How has the CFO’s position changed?

Traditionally, the focus of a CFO in an organization was on accounting, planning, budgeting, and cash flow. CFOs were primarily responsible for managing the organization’s core operations. They participated in negotiations with the banking industry to get the funds and resources required to ensure working capital for the ongoing business. They would assist in recommending the appropriate borrowing solutions in the event of any Capex decisions.

Nonetheless, a lot has changed over time. Over the past two decades, the CFOs have been responsible for managing the company’s core financial and accounting functions in addition to consulting with the CEO and the Board on matters of strategic importance, acting as a catalyst for change among their peers, including the head of human resources, chief procurement officer, chief marketing officer, and chief technology officer. The CFO is now involved in digital projects and automation that use robotics and machine learning to drive more efficient processes.

The following are some of the roles that report to the Modern CFO, according to a recent study that was released by a reputable analyst firm based on a survey they did with the CFO community.

- Corporate Policy

- Risk and Treasury Management

- Organizational Risk Management

- Internal Audit Acquisitions & Mergers (both Strategy and Execution)

- Regulatory Conformity

- Technology Information

- Electronic Transformation (Including decisions around RPA, Machine Learning etc.)

- Board participation

- Cyber Security

- Business physical security

- Investor Relationship

- Environment Social and Governance (ESG)

The information above may seem daunting because a Super Human is required to engage in all of the aforementioned topics successfully and efficiently. Do More with Less is today’s catchphrase, making this all the more important. The luxury of assembling huge teams with the requisite knowledge to coordinate the sheer volume of topics is not an option.

Latest Read: A Closer Look At Integrated Document Management And Accounts Payable Software

World of VUCA (Volatility, Uncertainty, Complexity, and Ambiguity)

In order to ensure the Company and the many functions within it achieve the desired goals, operating in a VUCA world provides a significantly larger difficulty. This doesn’t need to be emphasized because the effects of the current epidemic on the global economy and the financial health of businesses were felt by all of us. The VUCA world in which we live has been discussed and written about extensively.

- Business flexibility and adaptation

- Real-time information

- accelerated decision-making

- a flexible automation platform that supports dynamic business models and workflows

- Comparing established businesses to startups

Elements affecting the CFO’s expectations might be

- Board’s Mission and Vision

- Activities of the Company: Its Nature and Scale

- length of time in operation (i.e. Is it a Start-up)

- Revenue The number of employees, operations, and geographic presence.

What are some of the alternatives?

- Entail outsourcing the whole CFO role.

- Hire a CFO under a time-limited contract.

- Some of the CFO’s duties should be outsourced.

- The responsibilities associated with the operational and stewardship functions may be covered by this.

- Specialized fields such as international taxation and cyber governance, etc.

- Outsourcing particular responsibilities including M&A execution, capital and debt restructuring, regulatory implications and effect assessments, tax planning, and pre-IPO activity.

- There are a few possibilities when deciding whether to outsource your business, including a reputable BPO, advisory firms, and more recently, a company or partnership founded by former CFOs themselves.

