Decentralized finance, or DeFi, is a financial terminology for blockchains that uses emerging technology to remove third parties and centralized institutions from financial transactions. The components of DeFi are stablecoins, software, and hardware that enables the development of applications and digital alternatives.

Finance’s New Wave: Decentralized

DeFi challenges this centralized financial system by impairing brokers and gatekeepers and engaging regular individuals through distributed exchanges.DeFi takes the vital components of the work done by banks, trades, and safety net providers today like lending, borrowing, and trading and places it in the possession of regular people.” DeFi (or “decentralized finance”) is an umbrella term for financial service on open blockchains, fundamentally Ethereum. With DeFi, you can do the majority of the things that banks support i.e. earn interest, borrow, lend, buy insurance, trade derivatives, trade assets, and more, and that’s just the beginning; however it’s quicker and doesn’t need desk work or a third party.

As with crypto, for the most part, DeFi is worldwide, distributed (meaning straightforwardly between two individuals, not directed through a unified framework), pseudonymous, and open to all. This is the way that could work out. Today, you could place your reserve funds in a web-based investment account and procure a 0.50% loan cost on your cash. The bank then, at that point, pivots and loans that cash to one more client at a 3% premium and pockets the 2.5% benefit. With DeFi, individuals loan their investment funds straightforwardly to other people, removing that 2.5% benefit misfortune and acquire the full 3% profit from their cash.

DeFi Market Statistics

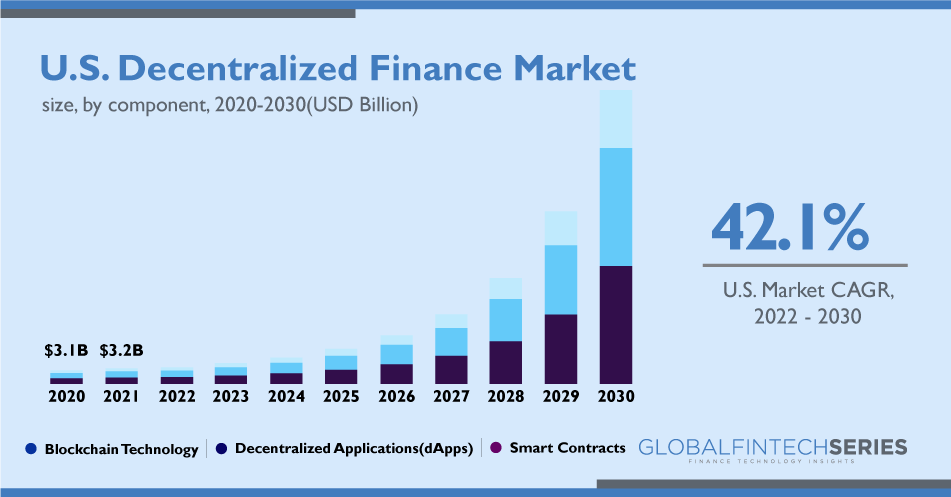

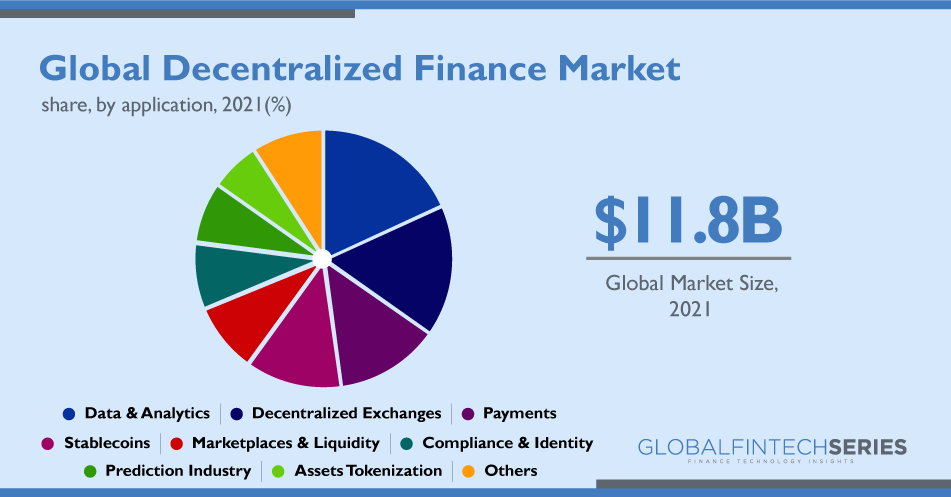

The worldwide decentralized finance market size was esteemed at USD 11.78 billion out of 2021 and is supposed to extend at a build yearly development rate (CAGR) of 42.5% from 2022 to 2030. The acknowledgment of DeFi (Decentralized Money) prompted a significant change in the financial arena, which is one of the essential elements driving market development. The connections of DeFi and decentralized stages on the blockchain have acquired prominence throughout the course of recent years. The reception has expanded because of DeFi’s capacity to dispose of the mediators in the financial processes. In addition, the use of DeFi in the protection business has been the most significant as the ordinary framework suffers from complex procedures, paperwork, and audit systems.

The data & analytics fragment ruled the worldwide business in 2021 and represented the greatest portion of over 18.0% of the overall revenue. DeFi conventions offer huge advantages for decision-making and data analysis. Attributable to DeFi conventions’ transparency in information and organization action, DeFi conventions help in risk the board and produce business open doors. With the assistance of the abilities presented by DeFi stages, clients can analyze yield and liquidity and assess stage takes a chance with utilizing different dashboards and devices.

How DeFi Is Used Today

DeFI is advancing into a wide assortment of basic and complex monetary exchanges. It’s controlled by decentralized applications called “dapps,” or different projects called “conventions.”

Read: Cybersecurity Timeline and Trends You Should Know before Planning for 2023

- Traditional financial transactions

- Decentralized exchanges (DEXs)

- E-wallets

- Stablecoins

- Yield harvesting

- Non-fungible tokens NFTs

- Flash loans

How To Participate In DeFi

If you’d like to learn more about DeFi in a hands-on way, here are a few ways to get started:

Sign For A Crypto Wallet

Despite the slump, DeFi wallets achieved 4.3 million remarkable figure. Despite the fact that clients might have different wallets/addresses this information point fills in as a commendable heartbeat on the general strength of the DeFi environment.

Read: 5 Unconventional Ways To Make Money On Crypto In 2023

Trade Digital Assets

Increasing action and interest in the DeFi market is a confirmation that a large number of individuals are utilizing the Ethereum blockchain to construct and take part in another monetary framework that is fueled by code — one that sets new principles for financial access, opportunity, and trust.

Look For Potentiality

The key to any foray into a new financial space is to start slow, stay humble, and don’t get ahead of yourself. Keep in mind that digital assets traded in the cryptocurrency and DeFi worlds are fast-moving and there’s significant potential for loss.

Conclusion

DeFi fills in as the front end for the digital economy with dapps answerable for most of the on-chain exchanges and exercises. Their basic advancements engage members to take responsibility for funds and connect in extraordinary and phenomenal ways. As DeFi dapps become more interoperable and cooperative, ecosystems start to shape and draw by the thousand of clients and developers the same. Generally speaking, DeFi stays one of the quickest developing and advancing areas in the digital asset space.

Read: Did You Know- 14 Bitcoin Facts

[To share your insights with us, please write to sghosh@martechseries.com]