Any new technology that enhances and automates the usage of financial products and services is referred to as “fintech,” or financial technology. The major six segments into which this technology is essentially split are listed below. Although there are a few additional minor components, we have only highlighted the key ones for the broad discussion while still offering pockets of extremely specialised technology.

- Payments as a Service (PaaS)

- Banking as a Service(BaaS)

- Insurtech as a Service (IaaS)

- RegTech as a Service (RaaS)

- Cybersecurity

- Wealthtech as a Services (WaaS)

- Blockchain

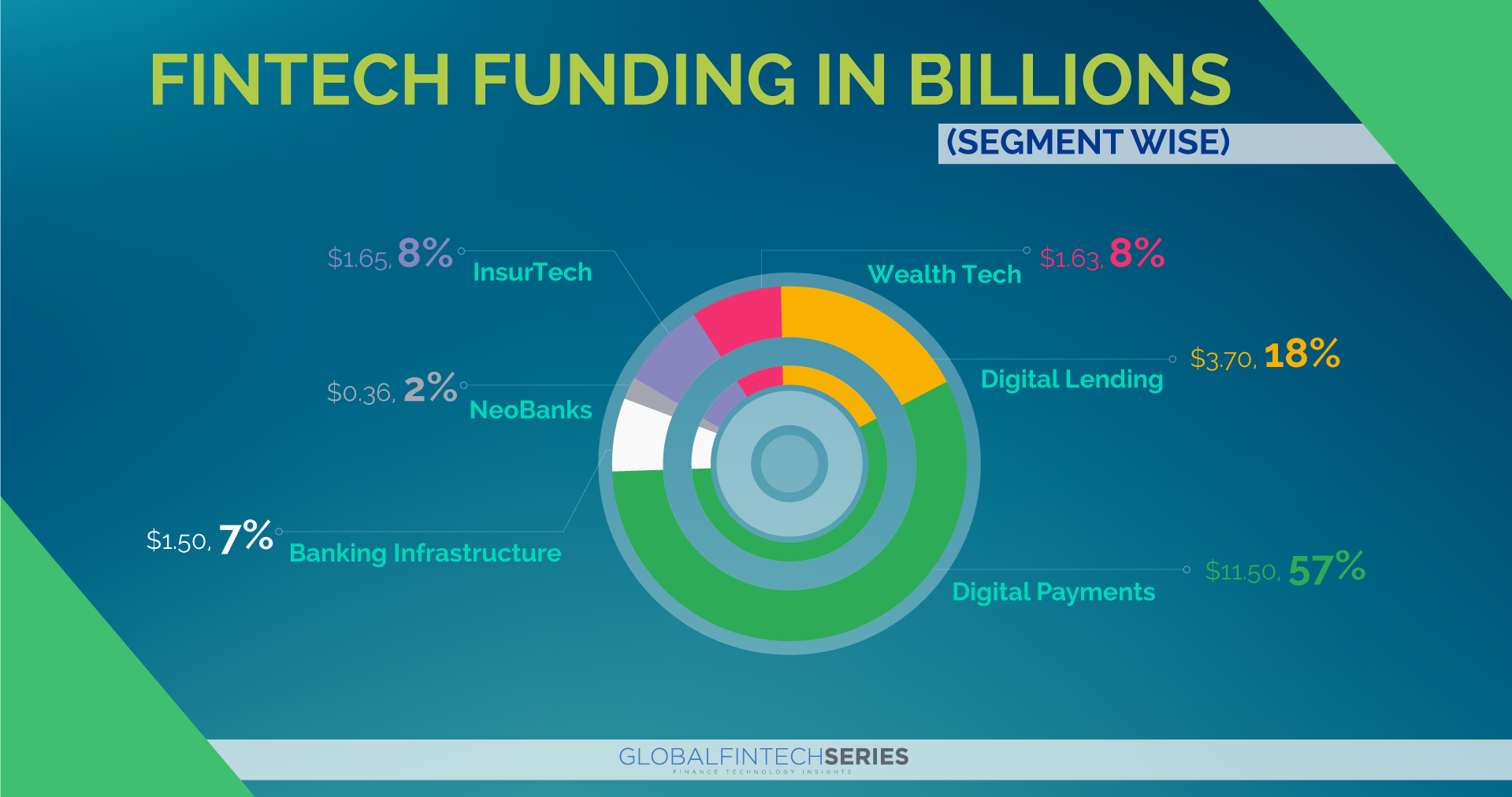

The chart illustrating Fintech funding across its various components is shown below. The most competitive funding sector is digital payments. In India, the payments sector accounted for over 48.5% of FinTech companies as of September 2021.

