Integrated Payments: What are they?

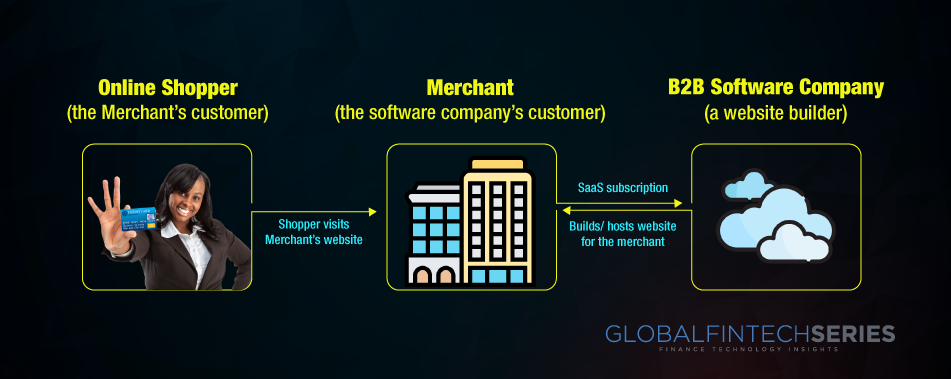

At its core, integrated payments combine two business models—software plus payments—in a way that is both straightforward and effective. The majority of the time, a B2B software provider already charges a client for a software subscription. Assume that the client is a retailer or other type of business that creates an online storefront utilizing a platform of software (like Wix or Shopify). Assume that the client is a retailer or other type of business that creates an online storefront utilizing a platform of software (like Wix or Shopify).

Integrated Payments are one of the industry’s best-kept secrets.

Revenue Model #1: SaaS subscription

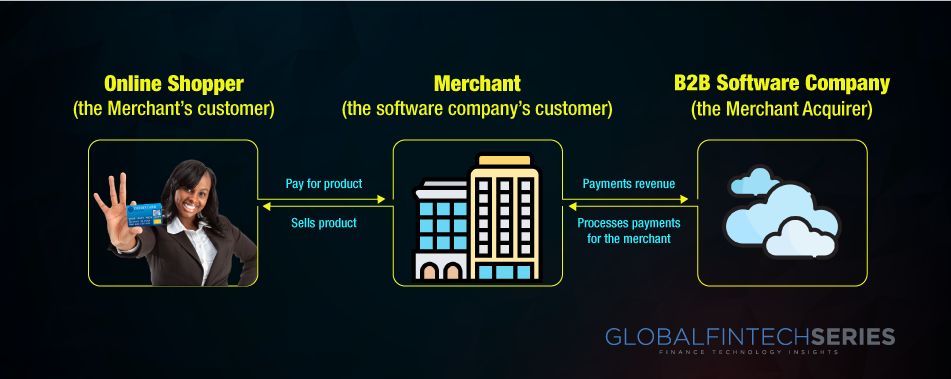

Most of the time, a third party acts as both the merchant acquirer and the payment gateway (e.g., Braintree). However, in the case of Integrated Payments, the software provider takes on the role of the Merchant Acquirer in order to earn the Acquiring Mark-up (if helpful, see my previous post on how payments companies make money), which is typically a percentage (for example, 1% of the payment volume).

Revenue Model #2: payments revenue

Notable examples of Integrated Payments companies:

There are a few (quite noteworthy) examples of integrated payments firms in the public markets, despite the fact that they are rarely branded as such. While some organizations, like Wix, Lightspeed, and Realpage, still have a lot of space to expand their payment operations, others, like Square and Shopify, already have large payment revenue streams. Like me, perhaps you were unaware that payments now account for the majority of Shopify’s income. The company’s total growth is primarily driven by payments, which have been a significant portion of the business.

Latest Read: One Of The Industry’s Best Kept Secrets: Expense Management By CFO’s

Integrated Payments: Why They Matter

-

More ARPU (or average revenue per user).

Fundamentally, the Integrated Payments model enables the B2B software business to profit from the sales of its clients (i.e., the merchant). Consider Shopify as an illustration of how this might be applicable. With over 1 million retailers using the Shopify platform and paying an average monthly membership of $29 to $299, the company earned $642 million in revenue (in 2019) from its software subscription business alone. Although $642 million is not a tiny figure, it pales in comparison to the $61 billion in income that Shopify’s clients, or the merchants, made from sales to their end customers. For every $100 in sales that its clients (i.e., the merchants) produce, Shopify may make $1 in payments income. By implementing an Integrated Payments model, Shopify is able to capitalize on the success and scale of its customers. In practice, Shopify is able to create a higher ARPU (or average revenue per user) from its more prominent clients that produce more sales, considerably in excess of the sticker price of the SaaS subscription.

-

An increase in customer retention

Another important advantage of the Integrated Payments model is that it integrates software and payment services, making it more difficult for clients to transfer suppliers.

As a cross-sell strategy, bundling Shopify Payments with the core Shopify e-Commerce platform should help to increase switching costs and, as a result, enhance customer retention. -

Growth is more rapid when ARPU and retention are higher.

With this cohort revenue chart from the company’s annual report, Shopify illustrates (without saying it explicitly) the idea that raising ARPU and bettering customer retention together boost net dollar retention.

Why (and how) SaaS businesses have transitioned into payments enterprises

Only the business end can opt whether it should switch to SaaS payment or not. It’s quickly come to be regarded as one of the most major questions facing businesses today. Particularly, more and more businesses are reassessing whether to purchase on-premise software or switch to the SaaS model (Software-as-a-Service). This is especially true for businesses that offer a variety of services to customers, where adaptability and creativity are crucial. On the other hand, when deciding whether to use SaaS billing or not, global revenue statistics are a key factor. Companies should keep in mind a number of other material and immaterial criteria when making a software acquisition choice.

Businesses using a payment process that only supports monthly pricing models won’t be successful in the long run since they are unable to handle usage-driven and consumption-based invoicing. SaaS payment can be useful here. Regardless of location, it can efficiently track the ongoing changes to subscriptions and the total amount charged on each invoice. Companies gain a better knowledge of consumer trends and how to compete in this way. We’ll now go over some of the main points for why companies should migrate to the cloud and think about switching to SaaS payments.

Latest Read: A Closer Look At Integrated Document Management And Accounts Payable Software

Expect to see more businesses offering integrated payments.

- As if starting a software firm wasn’t difficult enough, developing the payments tech platform requires a large amount of upfront effort, money, and R&D.

- There are obstacles to overcome in the form of regulations, which can vary from state to state.

- Then there are the continual initiatives for KYC, AML, fraud protection, and chargebacks, among other regular difficulties.

- Not to mention that it will probably take at least a year to complete the build-out, which will use up a lot of your engineering talent and may divert you from your main goal of producing high-quality software.

Conclusion

A software company could only recently start its own, brand-new payments company in order to use the Integrated Payment model. It is really difficult to start your own payments business. Starting a payments company has significant up-front costs, and the ongoing operations can be challenging.