A bitcoin Wallet’s Definition

On a pragmatic level, a Bitcoin wallet is a program in which we can send and receive bitcoins. Few people sound nervous when they want to have their bitcoin wallet because they aren’t sure about what exactly it is and how it works. This content shall be answering all questions for any first-time investor in the virtual domain. However, to our surprise a Bitcoin wallet does not store bitcoins within it, then, how can this work? A bitcoin wallet is just a medium functioning by a decentralized network via which we can trade in bitcoins to store it or to buy something.

How Does A Bitcoin Wallet Work?

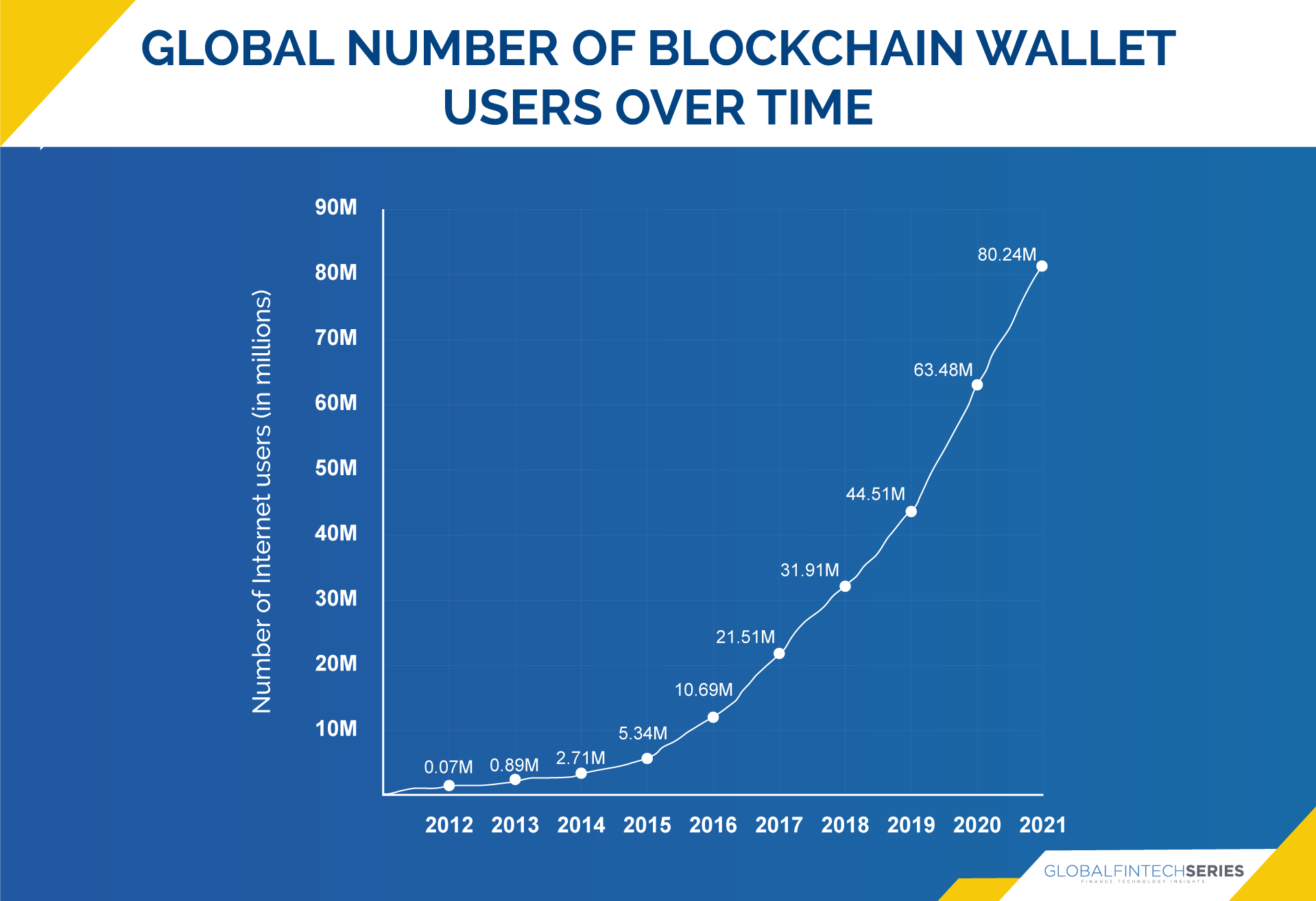

It works on a secure and safe digital ledger (DLT) called blockchain, using a Bitcoin wallet isn’t as simple as opening a leather flap. For that reason, it may be helpful to think of a Bitcoin wallet like email, says Sarah Shtylman, fintech and blockchain counsel with Perkins Coie. To send an email, you must use your password to log into your account, input user details, and then press the send button. To send Bitcoin, one also needs the coded key, the set password, to access the cryptocurrency wallet. Then the Bitcoin wallet address, similar to an email address, to send the cryptocurrency to them must be entered.“On the Bitcoin network, the public address is an identifier that points to a particular ledger entry (i.e., a Bitcoin balance) on the blockchain, and the private key is what enables its holder to edit the ledger entry (i.e., to transfer the Bitcoin to another user),” says Shtylman. You must keep track of your Bitcoin wallet’s key. If someone else has it, they can hack your wallet and steal all coins virtually. And, in I event of key loss, the user will be unable. to access his digital wallet. That’s because many cryptocurrency wallets are decentralized and secured cryptographically, in the event of the user cannot reset the password. Approximately 20% of circulated Bitcoins, worth billions of dollars, are lost in digital wallets that users are unable to access. Below is a chart reflecting the increasing number of bitcoin wallet users globally in past 10 years of time frame.

Types Of Bitcoin Wallets

Types Of Bitcoin Wallets

-

Mobile – These run on mobile phones like Mobile wallets. Examples could be WazirX multi-cryptocurrency wallet and Exodus bitcoin wallet. However, the risk of a wallet getting hacked is always there.

-

Web – Web-based wallets are used to store virtual coins via a third party, like Guarda Bitcoin Wallet. The user can easily access their account which is associated with crypto exchanges that allow them to trade and store crypto in a single virtual wallet. However, the risk of a wallet getting hacked is always there.