First Key FinTech Segment- Payment

Digital payments are made digitally; there is no actual cash exchanged. Such a procedure, which is often referred to as an e-payment, entails the transfer of money from one account to another while utilising a digital device for each party, such as a computer, smart phone, credit, debit, or prepaid card.

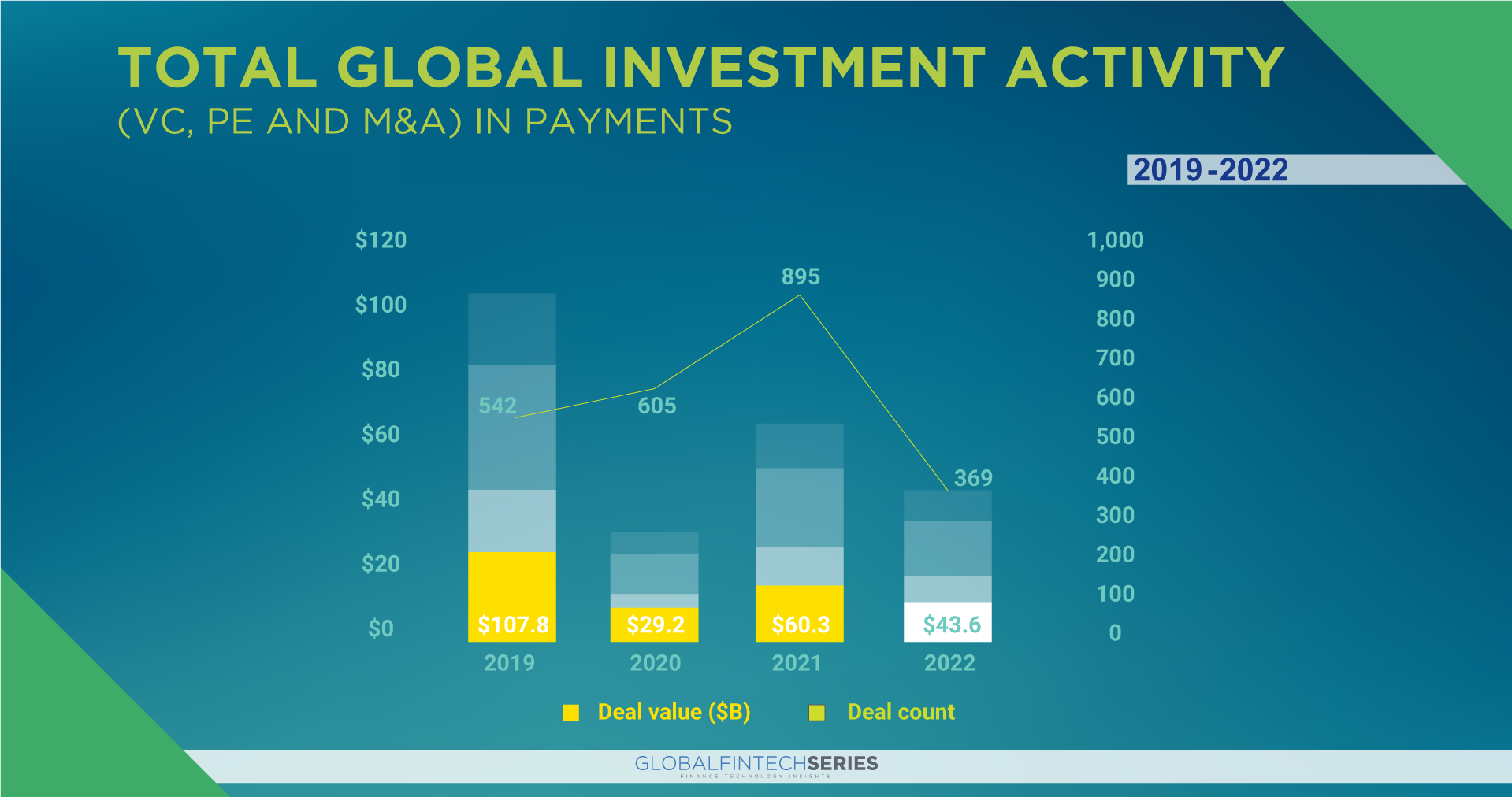

In comparison to 2021, when investments totaled $60.3 billion, they increased to $43.6 billion in 2022. the purchase of an Australian-based After Block’s (previously Square’s) $27.9 billion acquisition, which was also the largest fintech deal ever, came Thomas Bravo’s PE firm’s $2.6 billion purchase of Bottomline Technologies and Checkout.com’s $1 billion venture capital fundraising.

Read: What Is Machine Learning?

Banking as a Service is a second important FinTech market (BaaS)

The term “banking-as-a-service” refers to non-traditional businesses (often Fintechs) offering banking services and products digitally through third-party distributors. The size of the worldwide BaaS market was estimated at $2.41 billion in 2020 and is anticipated to increase by 17.1% annually to reach $11.34 billion by 2030. With APIs that connect banks and outside parties, banking as a service enables third-party organizations to use existing financial services. These APIs enable non-financial businesses, programmers, developers, and fintech organizations to utilize certain banking services.

Additionally, it extends its presence to non-banking businesses who want to offer their customers banking offices combined with their product offers. It creates a single platform to enable a quicker and easier access point for financial services. For instance, the checkout page of an e-commerce website will offer instant lending services in addition to a variety of payment choices, such as BNPL. To innovate financial services, banks are working with fintech firms, and BaaS will support the ecosystem of a general finance product. In this approach, the development of BaaS and its associated products and services plays a significant role in the future of Fintech. It has been greatly impacted by the advent of the mobile-first and digital transformation concepts.

