The Coronavirus pandemic was a phenomenal impetus for digital banking across the globe. With many branches briefly shut down and most physical interactions minimized, the retail bank consumers in the US had no real option except to embrace these self-service channels more than before. Almost every bank saw a spike in digital banking usage. The pandemic even pushed numerous clients to involve versatile banking interestingly, particularly in the more established companions.

The New Digital Banking Sphere

The responses to these questions are not quite as direct as they might appear. After the pandemic experience, clients appear to be looking not just for instant gratification, increased convenience, and flexibility, yet additionally for more custom-fitted services. Irrespective of the financial channel they use the branch, telephone, or mobile application one factor is always important for them which is the human touch. Although a portion of these verbose connections might get back to the branches for face-to-face collaborations. Branches are probably going to stay vital to banks’ general income development and reinforcing client connections. In any case, banks ought to exploit advanced financial energy by mixing computerized and human experiences.

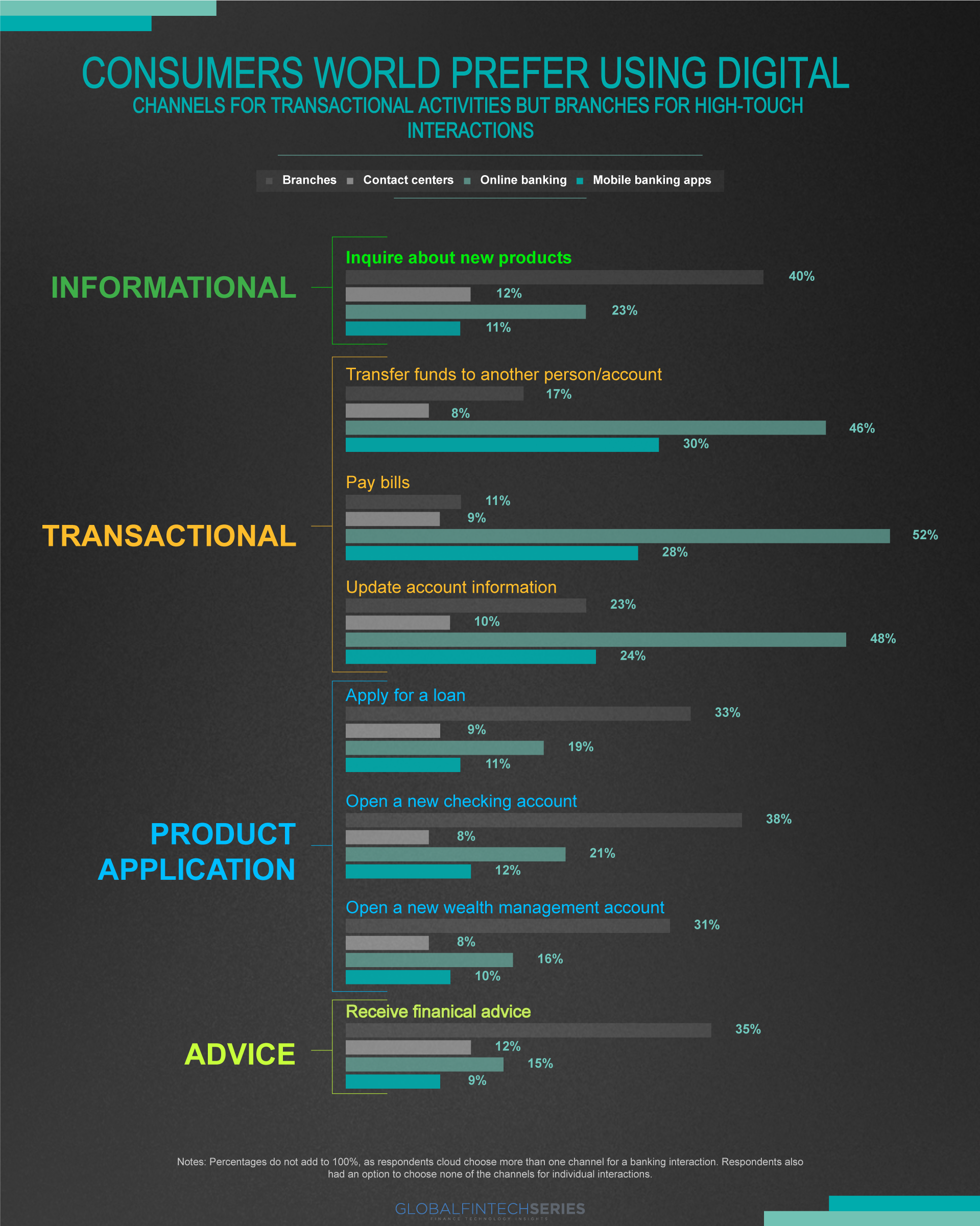

We can count on our fingers how advantageous it is with mobile banking like checking account status, paying bills, money transfers, or cash withdrawals from ATMs, etc. The new digital tools have also allowed user-friendly access to alternative financing options from banks, competitors, and big techs. The ultimate result is that stickiness with primary banks is at risk, especially among younger consumers. Below is an exhibit revealing statistical facts in the same direction.

What Is Mobile Banking?

