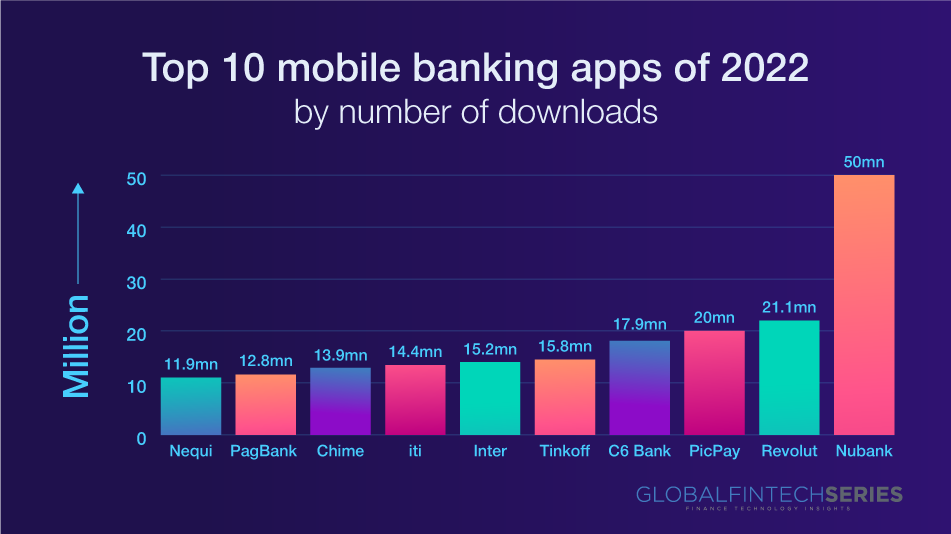

If money doesn’t grow on trees, then why do banks have branches? In this article, we shall be giving you a snapshot of the top 10 mobile banking applications which got viral in 2022 with their number of downloads on users smartphones or tablets. Try your hands on these apps to get a fair idea of the reason for their success in 2022. What changed and why with them we shall be in a better position to judge 2024 for the current year. Come, let’s have a look at the graphical presentation below depicting the top 10 banks mobile apps in accordance with the number of downloads in million.

1. Nubank (Brazil) Downloads: 50 million

In less than a decade since its founding in 2013, Nubank has established itself as the undisputed king, the seventh most downloaded finance app in the world, competing with PayPal and Alipay. Personal loans, credit cards, and a free digital account are its best features. Nubank, with more than fifty million downloads in 2022, will undoubtedly be the most frequently downloaded banking-related application. It has twice as many downloads as the second-placed banking app, namely Revolut.

Read the latest article: 10 Best Applications Of AI In Banking

2.Revolut (UK) Downloads: 21.1 million

The 2015-founded banking behemoth of European fintechs is frequently referred to as a “super-app.” It is deserving of its position on this list, with more than 21 million downloads in the past year. Instant payments, crypto trading, global transfers, virtual cards, and cashback on some of their favorite brands are a few of the features that can be discovered.

3. PicPay (Brazil) Downloads: 20mn

PicPay is a modest and reputable app that flies under the radar despite being one of only three apps on the list to reach 20 million downloads in 12 months. PicPay is a fully-digital banking app. With their free digital account, customers can easily send and receive funds, pay bills, earn cashback on purchases, reload their phone or transit card, and purchase credits for digital services such as Uber.

4. C6 Bank (Brazil)

Downloads: 17.9mn

C6 Bank was founded in 2018, and by 2022, this app had been downloaded nearly 18 million times. It offers customizable credit/debit cards, money transfers, investments, multi-currency accounts, insurance, and even dental plans.

5. Tinkoff (Russia)

Downloads: 15.8mn

Tinkoff, a Russian digital bank founded in 2006, combines familiar banking features such as savings accounts and transfers, utility bills, traffic fines, and toll road fees. Users can also withdraw cash from ATMs using QR codes and scan receipts with their smartphones. In the past year, this app was downloaded 15 million times.

6. Inter (Brazil)

Downloads: 15.2mn

Inter describes itself as “substantially more than a digital bank,” which poses an existential problem for this list; nevertheless, we’ve decided to include it! The well-known super-application combines various cost-free computerised features. It provides virtual credit and debit cards, individual advances and finance credit, a venture stage, fee-free transfers, insurance, and a free kids’ account that enables parents to teach their children important life skills such as saving and budgeting.

7. iti (Brazil)

Downloads: 14.4m

The Brazilian digital bank iti was created by the incumbent financial conglomerate Ita Unibanco, which was formed in 2008 by the merger of the country’s two largest banks. One of its best features is the moderately low age requirement: teens as young as 14 can pursue iti, involving them in financial education from the start. The application also offers Visas, savings goals, credits, and free currency exchanges.

8. Chime (US) Downloads: 13.9mn

Chris Britt and Ryan founded the digital bank Chime in 2013, making it the only U.S. company on our list. Similar to other applications, it initially struggled to build a user base: it took Chime five years to acquire its first million customers, but only another year to reach four million. Today, it provides clients with enticing features such as an overdraft limit of $200, peer-to-peer transfers, and access to coordinated stores two days earlier.

9. PagBank (Brazil) Downloads: 12.8mn

PagBank, from payment company PagSeguro, has become one of Brazil’s most popular banking apps. It describes itself as “the complete bank” and provides free digital accounts. In fact, nearly 13 million users downloaded PagBank in the past year, a remarkable achievement in the banking industry. PagBank, one of six Brazilian apps in our top 10, provides all the features you would expect from a bank, such as money transfers, credit and debit cards, mobile top-ups, insurance, and investments.

10. Nequi (Colombia) Downloads: 11.9mn

The race for tenth place was close, with only 50,000 downloads separating Colombian digital bank Nequi and its closest competitor. Nequi exemplifies a common occurrence in the South American financial sector: incumbent financial institutions launching brand-new, computerised brands. This contribution from Bancolombia was established in 2016 but has quickly risen to prominence, accumulating over 11 million downloads in recent months alone.

Read: The New Digital Mobile Banking Sphere