Recommended: Demystifying AR/VR Technology In Healthcare Domain

Insurtech is the third important FinTech sector.

The term “Insurtech,” which combines the words “Insurance” and “Technology,” refers to the intersection of the insurance industry, disruptive innovation methods, and digitization. The recent usage of cutting-edge methodologies like AI, ML, or big data in the insurance industry, as well as the emergence of startups, focused on providing this type of solution to develop disruptive insurance products that offered the overall concept an advantage. A few benefits are as follows:

lowering the cost of recruiting and onboarding new customers.

the potential for borderless global economic expansion.

Improve user experience while automating customer acquisition.

provides a variety of methods, contracts, and goods remotely and online.

enhancing fraud detection and security measures.

maintaining the strictest standards for both technological and legal security while bringing on new clients both offline and online.

Players in this industry include Damco Group, DXC Technology Company, Quantemplate, Acko, Digit, and Easy Policy. These companies are expanding as the insurance market heats up due to an increase in insurance policyholders, though this industry did experience some slowdown during the global financial crisis.

Innovative technologies are utilized by insurtech companies to create customer-focused insurance services and solutions, such as insurance comparison websites, employee group insurance plans, and digital insurance. Offering insurance infrastructure API, underwriting services, claims administration, customizing insurance products, and services pertaining to policy management systems can enable these services.

