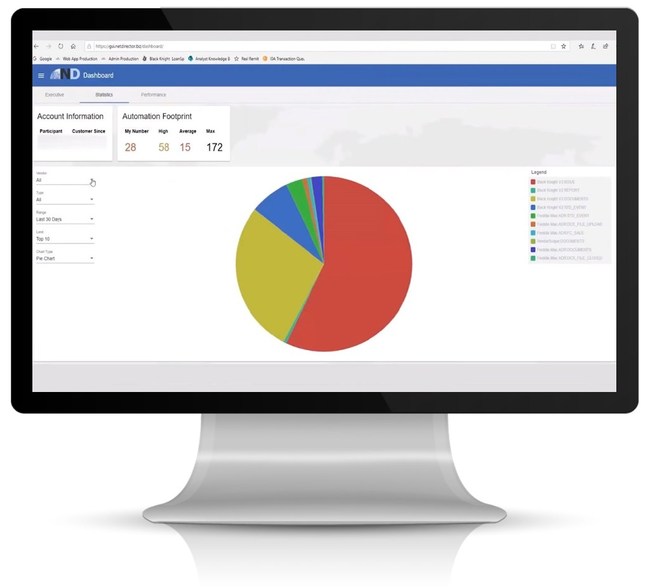

The most highly-demanded feature of the new Mortgage Banking dashboard is a series of analytics tools for transaction monitoring and analysis. Users will now be able to identify historical trends across a wide array of data sets, as well as monitor data flow and transaction success rates. These tools are built on cutting-edge frameworks and provide a clean graphical display of transaction frequency, volume, success, and more.

Read More: GlobalFintechSeries Interview with Tim Kelly, CEO & Founder at BitOoda

In addition, users can now see how their overall automation level compares to both the average NetDirector user and the users with the highest degree of automation by analyzing their Automation Footprint. The Automation Footprint is provided to each user on their personalized dashboard, where they can compare the number of different data transactions they are utilizing, to the maximum number possible, as well as to the average among all users and the highest among any one user.

The goal of providing this transparency is to allow default servicing firms and vendors to create highly reliable and efficient processes with as much automation as possible. As mortgage default volumes continue to shrink, firms are looking for every way possible to become lean and efficient. Their primary goal is to increase the volume of foreclosures they can process without adding labor and resources to their current team. Vendors are looking to increase their offerings and the ease of adoption/use for firms to ensure they continue to meet the rigorous technological demands of their customers. NetDirector enables both sides of the equation to reach unparalleled levels of efficiency and automation thanks to rapid deployment and one-to-many style integration hub technology.

Read More: Kreditech Rebrands to Monedo as It Steps Up Growth in International Lending Markets