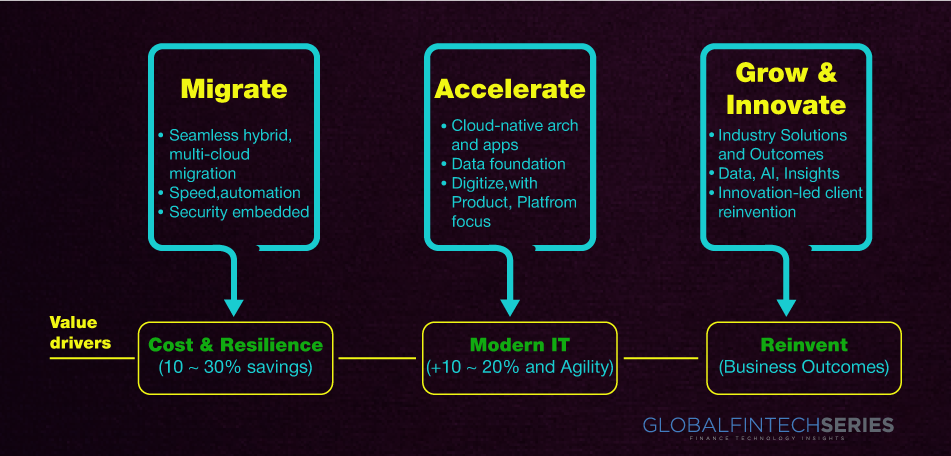

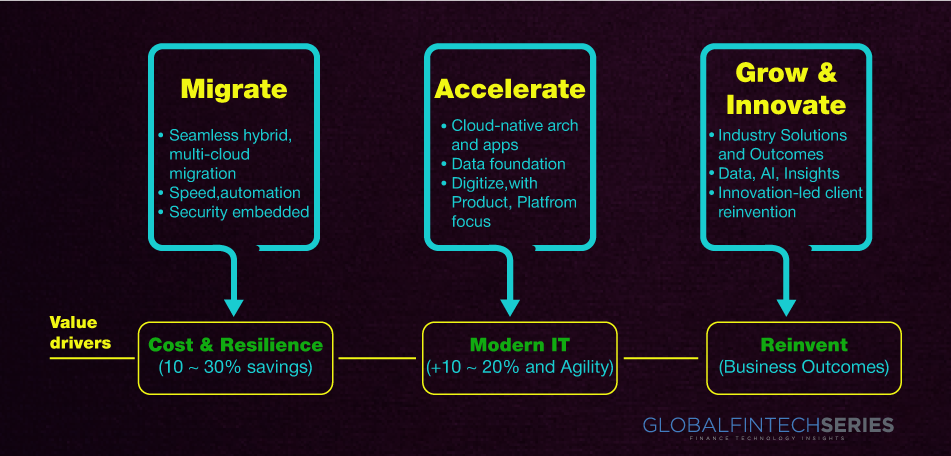

Cloud-based financial transformation

Professionals working for such companies have had corporate positions where they have participated in ERP implementation processes and/or been SAP end users. Many of the clients they serve use SAP to manage their business operations in these exciting times. Many of their clients are considering changing their IT infrastructure and moving to the cloud. From a financial standpoint, this is a crucial choice because it affects cash flows and how apps are used to support business activities. In very broad words, migrating an on-premises landscape to the cloud environment would entail shifting from CAPEX to OPEX in terms of cash flow.

Advantages and Drawbacks

Benefits

- Ability to recruit seasoned individuals for a set period of time or to fulfill any specific business requirement without being required to make a long-term commitment and rely on a particular skill set.

- Such businesses’ combined experience can be used to make the greatest decisions and provide the best results.

- The necessary criterion can be met by aligning the appropriate skill set.

- outside-in perspective: Use their expertise to implement the proper level of digital transformation to increase process effectiveness.

- Having such seasoned specialists as part of their project implementation services allows SAP Implementation Partners to offer value-added services.

- In other words, they can offer high-value company transformation services that will aid in transforming Finance & Accounting operations into digital ones.

Downsides

- Lack of knowledge of the client’s technology and application landscape, which delays effective performance during the services’ term

- Customers unable to cultivate and develop internal skills

- Due to the highly strategic nature of some specific tasks and efforts, protecting confidentiality might be difficult.

- Added costs associated with training clients served by these firms’ clients on the applications and technology

- Conflicts between the individuals assigned under such contracts and the stakeholders at their customers could arise, resulting in disagreements of opinion.

- In order to deliver end-to-end automated managed business process services, it will be fascinating to investigate how such service providers might collaborate with platform service providers and Implementation Partners.

- Exploring the potential of how such business models might function will be beneficial because it raises several interesting concerns, such as:

Conclusion

Customers may be able to take advantage of more of these value-added service models in the future if they can access not only the best technology but also the correct knowledge when it’s needed for the best results. Unless the VUCA world has more surprises in store, where being ready to move quickly and adaptably would be an essential surprise.

Latest Read: 10 Of The Best Stock Market Podcasts