Robinhood aims to bring opportunity, through technology, to help people invest, on their terms, on their mobile devices. They recently introduced new access points to the markets and created space for people to learn about the financial world. Robinhood pioneered commission-free trading, and was the first to do so for options trading.

With their options trading experience, investors now have an intuitive and cost-effective platform to trade options, which includes enhanced educational materials on options trading. Robinhood offers commission-free options trading alongside stocks and ETFs to help customers manage all of their investments in one place.

Over the last few months, Robinhood has rolled out multiple updates to the Robinhood Options offering in an effort to deliver the best possible experience to end-users.

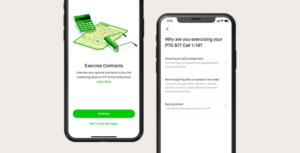

Introducing In-App Exercise and Instant Exercise Features

Robinhood has added the ability to exercise contracts in the app. With in-app exercise, investors can exercise options contracts directly in the app to help avoid delays and trade restrictions. Funds and shares from exercises are available immediately during market hours.

Read More: BillingPlatform Increases Standing in MGI 360 Ratings Report for Agile Monetization Solutions

By designing this experience, before exercising an option, customers will be asked to review their strategy, associated risks, and potential reasons to not exercise the contracts, in order to help them determine whether exercise meets their objectives. The platform will also display alerts and available actions when exercising a contract. These features were launched in the last few weeks and have been fully rolled out to all options customers.

source: Robinhood

Read More: German Peer-to-peer Lender auxmoney Raises €150 Million