So what is FinOps?

FinOps is all about getting the most possible value from each cloud dollar you spend. In order to ensure that both the engineering and finance departments of the company are aware of and in charge of their actions, it is essential that your team adopt some quite diverse expenditure management strategies. It’s also critical to remember that FinOps is not always about cost-cutting or cost-saving, however, implementing FinOps concepts can frequently assist in eradicating wasteful spending. Cross-functional teams are involved in a cooperative effort to reduce cloud expenses through the use of FinOps, a technique in cloud financial management.

The term “FINOPS” is a portmanteau of the words “FINANCE” and “DEVOPS,” emphasizing the interaction and cooperation between business and engineering teams.

The term “FINOPS” is a portmanteau of the words “FINANCE” and “DEVOPS,” emphasizing the interaction and cooperation between business and engineering teams.

Latest Read: A Closer Look At Integrated Document Management And Accounts Payable Software

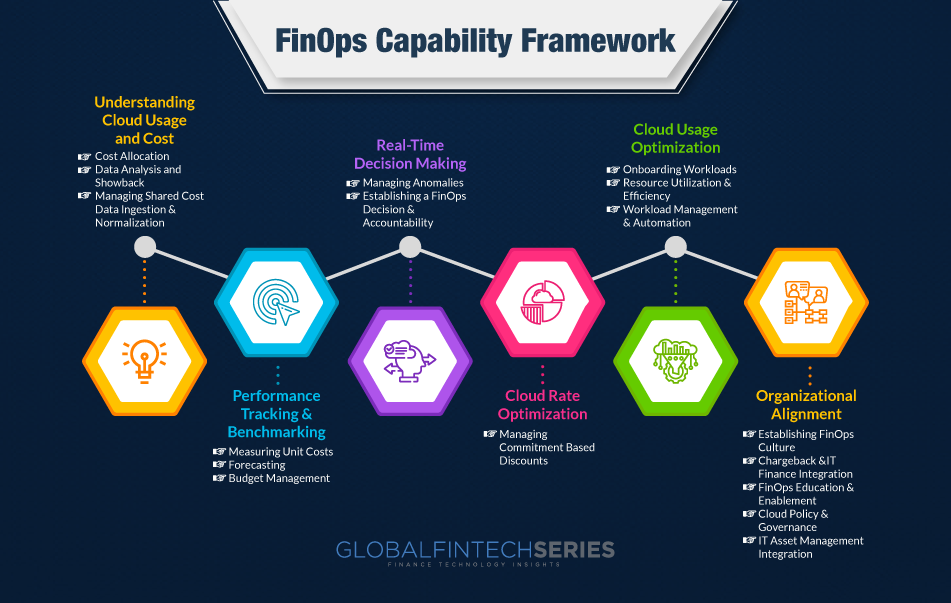

FinOps Blueprint and Guidelines

The FinOps methodology brings leadership from the finance, IT, and DevOps sectors on a single table for controlling the overall cost of cloud deployments. The company gives cross-functional teams the authority to control cloud costs while operating according to FinOps principles. In order to enforce the industry standards for cloud financial management, the FinOps initiative frequently involves sets of governance mechanisms with a team or council.

Four steps can be taken to implement a FinOps framework:

- Analysis.

- Benchmarking

- Optimization

- Negotiation- cloud service provider (CSP)

To maintain efficiency, spur innovation, and reduce costs, these measures should be repeated periodically.

Team Structures for FinOps

A cross-functional team known as a Cloud Cost Center of Excellence (CCoE) interacts with the rest of the business in organizations using the FinOps model to manage the cloud strategy, governance, and methodologies that the institution can use to transform the business using the cloud.

Getting Started in FinOps

Understanding cloud performance and usage in great detail is essential for a successful FinOps project. An audit of the cloud is a good place to begin.

A cloud audit is made easier by a number of data-collecting capabilities and tools when cloud instances powered by Intel® Xeon® Scalable processors are used. For instance, the consumption of CPUs, memory, PCIe interfaces, and other hardware resources in the cloud can be revealed via the Intel® Telemetry Collector. With Intel® cloud optimization tools and libraries, DevOps and IT teams may adjust cloud workloads and rightsize instances after conducting a cloud audit and evaluation.

Moreover, Intel provides a range of benchmarking capabilities that can aid FinOps teams in managing and understanding the price/performance demands placed on their workloads. To assist in decision-making regarding workload placement and optimization requirements, these benchmark tools and protocols can be used across a variety of cloud service providers and instance kinds.

After achieving their optimization objectives, FinOps will want to keep an eye on cloud workloads. The best feasible balance between performance and cost will be maintained over time even if needs and usage are expected to fluctuate.

Latest Read: One Of The Industry’s Best Kept Secrets: Expense Management By CFO’s

Faster spending and innovation

The dynamics of IT spending and procurement are profoundly changed by the cloud. Engineers can spend a lot of money because of the rapid innovation it fosters, and Finance won’t know how much until they receive an invoice at the end of the month. Also, spending is no longer a set unit cost since cloud computing makes spending so dynamic that it can change in milliseconds. How is it possible to expect a finance staff to comprehend and analyze this? Nonetheless, this paradigm also makes experimenting possible. Instead of making the significant upfront investment in hardware that is frequently needed, you may just spin up a new instance to test out a new idea. Certainly, this can lead to wasted money, but it also makes experimenting less financially hazardous.

The finance and procurement departments are cut out of the process because teams aren’t purchasing “things” in this newer spending model. As a result, they risk losing oversight and control over the budget.