-

Desktop – Desktop wallets, like Exodus and Guarda, are software you can download onto a computer to store coins on your hard drive. This makes the security layer more versatile as compared to the web and mobile apps because there is an absence of third-party services to store coins.

-

Hardware – Like a USB drive, hardware wallets are physical devices, that are not connected to the web. These include Trezor Model T Bitcoin Wallet and Ledger Nano X Bitcoin Wallet to make transactions. This is a very secure device but also risky and the wallet might become inaccessible if the key is lost. Hardware-based crypto wallets are also known as cold storage or cold wallets.

-

Paper Wallets – A QR code, is printed on a paper document that needs to be kept safely by the user but in this case, it’s also impossible for a hacker to access and steal the password online.

What to Think About While Choosing a Bitcoin Wallet?

Read more: Robotics And Artificial Intelligence

1. Think About How You Plan on Using Crypto -For a frequent trader who constantly needs to buy and sell will need a hot wallet while someone who is looking for a long-term holding of coins will require a cold storage wallet. The applicable withdrawal fees need also to be paid.

2. Research a Wallet’s Reputation -One must do basic research like reading online reviews about the user experience, extra features of the wallet, and, the prime most, security and safety. Pay attention if a wallet has any time been hacked so that one can avoid those that have faced serious breaches in the past.

3. Research Wallet Backup Options – Few wallets also provide the facility of giving a backup option depending on the user’s usage and needs.

4. Pay Attention to Key Management – The aspects that determine who is in charge of keeping private keys vary across all wallets, and this has significant ramifications. In a select few wallets, the management of the wallet keys serves as the wallet’s service provider, meaning that in the event that the user loses the wallet key and password, they can be recovered through the management. However, some wallets depend entirely on users. Focus on service providers who keep a backup of your keys if you’re worried about losing the key to your virtual wallet. Yet, if the decentralized nature of cryptocurrencies appeals to you, you can choose a wallet where you have full control over your key—and, consequently, your money.

Read: Cybersecurity Timeline and Trends You Should Know beBeforelanning for 2023

[To share your insights with us, please write to sghosh@martechseries.com]