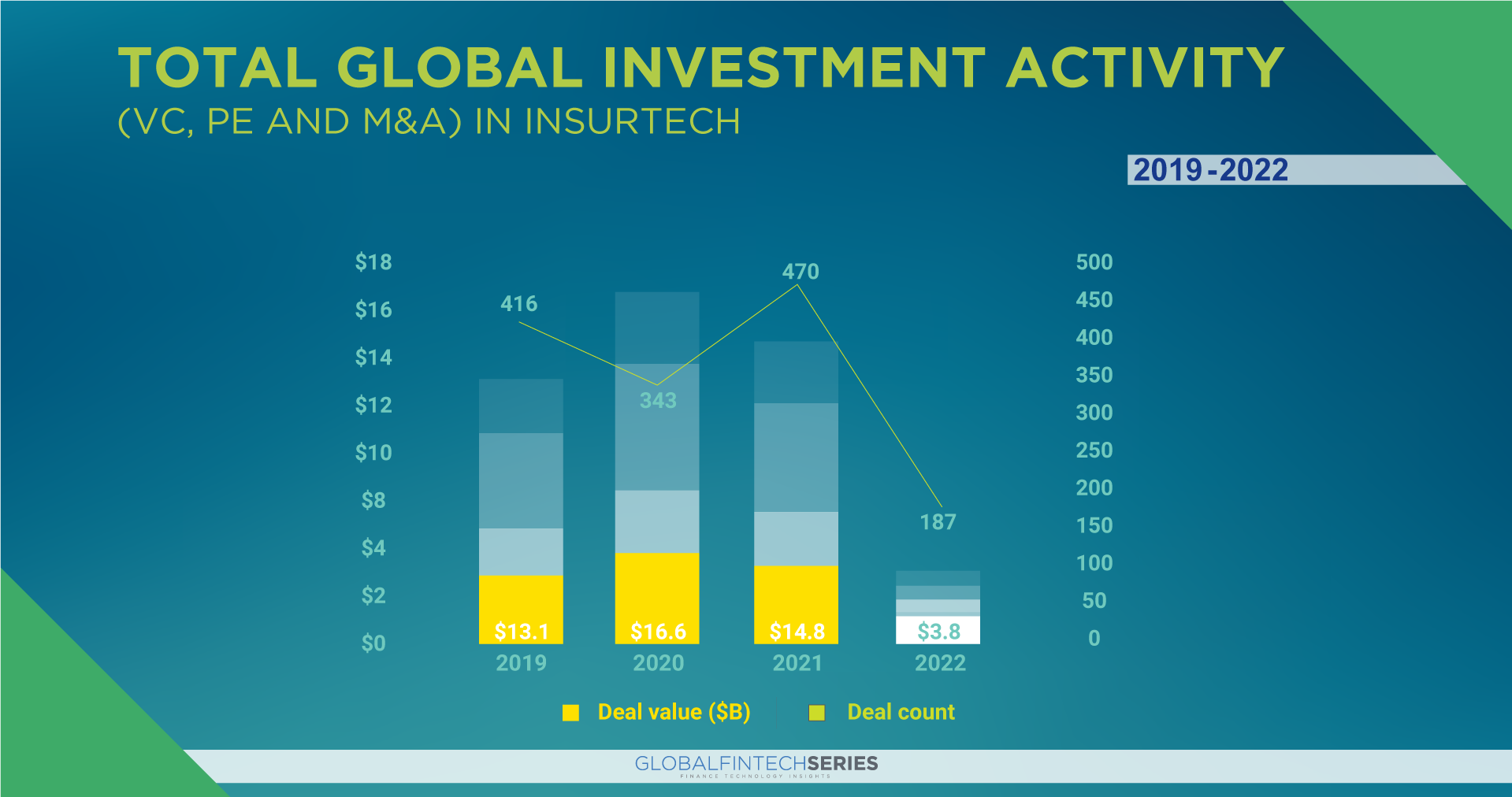

The amount of investment in the insurtech sector fell noticeably, from $14.8 billion in 2021 to $3.8 billion globally in 2022. The acquisition of US-based Zenefits by TriNet for $220 million was the largest insurance technology deal of the year. Following this were many venture capital investments for $100 million or more, including raises of $211 million and $200 million from Healthcare.com and New Front Insurance, both in the US, and a $196 million raise from Alan, a company based in France. The majority of insurtech in the world was by far concentrated in the Americas and Europe.

The amount of investment in the insurtech sector fell noticeably, from $14.8 billion in 2021 to $3.8 billion globally in 2022. The acquisition of US-based Zenefits by TriNet for $220 million was the largest insurance technology deal of the year. Following this were many venture capital investments for $100 million or more, including raises of $211 million and $200 million from Healthcare.com and New Front Insurance, both in the US, and a $196 million raise from Alan, a company based in France. The majority of insurtech in the world was by far concentrated in the Americas and Europe.