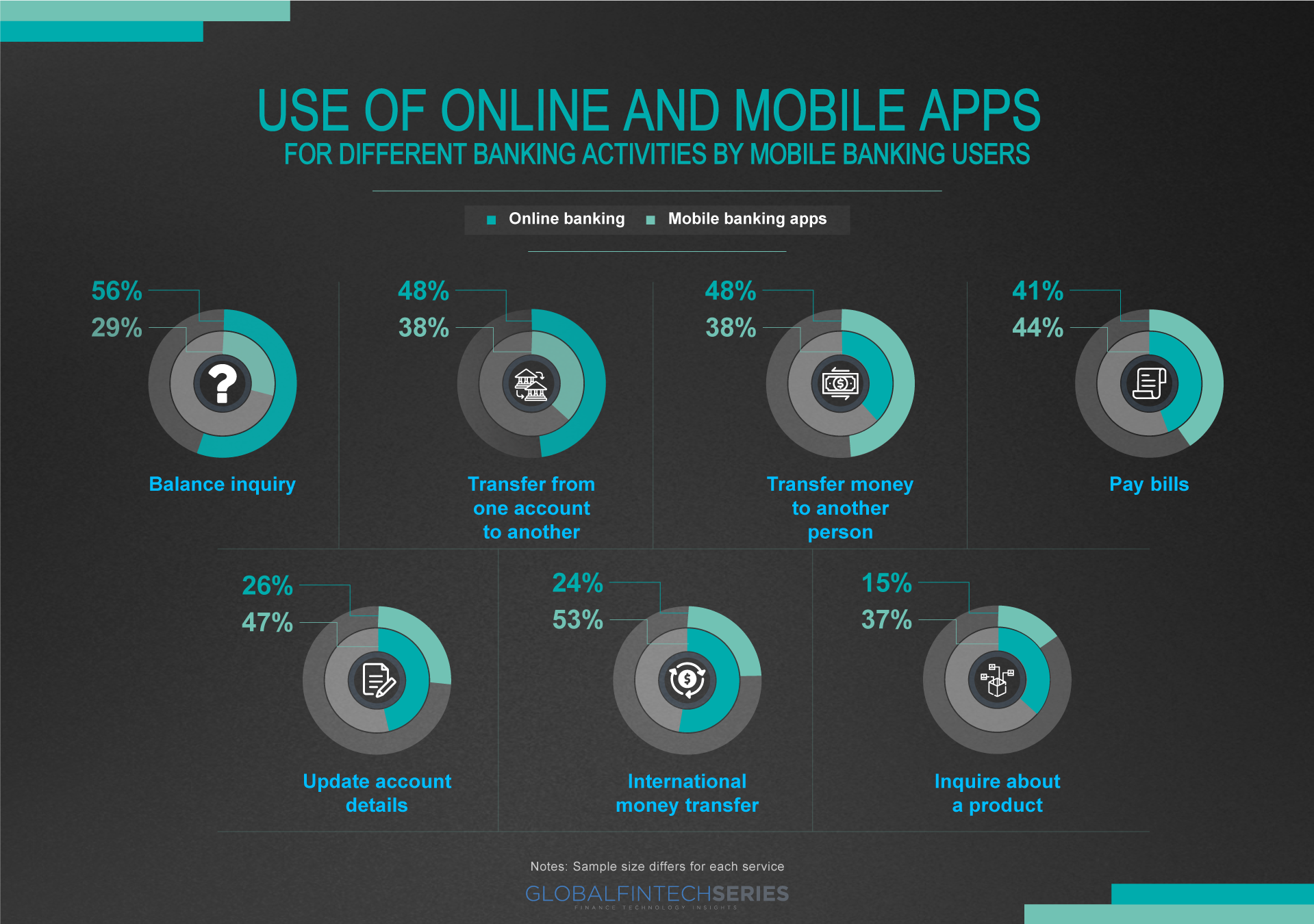

It is an application on smartphones that acts as a pocket bank and works without any waiting line. The bank app needs to be activated with signup with login id and password, nowadays with the help of biometrics, through face recognition also the customer can sign the app easily and hassle-free. It is a one-stop solution in the app that not only helps to access your statements, check your bounced cheques, or with the issuance of debit cards but also acts as a locator which can guide you to your nearest ATM. Over 79% of cell phone users have bank apps on their devices for web-based payments. As a general rule, there are more than 7 billion mobile banking clients around the world. The exhibit below portrays the usage of online apps for various banking activities by mobile banking users.

Read more: Robotics And Artificial Intelligence

What Can We Do With M- Banking?

# Account Information

-

Bank statements

-

SMS alerts of transactions activation/deactivation

-

Fixed deposits and recurring deposits activation/deactivation

-

loan details

-

Debit/credit card details and their activation/deactivation

-

Insurance details and its activation/deactivation

-

Investment in shares/mutual funds

#Transaction – Clients can make a transfer of their funds between self-operated accounts, and also make payments to any third-party bank account, or make a bill payment of utility, premium payments, and loan repayment using the mobile app. Also, the banking apps integrate online shopping for the customers laced with offers, cash backs, and rewards upon using these online services.

#Investments – The financial services provided by the banks like deposits, insurance, and equities from their m-banking interface embedded in the app.

#Loans – Banks also give access to loan management to their clients via M-Banking. Customers will be able to know the status of their loans, pay their EMIs, and even get small digital loans using app-based mobile services.

# Customer Support -An option in the m-banking for services like checkbook, debit & credit card, and loan applications are also provided. The clients can also check their ATM card and credit card reward points with a single click.

#Content services -Many banks serve their clients with many loyalty programs, web shopping discounts, offers, etc through m-banking.