Fourth Key FinTech Segment-Regtech

RegTech as a Service (RaaS) encourages financial institutions (FIs) to view regtech as a tool to enhance operational efficiency and regulatory compliance. a subgroup of fintech that focuses on developments that could deliver administrative requirements more effectively and realistically than current capabilities. Regulatory innovation companies employ innovation to make clients’ compliance easier, ensuring less opposition and streamlined client onboarding procedures. RegTech companies provide services like KYC and ID check, charge consistency, computerized onboarding, AML consistency, misrepresentation discovery tools, and risk the executive’s devices and programming that share an awareness of the administrative requirements and help them easily comply with those requirements. By providing several consistency-related administrations, ClearTax, EaseMyGST, and Khata Book are leading the RegTech space.

ACTICO GmbH, Broad-ridge Financial Solutions, Inc., Deloitte Touche Tohmatsu Limited, Jumio, MetricStream Inc., NICE, PwC, and Thomson Reuters are important players in the global regtech market.

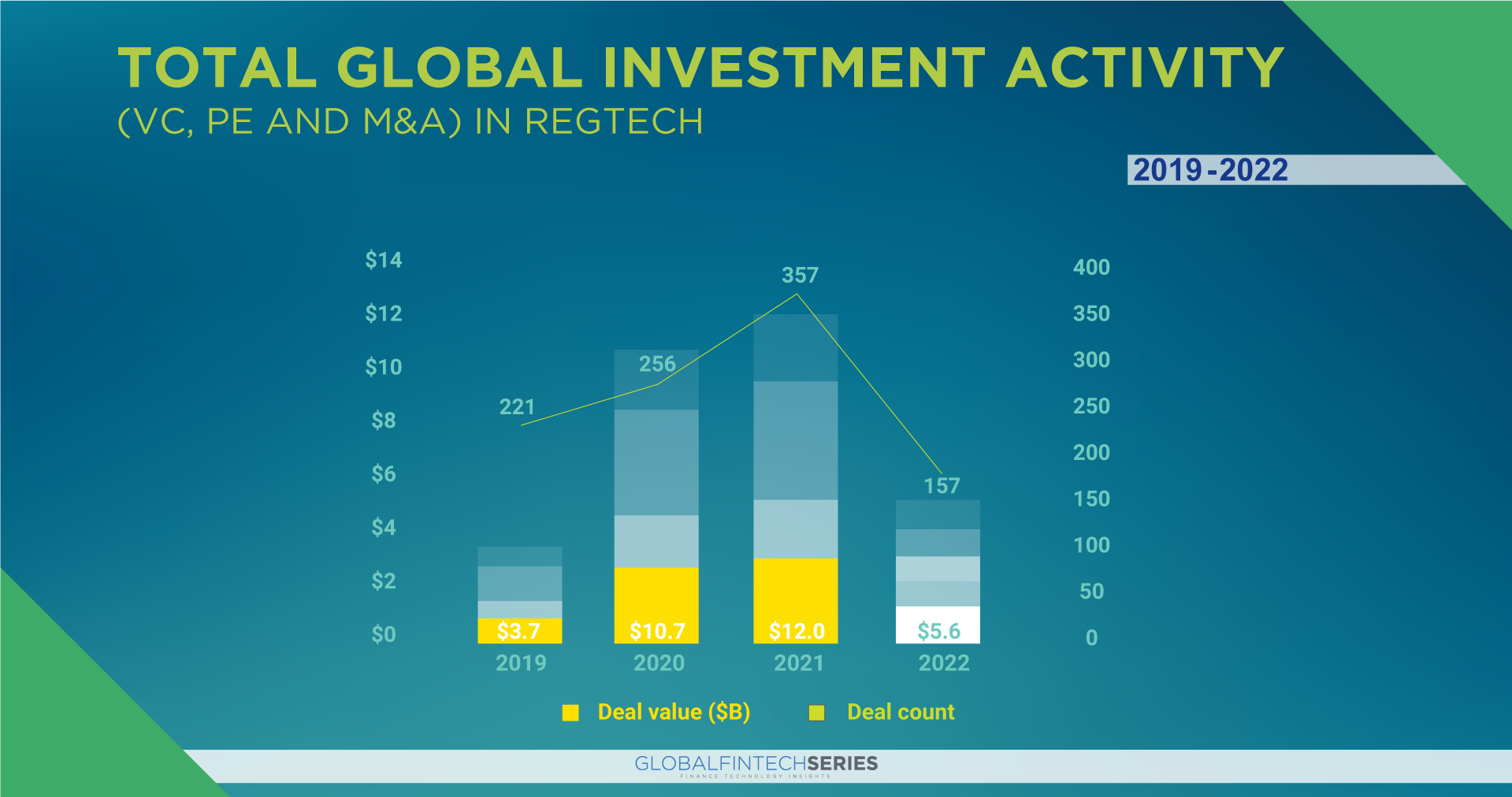

Regtech businesses attracted $5.6 billion in investment worldwide. The majority of investments in the regtech sector were made in the US, including the $240 million purchase of FourQ by cloud-based financial operations company Blackline and the $2.6 billion takeover of Bottomline Technologies by Thomas Bravo.

Cybersecurity is the fifth important FinTech segment.

Internet security isn’t just about managing risk; it’s also a crucial factor in shaping product capacity, hierarchical viability, and CRM. Although advancement has always been a never-ending race in cybersecurity, it is now happening more quickly. In order to retain their organizations, businesses continue to invest in innovation. In order to support remote work, improve the client experience, and foster respect, they are currently adding more frameworks to their IT organizations, which could lead to new risks. Four significant fundraisers in the US, including $550 million by Fireblocks, $170 million by Chainalysis, and $100 million by TokenEx and Cowbell Cyber, maintained the principal areas of strength in the cybersecurity sector. Veriff, based in Estonia, raised $100 million as well in 2022. Google’s $5.2 billion acquisition of incident response startup Mandiant in March 2022 demonstrated the enormous importance that hyper-scale providers are giving to cybersecurity platform and automation solutions. When complete, the arrangement would shatter global records.

Wealth technology is the sixth key FinTech segment (WaaS)

White-label, embedded wealth, digital brokers, Robo retirement, and digital portfolio management One of the most well-known segments of WealthTech businesses is robo advisers.

Globally, the VC funding rounds of US-based Titan ($100 million) and UK-based MoneyFarm ($59.8 million) helped abundant tech bring in $443 million in 2022. Financial supporters now view open doors with a more fundamental perspective due to the wealthtech sector’s growing development. They are currently focusing less on making broad bets throughout the industry and more on funding niche experts with Unique business models that are viewed as being more significant, robust, and financially viable than their competitors. Model, Blockchain.com announced the acquisition of the Singapore-based exchanging firm Independence, and advanced resource stage Golden Gathering announced the acquisition of the Hong Kong (SAR), China-based resource the board company Celera Markets. developed crossover abundance warning models that focused specifically on giving innovation stages.