#Consumer Complaints -Clients can drop-in complaints about any forgery or invalid transaction from their accounts at a single click through their smartphones or desktop.

Read: Let’s Understand Crypto In A Layman Language

Advantages Of M-Banking

-

Offers 24-hour accessibility to banking

-

Saves time

-

Provides a convenient way of making fund transfers and payments

-

Enables easy tracking and monitoring of bank accounts

-

Facilitates quick reporting of any illegal transaction or fraudulent activity

-

Allows swift redressal of consumer complaints

-

Increase request processing speed

-

Makes online shopping possible

-

Allows trouble-free management of investments

-

Sends notification of bill or loan payments

-

Encourages customers to stay indoors during a pandemic

-

Eliminates the need to carry cash all the time

-

Reduces chances of theft

Mobile Banking Disadvantages

-

M-application fraud-based transactions increased tremendously by over 600% since 2015 which is an alarming situation.

-

89% of digital fraud losses are based on account hacking by illegal Digi hackers.

-

One in every 20 fraud attack cases concerns an M-Banking.

-

On average, there are 82 new rogue applications daily submitted.

-

Mobile fraud losses reaches more than $40 million across 14,392 breaches in 2021 alone.

An AI-Enabled Future

Similar to the evolution of cloud platforms, banks should move a step further and think about the utilization of artificial intelligence. While there are demonstrated instances of powerful applications, many banks believe Artificial intelligence to be experimental. Banks should consider their AI and ML approach and put resources into an artificial intelligence execution venture for fruitful results. The developing reception of computer-based intelligence vows to lastingly affect the financial business. Although banks should in any case conquer huge functional and authoritative difficulties, they are taking extraordinary steps forward in execution and reception. To understand the full advantages of man-made intelligence, banks should finish what has been started today and keep on building the mechanical establishments and cycles important to push ahead into what’s in store.

Read: Cybersecurity Timeline and Trends You Should Know Before Planning for 2023