Read: 5 Unconventional Ways To Make Money On Crypto In 2023

Seventh Key FinTech Segment- Blockchain/Cryptocurrency

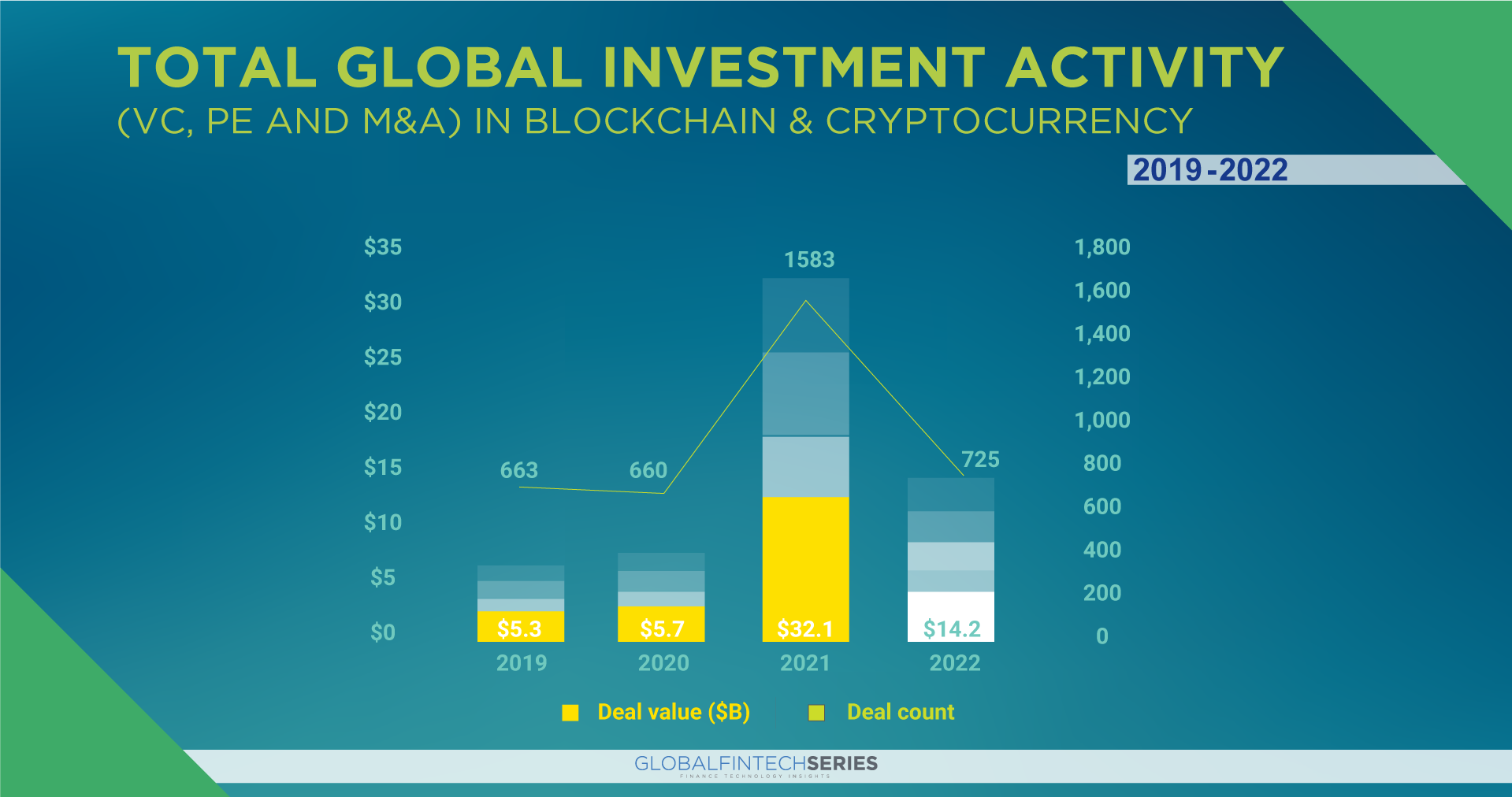

Blockchain technology is a distributed, decentralized ledger that stores a record of who is responsible for what resources. The blockchain technology is a true disruptor for industries including payments, cybersecurity, and healthcare because any data stored there cannot be modified. Learn more about it, its applications, and its past. Crypto and blockchain investment decreases from its peak in 2021 but continues to outpace all other years. Global investment in cryptocurrencies and blockchain declined to $14.2 billion in 2022 after a record-breaking 2021. Notwithstanding the unexpected conflict between Russia and Ukraine, global growth, and the challenges faced by the Terra crypto ecosystem, investment at the halfway point of the year remained strong over the years leading up to 2021. This includes the evolving nature of the area and the variety of technologies and systems luring the venture.

The Key Line

On a worldwide platform with its equivalents, each section autonomously contributes to the Fintech Verse. Tech-savvy legacy banks who develop their own BaaS Market platforms will not only gain an advantage over their competitors financially, but will also unlock new sources of income by modifying their platforms. PayTechs, LendTechs, and WealthTechs, which are closely related to BaaS, will predominately drive the global Fintech landscape. Thus, Banking-as-a-Administration and the upcoming digital banking ecosystem enablers will be Fintech’s ultimate demise.

Read: Did You Know- 14 Bitcoin Facts

[To share your insights with us, please write to sghosh@martechseries.com]